Airbnb Stock: A Bet on New Multi-Billion Dollar Businesses starting in 2025

In 2024, Airbnb stock underperformed the major U.S. indices by a wide margin. What will happen in 2025?

I have been invested in ABNB 0.00%↑ stock for two and a half years. It is one of my favored investments because I can evaluate the company and its products from a customer perspective. For years, I've enjoyed staying in Airbnb accommodations on my travels. And since 2024, I have also gained my first experience as an Airbnb host by renting out our Villa Calmatzo in the southwest of Mallorca.

In my last post on Airbnb in April 2024, I asked: Has the potential of Airbnb stock been maxed out?

At that time, I wrote:

"Given the already relatively high valuation of Airbnb stock, there is little room for the stock to rise in the short-term."

In April, I took partial profits in my model portfolio at prices above $160. Only to repurchase those Airbnb stocks four months later, after a 35% price drop. This time I seemed to have the right (i.e. lucky) timing.

Currently, Airbnb's stock is trading almost unchanged from where it started the year, lagging well behind the S&P 500 and Nasdaq 100. In this post, I'll explore whether 2025 could be a better year for Airbnb shareholders.

Airbnb's Q3 2024 Financial Results

Here's a quick summary of Airbnb's results for the third quarter of 2024:

In the third quarter of 2024, Airbnb generated 10% more revenue than in the previous year. Total revenue was $3.7 billion. The increase in revenue was primarily due to solid growth in the number of nights spent on the platform and a slight increase in the average daily rate (ADR).

Net income in Q3 2024 was $1.4 billion, representing a strong net income margin of 37%. However, compared to Q3 2023, net income decreased significantly. This was mainly due to a special tax effect of $2.8 billion in the prior year.

Adjusted EBITDA was $2.0 billion in the third quarter of 2024, up 7% year-on-year. Adjusted EBITDA margin was 52% in the third quarter of 2024 compared to 54% in the third quarter of 2023.

Free cash flow was $1.1 billion in the third quarter of 2024, resulting in a free cash flow margin of 29%, compared to $1.3 billion in the third quarter of 2023. The year-on-year decrease in cash flow was primarily due to a one-time payment of $163 million to the IRS.

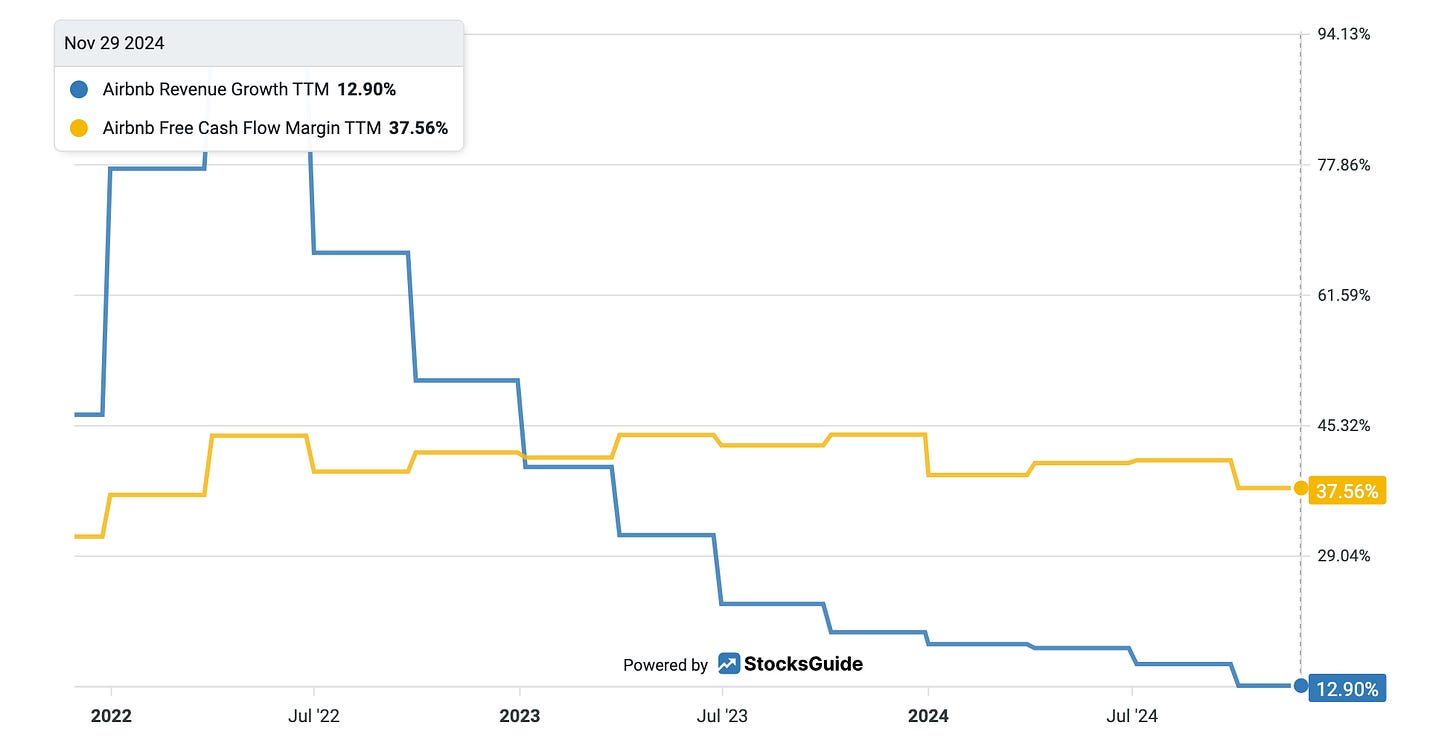

Free cash flow for the trailing twelve months was $4.1 billion, resulting in a free cash flow margin of 38%. This represents a decrease of 6 percentage points in the free cash flow margin compared to the prior year.

Airbnb's stock, which had been a strong performer in recent months, briefly dropped 10% after the release of these numbers. I think investors had exaggerated expectations and were disappointed by the significant weakening of the cash flow margin, which was outstanding last year. Although I believe 38% is still good for a company investing into growth.

Overall, the growth of Airbnb's business remains intact, although at a much slower pace than in previous years. This is due to the law of large numbers, because in the third quarter of 2024 alone, the gross booking value (GBV) is $20.1 billion, an increase of 10% over the previous year. To achieve future growth of 10%, an additional $2 billion in bookings will have to be made through the platform - in a single quarter.

Airbnb's 2024 Guidance

In the seasonally weaker fourth quarter of 2024, Airbnb expects revenue to be approximately $2.4 billion. This brings full-year 2024 revenue to just over $11 billion, representing growth of only 11-12% compared to 18% last year.

For 2024, Airbnb expects an adjusted EBITDA margin of approximately 35%. The free cash flow margin is expected to be several percentage points higher than the adjusted EBITDA margin.

In the fourth quarter, profitability will decline year-on-year due to higher marketing and product development expenses.

What Can We Expect From The Airbnb Stock In 2025?

The management of Airbnb has not made any statements for the year 2025 so far.

However, it is clear that the growth of the core business has slowed significantly in recent years. This trend is expected to continue through 2025. In addition, the free cash flow margin has been declining recently, although at a high level.

So it should come as no surprise that Airbnb's stock price hasn't really made any progress in 2024.

In order to continue to generate double-digit revenue growth in the coming years, it will be essential for Airbnb to develop new revenue streams. This has been discussed for several years now. To date, it has not been specified what these new businesses will be. This uncertainty is weighing on the stock price.

CEO Brian Chesky has now provided the first quantification of what we can expect from Airbnb stock in 2025: he expects Airbnb to launch one to two new businesses each year over the next few years, generating an additional $1 billion or more in annual revenue.

„I think the next chapter of Airbnb is starting next May, the next chapter is really about taking Airbnb and expanding it beyond our core business…And what I expect is every year now, for the coming years, we will launch one to two new businesses that will generate $1 billion or more of revenue incrementally a year…. And over the next decade, we're going to go far beyond travel.“

That's quite an announcement: it means that if Airbnb successfully executes its business plan, the company will return to double-digit growth by 2026 at the latest.

In the short term, the new revenue streams are likely to be related to expansion within the travel sector, such as hotel and car rentals, but in the longer term, the company plans to expand into completely different areas.

Airbnb as a super app?

I am as skeptical as I am excited.

Valuation of Airbnb Stock vs. Booking Stock

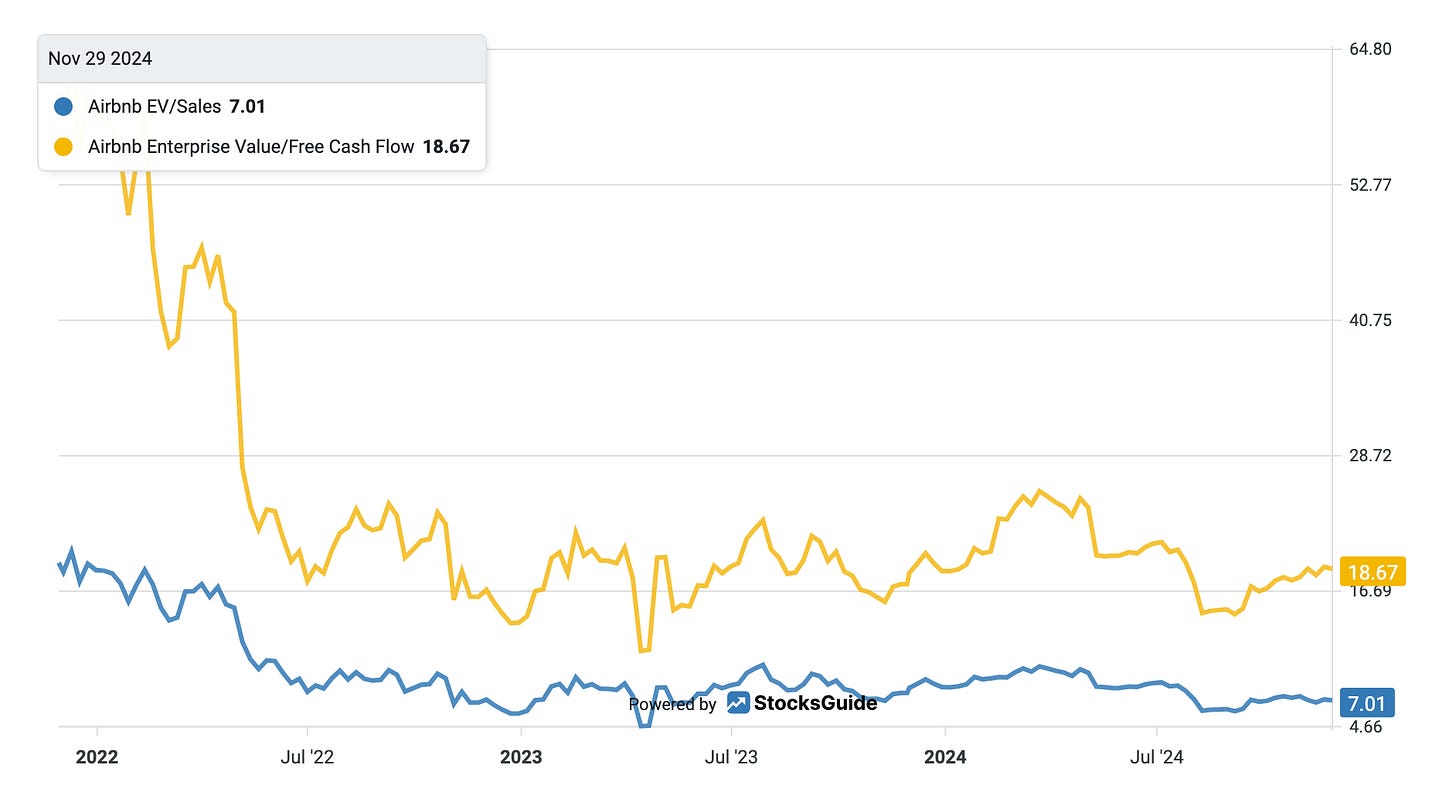

Airbnb shares are valued lower than the average of the last few years, both on the basis of a sales multiple (EV/Sales) of 7 and cashflow multiple EV/FCF (explained here in simple terms) of 19.

However, this is understandable given that growth and high profitability have moderated somewhat recently.

I think the current valuation is fair.

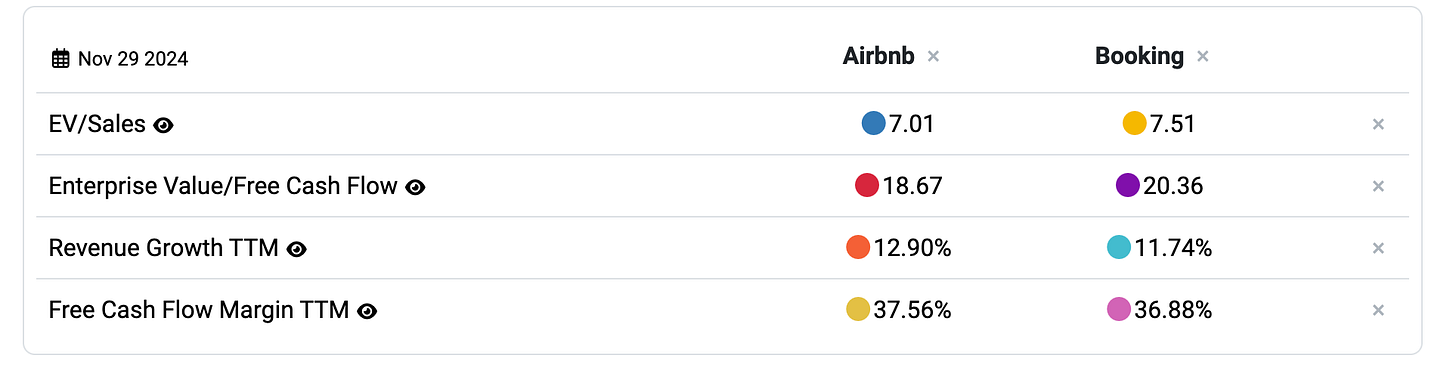

Also, the valuations of Airbnb and BKNG 0.00%↑ have converged over the past year. Both companies are growing at low double-digit rates, both are similarly profitable, and both are similarly valued right now.

Airbnb stock is therefore not much more than a good holding position at the moment.

Over the past two years, the Booking stock has been a much better investment than Airbnb. I see greater potential for Airbnb in the coming years, as I believe in the acceleration of growth through new business areas. Booking has already undergone this expansion outside its core business, so it will be much more difficult for its competitor, which is more than twice the size of Airbnb, to maintain its double-digit growth in the coming years.

From a customer perspective, I am very happy with Airbnb. In more than 10 trips using Airbnb, I have never had a problem with the accommodation and have often been pleasantly surprised. And in the last few months, the first bookings of our vacation villa in Mallorca were handled perfectly by Airbnb. That gives me confidence - also in my role as an investor.

Conclusion

Airbnb is currently experiencing a decent 2024, no more and no less. I expect 2024 to be a transition year as new businesses are developed that will lead to accelerating revenue growth starting in the second half of 2025 (or even 2026).

However, there will be at least two to three more difficult quarters of declining growth before that.

Nevertheless, I plan to hold Airbnb for the long term and even add to my position if the opportunity arises. That's because I have long-term confidence in the talented management team led by Brian Chesky. He has never disappointed me, so I assume he knows what he is doing when he promises us investors billions in additional revenue from new sources.

This is certainly plausible given the incredibly large network effects of the Airbnb platform, which have only been monetized to a very limited extent.

If you want to stay up to date on what is happening with Airbnb, you can subscribe to my free substack here:

*Disclaimer: The author and/or related persons or entities own shares of Airbnb. This post is an expression of opinion and not investment advice.

Nice blog! One thing I want to point out is booking has a very large share buyback program and has been running in years. Airbnb on the other side, has pretty heavy dilution due to large stock based compensation. Both are great companies, but if I have to pick one, BKNG is safer.

Nice take. Do you have a deep dive on Airbnb?