Has the potential of Airbnb stock been maxed out?

Sell-side analysts no longer love the leader of the sharing economy. Should you be cautious, too?

I have been invested in Airbnb ABNB 0.00%↑ since 2022. The timing of my entry was good, after less than two years the Airbnb position is up 60%.

One of the regular checks I make as an investor is to review the "price potential" of my portfolio according to the prevailing analyst opinions. Even if I don't pay much attention to the analysts' price targets: It is always interesting to see what other market observers think about "my" companies. Such routine research has now revealed that Airbnb is the only company in my investable sample portfolio where the average analyst price target is below the current share price.

Reason enough to take a closer look at Airbnb in this article, and also to check my own opinion.

Has the potential of Airbnb stock really been maxed out, as analysts believe?

The Airbnb business figures for 2023

Airbnb was able to increase its revenues in 2023 by 18% year-on-year to 9.9 billion USD. Revenue growth was thus significantly slower than in 2022, when the figures were still distorted by low comparables during the coronavirus pandemic, with high growth of 40%.

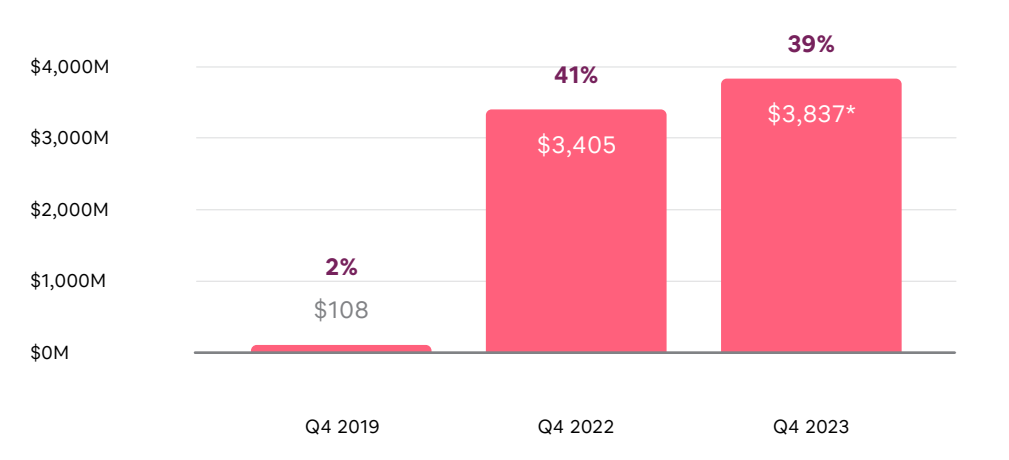

Free cash flow improved to 3.8 billion USD in 2023, representing an excellent free cash flow margin of 39%.

After reporting net profit for the first time in 2022, it more than doubles to 4.8 billion USD in 2023. However, the resulting outstanding net margin of 48% is distorted by one-off tax effects, and net profit and margin will be significantly lower in 2024.

Airbnb has become a very efficient company during the pandemic. At the end of 2023, Airbnb employed around 6,900 people, which translates into revenue of almost 1.5 million USD per employee. By comparison, its competitor Booking has a turnover of around 900,000 USD per employee.

Thanks to these efficiencies, Airbnb has become a veritable cash machine in recent years. By the end of 2023, the company had 10 billion USD in cash reserves.

Airbnb on the verge of next expansion step

Over the past few years, Airbnb has focused on improving its core product in the wake of the coronavirus pandemic. As an Airbnb host of a holiday villa in the southwest of Mallorca, I have been able to observe from the customer's point of view how the platform has been continually improved for guests and even more so for hosts.

It has never been easier to become an Airbnb host and this is reflected in the figures: at the end of 2023, for the first time, there were more than 5 million Airbnb hosts worldwide, with 7.7 million properties offered for rent, an increase of 18% compared to the previous year.

For the company's medium-term growth prospects, it is particularly important that the number of properties available for rent on the platform continues to grow at double-digit rates. This will be achieved by focusing even more on international markets. This is because supply in North America is growing much slower than the markets in Europe, South America and Asia, which are even less developed for Airbnb.

It is likely that Airbnb will expand into other segments of the travel market in the future. So far there have been only vague announcements:

"We also believe that now is the time for us to expand beyond our core business and reinvent Airbnb. While this will be a gradual, multi-year journey, we’re excited to share more about this later in 2024."

I speculate that the analyst community's very cautious to negative assessment of further growth prospects will be revised somewhat in the course of 2024. New product announcements should capture the imagination of market watchers.

The risks from regulation

The assessment of the risks that could arise for Airbnb from increasing regulation is particularly important for the further development of the share price. It remains to be seen whether many other cities will follow New York City's lead. The city council there has drastically restricted the ability to rent out apartments through Airbnb since September 2023.

Personally, I think the risks of regulating Airbnb are sometimes overstated. After all, it cannot be in the interest of city councils to see hotel prices rise drastically (as seen in NYC) after a comprehensive Airbnb ban, making these cities unaffordable for many tourists.

Moreover, Airbnb is extremely well diversified geographically. No single city accounts for more than 2% of its revenue. Nevertheless, increasing regulation of short-term rentals is one of the biggest risks for Airbnb shares.

Share buybacks prevent dilution

Since 2022, Airbnb has been buying back its own shares out of its high cash flow, thus counteracting dilution from share-based compensation (SBC).

Airbnb's share repurchases in 2023 totaled 2,25 billion USD, meaning that almost 4 billion USD worth of shares have been repurchased since 2022. The number of shares outstanding has therefore remained stable recently.

Meanwhile, a new share buyback program has been announced that will allow the repurchase of up to 6 billion USD of shares from 2024. In addition, SBC growth will slow significantly from 2025 as the generous employee stock option plans from the IPO expire in 2024.

The Airbnb guidance for 2024

At the beginning of 2023, analysts had predicted that Airbnb's growth would decline drastically; on average, experts only expected revenue growth of less than 12% in 2023. In the end, as we all know by now, it turned out to be a highly profitable 18% revenue growth.

For 2024, the analysts are once again quite pessimistic. For the coming years, they expect "only" small double-digit growth. The net margin is expected to stabilize at around 25%.

For the first quarter of 2024, however, Airbnb management expects revenue growth of 12-14%. No guidance has yet been given for the full year.

I am slightly more optimistic than most analysts and expect Airbnb's revenues to reach well over 11 billion USD in 2024, up from 9,9 billion USD in 2023.

Much more important to me than the short-term pace of growth is management's promise to keep the Airbnb organization as lean and efficient as it has been in the recent past. In other words, I expect a further significant increase in cash flow and EBIT in 2024, even if net income is likely to be significantly lower than earnings per share in 2023 due to one-off tax effects.

The valuation of Airbnb shares

Airbnb's earnings per share jumped from 2,79 USD to 7,24 USD in 2023, partly due to one-off effects. Based on a share price of 158 USD, this implies a P/E ratio (TTM) of 22. However, this P/E will increase significantly over the next few quarters due to the aforementioned one-offs effects from 2023.

Airbnb's EV/sales ratio (forward) is over 8, which is quite a sporty price for the stock given future growth of max. 15%.

At these prices, Airbnb is certainly no longer a bargain. Nevertheless, I think Airbnb's valuation is fair given its extremely efficient growth.

However, given Airbnb's relatively high valuation, there is probably little room for short-term price increases. Nevertheless, even at these levels, I believe the stock is a good long-term investment. I therefore plan to hold the stock for the long term in my portfolio.

Nevertheless I have reduced the Airbnb position slightly and taken some initial profits in order to increase my cash reserve in my investable sample portfolio back to 10% ahead of what is expected to be a turbulent quarterly season.

If you would like to follow the development of Airbnb stock together with me in the future, you can

*Disclaimer:

The author and/or associated persons or companies own shares in Airbnb. This article is an expression of opinion and does not constitute any investment or financial advice.

Nice write-up, Stefan! Airbnb remains such an interesting company to me.