Twilio Stock: An Old Acquaintance New to my Portfolio

Few investors are currently interested in Twilio shares. Why I now decided to invest into the SaaS stock for the second time since 2018.

Long-time readers of my German blog will be familiar with Twilio TWLO 0.00%↑ . From the beginning of 2018 until 2020, I had already invested in the shares of the CPaaS (Communications Platforms as a Service) market leader with great success, achieving triple-digit gains at the time.

I was basically right to get out of Twilio in 2020, even if I got out too early. Like many other SaaS stocks, Twilio's share price soared to unimaginable heights (over 400 USD) by mid-2021, only to plummet brutally to 50 USD.

So far, Twilio stock hasn’t recovered. And yet I have now decided to re-enter the stock. Here is the background to my renewed investment case for Twilio:

The Twilio Story

Twilio is a Silicon Valley SaaS company founded in San Francisco in 2008 by Jeff Lawson, who served as CEO until early 2024. The company was founded with the goal of making communication over the Internet easier and more accessible. Twilio developed a cloud communications platform that allows developers to integrate telephony and messaging capabilities directly into their applications without having to worry about the underlying infrastructure.

Twilio - The Early Years

Twilio's core concept was to provide developers with a simple API (Application Programming Interface) that would allow them to integrate communication services such as calls and SMS into their applications. This idea was very popular in the early days of cloud technology, as it allowed businesses to scale their communications solutions without having to invest in expensive hardware or telecoms infrastructure.

The first version of the Twilio API was released in 2008, enabling developers to make and receive calls with just a few lines of code. This innovation was a major step forward, significantly reducing the complexity and cost of integrating communications services. In the years that followed, Twilio continued to add new services, including SMS, video calling and chat. The company relied heavily on the developer community to cement Twilio's position as a leading provider of cloud-based communications services.

IPO and Further Expansion

Twilio went public in 2016. The IPO was a huge success, with the share price rising more than 90% from the issue price of 15 USD on the first day of trading. The capital raised from the IPO enabled Twilio to continue to expand, both organically and through acquisitions.

In the following years, Twilio expanded its capabilities by acquiring several companies, including SendGrid, a leading email service provider, in 2019 for 3 billion USD, and Segment, a customer data provider, in 2020 for 3.2 billion USD.

Both acquisitions were overpriced from today's perspective. They were paid for with Twilio stock, which was also overvalued at the time. As a result, while these transactions were cash friendly, they resulted in a large dilution to Twilio shareholders and an inflation of intangible goodwill on Twilio's balance sheet.

Twilio Today

Twilio's revenue has grown 15-fold since its IPO just 7 years ago, and today Twilio is a global leader in cloud communications and CPaaS (Communications Platforms as a Service) with over 4 billion USD in revenue and a broad range of services.

Through the acquisition of Segment, Twilio has also developed a strong presence in customer engagement platforms, with a focus on customer data. In particular, the combination of communications services and customer data enables Twilio to holistically help companies build better and more efficient relationships with their customers.

The Change in Management

So much for the theory and vision of charismatic founder Jeff Lawson. Unfortunately, as is so often the case, the integration of the major acquisitions mentioned above has not gone smoothly in practice in recent years. Two smaller acquisitions were even divested in 2023.

The ambitious growth targets were not met and Twilio did not make the necessary progress in terms of profitability. And so it came to pass: Jeff Lawson had to step down at the end of the 2023 financial year and hand over the CEO chair to Khozema Shipchandler.

The new CEO has been on board at Twilio since 2018 - after a long career at General Electric - when he joined as CFO. Khozema Shipchandler may be less visionary than his predecessor, but he knows exactly what it takes to finally create shareholder value again on the back of more than 4 billion USD in revenue and a huge customer base of 316,000 active customers - at least that is the core of my investment case.

First, the new CEO questioned the poorly performing acquisition of Segment; a sale was considered in early 2024 and rejected. Instead, it was decided to keep Segment, reorganise it and better integrate it into the core Communications business. The goal is to reach profitability with Segment by mid-2025.

Twilio's Market and Competitive Position

Twilio's total addressable market (TAM) is difficult to estimate as it encompasses different sectors and forms of communication. Twilio's core market is the CPaaS market, which is expected to grow to over 50 billion USD by 2026, according to technology analysts. Twilio is one of the leading providers.

With the acquisition of Segment in 2020, Twilio has significantly expanded its addressable market. The market for customer data platforms and customer engagement is estimated at over 80 billion USD.

Overall, Twilio's TAM is estimated to be well over 100 billion USD. So there is plenty of room for further growth. However, the competition is fierce.

As the market leader, Twilio faces a number of smaller competitors that have positioned themselves in different areas of cloud communications.

Its biggest competitors include Vonage (formerly Nexmo), which was acquired by Ericsson in 2021 for over 6 billion USD, and Sinch, another Swedish listed company. Twilio's main US-listed competitors are Bandwidth and RingCentral. Other competitors trying to position themselves as Twilio alternatives with aggressive pricing include Bird (formerly MessageBird) from the Netherlands and Plivo.

Twilio Business Figures for Q2 2024

For years, Twilio's revenue growth has been masked by its many acquisitions. The opposite is now the case, with reported figures looking a little low as some peripheral businesses have been sold. However, the fact remains that Twilio, like most of its competitors, only achieved single-digit organic growth of around 7% in the first half of 2024.

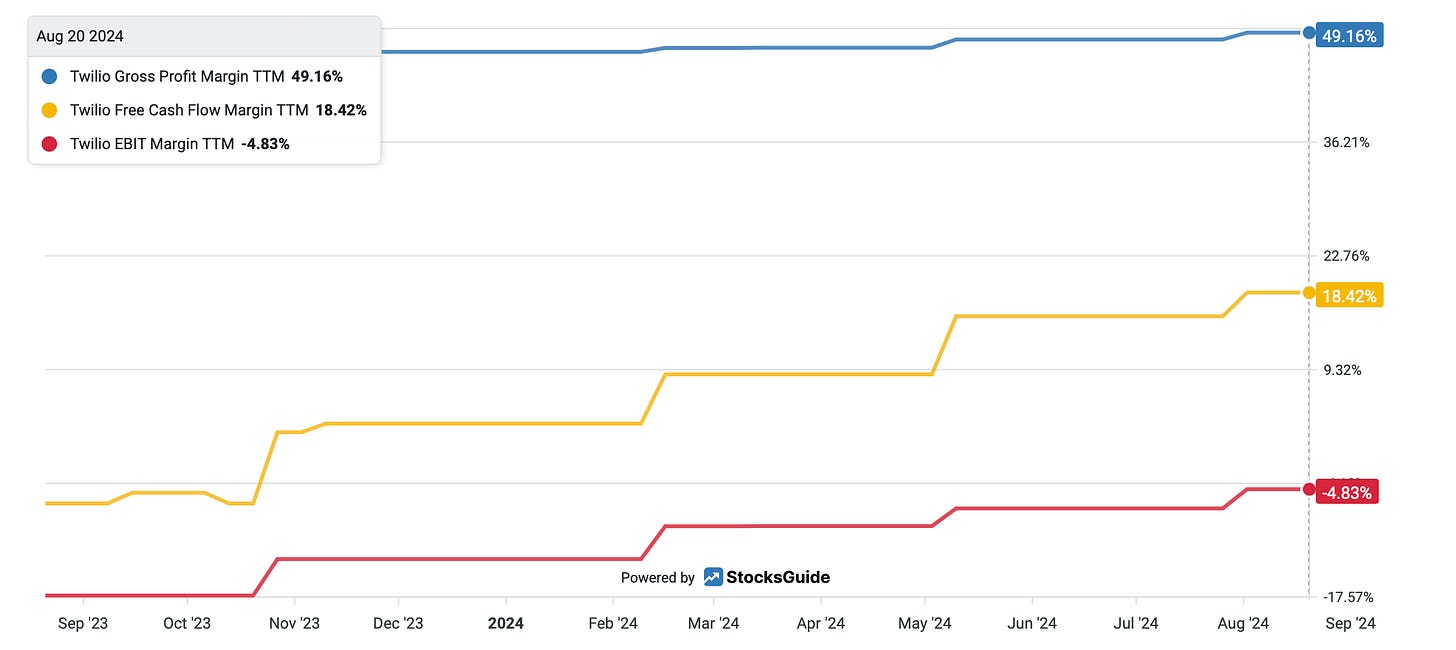

The focus on profit and cash flow is much more important than the meagre revenue growth at the moment. In recent quarters, management has made impressive progress in terms of profitability through consistent cost cutting. The GAAP EBIT margin has increased by 13 percentage points in a year and is now close to break-even. The free cash flow margin has increased even more, reaching almost 20% over the last 12 months.

The GAAP operating loss for the second quarter was only 19 million USD compared to 142 million USD in the year-ago period. Free cash flow increased over 170% year over year to 198 million USD.

Twilio 2024 Guidance

In 2024, Twilio management expects revenue to grow by approximately 5% to 4.4 billion USD. Adjusted for the sale of unprofitable businesses, this represents approximately 7% growth.

For the full year, earnings are expected to jump sharply. After raising its own guidance, Twilio now expects free cash flow of 650-675 million USD in 2024, with a margin of just over 15%. The margin is likely to be slightly lower than in previous quarters as employees are now increasingly paid in cash and the company is much less generous with stock-based compensation than in the past.

Following the very optimistic statements in the Q2 analyst call, I expect cash flow to continue to grow significantly in the coming years. I expect free cash flow to exceed 1 billion USD by 2026 at the latest.

The bottom line should also be clearly positive (on a GAAP basis) by 2026 at the latest, at least as far as the operating business is concerned.

Balance Sheet Risks

One problem that could stand in the way of a corresponding net profit is the high level of intangible goodwill on Twilio's balance sheet, which stems from its expensive acquisitions.

After an initial write-down in the course of the 2023 financial statements, goodwill remains at 5.2 billion USD. This could lead to further write-downs in the future, resulting in a GAAP net loss, even if the company is operationally profitable.

Although such goodwill write-downs are non-cash, the negative news could weigh on Twilio's share price again.

Otherwise, Twilio has a strong balance sheet. Debt of 1.1 billion USD is offset by cash reserves of 3.1 billion USD.

Aggressive Share Buyback

In the past, the significant dilution of Twilio's shareholders due to the numerous share-funded acquisitions has been a major issue. This was exacerbated by large share-based compensation payments to employees.

The number of shares outstanding almost doubled between 2019 and 2023.

Under the new CEO, Twilio has made its share buyback programme, which began in 2023, even more aggressive: The company has repurchased 2.2 billion USD worth of its own shares through Q2 2024, and plans to spend another 0.8 billion USD worth on buybacks through the end of 2024.

The Valuation of Twilio Stock

At a share price of 60 USD, Twilio has an enterprise value of 7.8 billion USD. The EV/sales ratio is less than 2. In mid-2021, amid the hype surrounding cloud stocks, the valuation was 66 billion USD and the EV/sales ratio was 35.

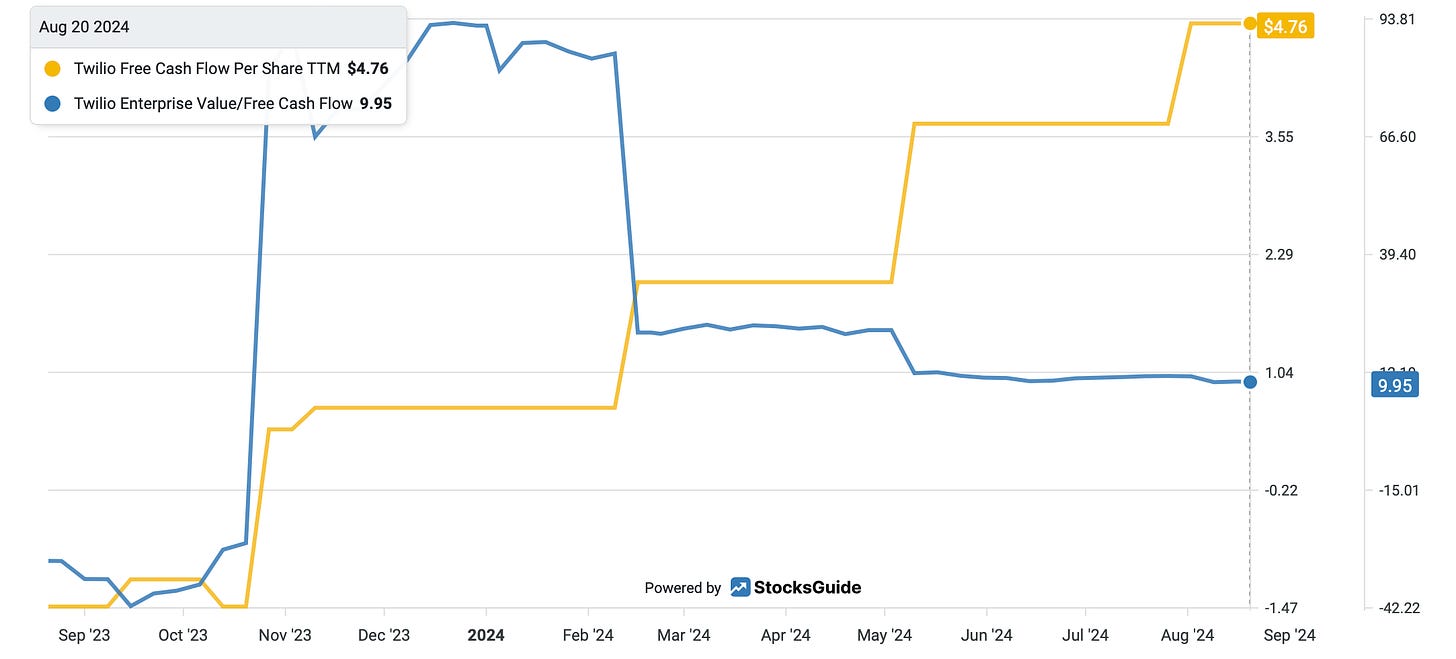

At that time, of course, this valuation was an absurd exaggeration on the upside. Today, I see a downward exaggeration. On a trailing 12-month basis, the enterprise value is less than 10 times free cash flow. Free cash flow per share continues to soar and is supported by the aggressive share buyback programme.

In a reasonably favourable stock market environment, I see a good chance of a triple-digit price recovery for Twilio within the next 3 years.

I would like to see a significant write-down of the inflated goodwill on the balance sheet at the end of 2024. This would mean that the company would have to report another large net loss in 2024, but could then restart in 2025 after having cleaned up the balance sheet.

Conclusion

I have included Twilio in my sample portfolio for the second time since 2018. The former high-growth stock is now finally focused on increasing shareholder value, thanks to the new management's consistent restructuring course.

Few investors are currently interested in Twilio shares. For me, the company is an interesting investment for counter-cyclical and more value-oriented tech investors at a share price of around 60 USD.

If you want to follow Twilio with me from now on, you can

*Disclaimer:

The author and/or associated persons or companies own shares in Twilio. This article is an expression of opinion and does not constitute investment advice.

One question, aren’t you worried about stock based compensation being so high? If le you exclude it the FCF declined sharply.

Thanks. FCF Yield is 8% -- good.