Looking Back At Tech Stocks In 2024 - My Portfolio Setup for 2025

Why my expectations are particularly optimistic for a bunch of second-tier stocks.

Once again, it's annual review season. And like many others, I would like to review the stock market year with you and share my favourites for 2025.

At the end of 2024, I can look back on a performance of almost +30% in my sample portfolio. After a performance of +36% in the previous year, the tech crash year of 2022 has almost been made up for and the overall performance is very satisfactory. But more about that later.

The stock market year 2024 was divided into two parts: In the first half of the year, the "Magnificent 7", and with them the Big Tech-dominated Nasdaq 100 Index, continued to march away from the small caps: By mid-year, the Nasdaq 100 was up +18%, while the US small-cap index Russell 2000 was flat.

In the second half of the year, small caps began a five-month race to catch up: by the end of November, the Russell 2000 was up a whopping +20%, just a few percentage points behind the Nasdaq 100. In December, however, the US small caps ran out of steam and corrected, leaving a year-to-date gain of just over +10%. In strong contrast, the Nasdaq 100, led by Big Tech, once again demonstrated its relative strength in December, ending the year up an outstanding +28%.

The "Magnificent Seven" were back on the march in 2024

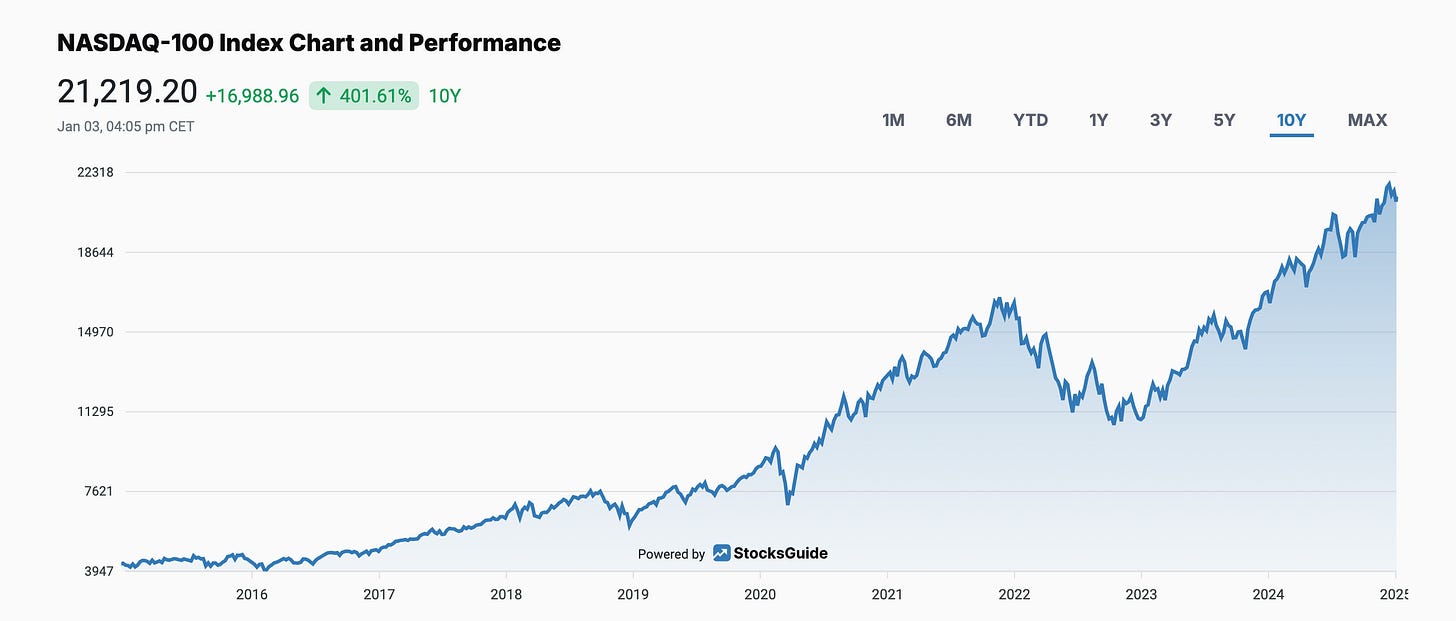

The big tech-heavy Nasdaq 100 once again took the cake among the major stock indices. After an outstanding performance of +55% in 2023, the +28% gain in 2024 means that the main barometer of tech stocks has almost doubled in the last two years!

It is important to remember what has happened to the Nasdaq over the long term: the Nasdaq 100 index has quintupled since the beginning of 2016! That's an average return of 20% per year over the past nine years!

If you are one of the lucky owners of a Nasdaq ETF, you can thank the tech giants Apple, Microsoft, Alphabet (Google), Amazon, Meta (Facebook) and especially Tesla and Nvidia for the great performance of the past few years.

After an incredible rally in 2023 (when these stocks all gained more than 50%), the "Magnificent Seven" (with the exception of Microsoft) gained another 30% or even more in 2024. Nvidia, Tesla and Meta were the biggest winners of 2024, just like last year:

Recovery Of US Tech Small Caps

In contrast, tech stocks from the back rows recovered relatively slowly over the course of the year from their lows in early 2023. The Nasdaq Cloud Index, which includes the major SaaS companies, gained +41% in 2023 and another +12% in 2024. Keep in mind, that it had previously lost two-thirds of its 2021 peak and is still down 40% today, unlike the Nasdaq 100!

Technology stocks in the broader market have thus recovered significantly over the past two years from the tech crash of 2022, but unlike Big Tech, they are still well below their previous highs.

This is even more evident in the portfolios of tech fund managers like Cathie Wood. Although her ARK Innovation ETF is up +14% in 2024, the fund is still 63% below its 2021 peak.

With this in mind, I would like to use this annual review to summarize my own investments in my model portfolio (= High-Tech Stock Picking wikifolio) in 2024 and explain the composition of this portfolio for 2025.

Performance of My Sample Portfolio

The High-Tech Stock Picking wikifolio performed very well in 2024 with a performance of almost +30%. After +36% in 2023, the recovery from the 2022 crash is now well advanced. But the drawdown from the all-time high reached at the end of 2021 is 19%.

However, it should also be noted that despite this encouraging performance, the wikifolio has significantly underperformed the Nasdaq 100 index since 2022. After the wikifolio was almost continuously ahead in the long-term comparison from 2016 to 2021, the Nasdaq is currently far ahead of the wikifolio with its small caps thanks to the incredible Big Tech development over the last three years.

Nevertheless, I am very satisfied with the performance of the wikifolio of almost +30% in 2024. This is because the performance was achieved almost exclusively in US small caps, which gained only +10-12% as measured by the Russell 2000 or the Nasdaq Cloud Index.

I was particularly pleased that several of my highly weighted, high-conviction positions were revalued in the financial market and outperformed in 2024.

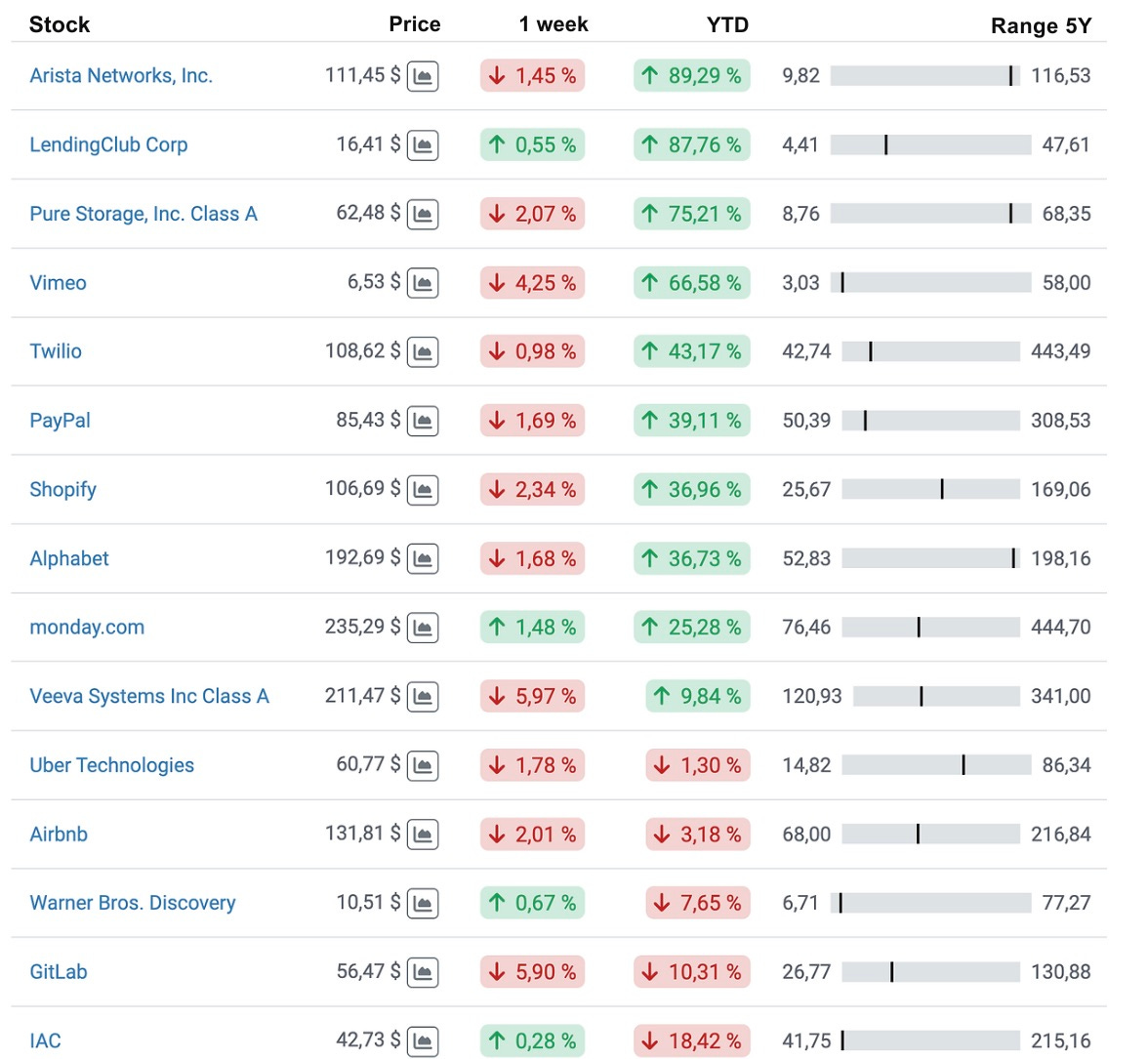

Outstanding price gains in the portfolio in 2024 were seen in Vimeo, LendingClub, and AI winners Arista and Pure Storage.

Only one stock in the portfolio suffered significant double-digit losses in 2024. Of all things, it was the IAC stock, one of my longtime favorites. More on that later.

Most importantly for me, in 2024, as in 2023, I didn’t had to correct a lot of stock-picking mistakes. There was only one low point, the painful exit from ZoomInfo, which resulted in significant book losses. In addition, I realized smaller losses (just in time before a larger drop) when I exited ZipRecruiter after that investment case did not work out.

On the other hand, most of my picks were very successful over the course of 2024: I realized triple-digit profits on sales of "AI winners" Pure Storage, Arista, CrowdStrike, and Alphabet.

I made double-digit gains on smaller partial sales of Twilio, LendingClub, Vimeo, monday.com and Airbnb. I would like to emphasize that the sales of these positions were purely tactical in nature and were made for rebalancing and diversification and optimization reasons.

Conclusion On 2024

I am very pleased with the performance of 2024, even though my model portfolio has not yet been able to catch up with the seemingly unbeatable Nasdaq 100.

As a stock picker with my small and mid caps, I just couldn't keep up with the insane performance of Big Tech over the past few years. I have to accept that, and given the extraordinary performance of the Nasdaq index (20% p.a.) over the past 9 years, I have no problem with that.

I am strongly convinced that such a Nasdaq development will not be repeated in the coming years until the end of this decade. As in 2023, the Magnificent 7's gains in 2024 came primarily from higher valuations of these stocks. They are trading at multiples of earnings and cash flow that are well above their growth rate and are therefore very expensive by historical standards. This will not last forever. VALUATION MATTERS!

Which brings us to the 2025 outlook. As important as reflection and looking in the rear-view mirror are, the future is what is traded on the stock market. And what is even more interesting at the moment is looking into the crystal ball.

Structure Of The wikifolio For 2025

At the risk of repeating myself: In my opinion, an enthusiastic stock picker with a carefully selected portfolio of small cap stocks has a great chance of finally outperforming the overall market, including the Nasdaq 100, over the next few years.

Sooner or later, the fact that smaller companies have an easier time multiplying their enterprise value due to their smaller size will reassert itself in the marketplace. Even if recent years suggest otherwise, it is no coincidence that small caps have historically outperformed blue chips. Unfortunately, only the more experienced investors among you can remember this.

My investable model portfolio starts the new year with 15 stocks just like last year.

I am significantly overweight, with about 10% each in the same four high-conviction buys as last year, plus PayPal. About half of the portfolio is currently invested in these five companies:

Vimeo actually experienced the re-rating I predicted last year, with a +67% increase in share price. I expect this positive trend to continue through 2025. As a profitable SaaS company, Vimeo is still extremely undervalued at less than twice its revenues. Especially since it is clear to observers of VMEO 0.00%↑ stock that the company will return to its growth path in 2025. Read more in my Vimeo stock analysis.

With high write-offs, strategic partnerships and a major reorganization in 2024, Warner Bros. Discovery has set the stage for a near-term turnaround. Investors have already started to reward this in the last months of the year. But I think the WBD 0.00%↑ stock is still significantly undervalued, especially compared to Netflix and Disney, even after the 60% rally in the second half of the year. To the Warner Bros. Discovery stock analysis.

During the first half of 2024, I built up a substantial position in PayPal. The timing was very good, and at the end of the year, the PayPal's position in my portfolio is already up by about +40%. PYPL 0.00%↑ remains one of my absolute favorites for 2025, thanks to the convincing work of the new management team, as explained in my PayPal stock analysis.

LendingClub stock has had a well-deserved recovery over the last 14 months, more than tripling from its lows. Prior to this, the LC 0.00%↑ stock was completely mispriced as a bankruptcy candidate. As expected, this was corrected as the loan specialist proved that it could be sustainably profitable even in a period of rising interest rates. Now that interest rates are falling, profits should rise significantly in 2025. Read more in the LendingClub stock analysis.

IAC is currently the only remaining problem child in my portfolio. For some time now, the holding company has been valued as if the billions in off-market investments were worthless. Will the IAC 0.00%↑ management be able to regain investors trust with the planned ANGI spin-off in 2025? In the meantime, patience will be the order of the day. Go to the IAC stock analysis.

In addition to these 5 core positions, I am holding the following new additions from 2023/2024 in the portfolio with a weighting of 4-7% each, all of which I believe will outperform in 2025. These stocks have a combined weight of 33%:

monday.com (MNDY 0.00%↑) : Read the stock analysis here (unfortunately only in german)

Twilio (TWLO 0.00%↑) : read the Twilio stock analysis here

GitLab (GTLB 0.00%↑) : read the GitLab stock analysis here

Airbnb (ABNB 0.00%↑) : read the Airbnb stock analysis here

The sample portfolio is rounded off by Arista Networks, Alphabet, Pure Storage and Shopify, with a total weighting of just 8%. All of these stocks have multiplied in value since purchased. The book gains range from 371% to 2,366%. I consider these stocks to be quite expensive at the moment and, after the strong gains, I only hold small residual positions.

The Bigger Picture

The average annual performance of the High-Tech Stock Picking wikifolio - after all costs - since its launch in 2016 is currently at 15% p.a.

A clear double-digit return is what I expect from myself and this long-only equity portfolio over the long term. Some critics claim that this is not a good management performance and point to the underperformance of the wikifolio against a Nasdaq ETF, which has been going on for several years.

I would like to counter that this 20% p.a. return on the Nasdaq ETF over a long period of 9 years is absolutely outstanding and will almost certainly NOT be repeated in the coming years. If you don't believe me, just wait a few years and come back to this article in 2030 at the earliest ;-)

In my experience, a long-only stock-picking strategy like the one I have been using for decades can achieve a double-digit performance of 10-15% over the long term. I have been competing with my wikifolio since 2016 to prove this. In the first 8 years, I hit the upper end of this target range, despite the tech crash of 2022.

There is a lot that suggests that in 2025, quality second- and third-tier stocks could finally outperform Big Tech again. That's because the "Magnificent 7" have become expensive, and some of them are even far too expensive for my taste.

In the second half of 2024, there was definitely a change in sentiment. The US small-cap index, the Russell 2000, outperformed the major indices, including the Nasdaq 100, in 5 out of the last 6 months of the year.

However, the small caps ran out of steam before the turn of the year and the Magnificent 7 once again showed the relative strength they have been accustomed to for years in December. I'm not sure whether this was the last gasp of Big Tech. In any case, it will be even harder for these giants to justify their high share prices in 2025. Nvidia and Tesla are even more "priced for perfection" than Apple and Microsoft. The rsik is correspondingly large. But this has been the case for years, and so far it has all worked out well for the lucky big tech shareholders.

I have been in the stock market for more than 35 years. During that time, I have learned that stock market valuations can sometimes deviate significantly from the true value of a company for a long time, but then often return to it in leaps and bounds. I am very confident that in 2025 we will still be discussing some positive revaluations for selected second-tier stocks.

However, I would not be surprised to see a significant correction or even a crash in the so-called AI winners. I would therefore advise all Nvidia and Co. shareholders to consider taking some profits and diversifying their portfolios at the beginning of the year.

On that note, I wish you and your loved ones a happy and healthy New Year and a prosperous 2025.

If you would like to follow the performance of tech stocks in general and my portfolio companies in particular, you can now subscribe to my 100% free High Growth Investing Substack here:

*Disclaimer: The author and/or associated persons own shares in the companies mentioned in this article. This article is an expression of opinion and not investment advice.

Really enjoyed this analysis Stefan! Your conviction in "comeback stories" versus the seemingly unstoppable Magnificent 7 raises a fascinating question - in today's winner-take-all tech landscape, are we perhaps overvaluing the possibility of turnarounds? While PayPal and Warner Bros still have strong market positions, I wonder if the moats of fallen tech leaders can ever be rebuilt once breached. Would love to hear your thoughts on what makes these particular turnaround stories different from the countless tech companies that never recovered their former glory. Cheers!

Don’t crash into their stock chart 😊