GitLab Stock Analysis: Sudden CEO Change Against Tragic Background

Here are the reasons why I expanded my position in GitLab after the latest events.

This article is an update of a GitLab stock analysis first published in June 2024. It has been expanded based on figures from the third quarter of fiscal year 2025.

Those of you who have been following this Substack for a while know that I have a special affinity for exciting companies in the software industry.

Today, I am once again able to share with you a software growth story that, surprisingly, has its origins in Europe.

It is GitLab GTLB 0.00%↑ , a company from the 2021 IPO vintage. At the time, such high-growth companies were coming to the Nasdaq at inflated prices. Therefore the crash of GitLab's share price by about 80% in 2022/2023 was almost inevitable.

In mid-2024, the GitLab stock made its debut in my High-Tech Stock Picking sample portfolio after being on my watchlist for quite a while. The timing was good, and the stock has been on a clear uptrend ever since.

After the results for the third quarter of FY25, ending in January, I recently increased my GitLab position. Here is the background to this investment case:

What is the GitLab Offering?

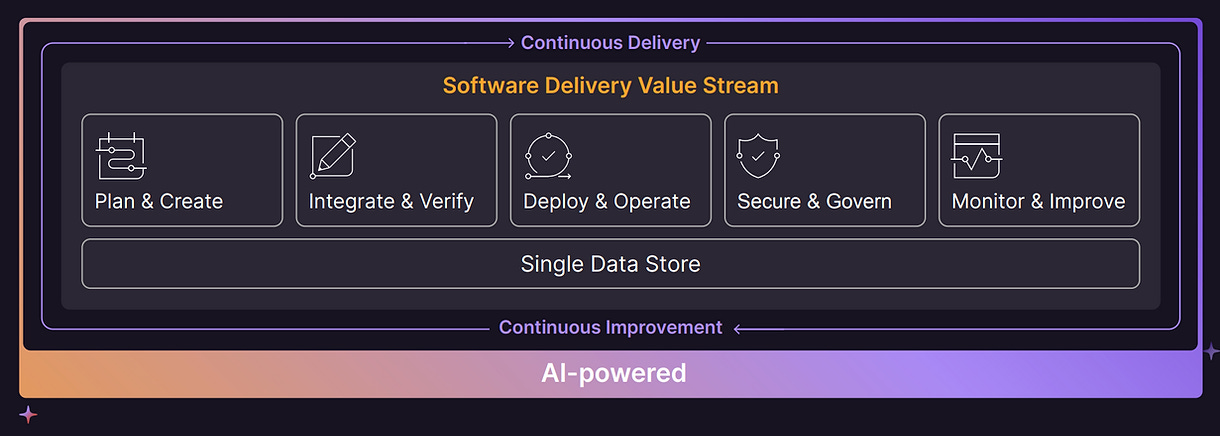

GitLab is a comprehensive toolset (the marketing people would say "platform") that supports the entire software development cycle, and has established itself as one of the major players in the world of DevOps and DevSecOps.

DevOps is an approach to software development that aims to improve collaboration and communication between the traditionally separate development (Dev) and operations (Ops) teams. The goal of DevOps is to increase the efficiency, speed, and quality of software development and delivery by integrating and automating development, testing, deployment, and operations processes.

DevSecOps is an extension of the DevOps approach that emphasizes security. The goal of DevSecOps is to integrate security considerations and practices throughout the software development cycle and operational processes. Unlike traditional approaches, which often add security controls at the end of the development process, DevSecOps ensures that security is built in from the beginning.

This approach aims to proactively identify and minimize security risks, rather than reacting to security issues after software has been developed or even delivered.

The History Of GitLab

GitLab was first developed as an open source project in 2011 by Dmitriy Zaporozhets from his home in Ukraine. The idea was born out of the need to create a better solution for version control and collaboration in software development projects. Originally started as a non-commercial project by a developer for developers, GitLab provided a web-based user interface for Git repositories, similar to GitHub, but with the difference that it could be installed on users' own servers. It was not until 2014 that GitLab Inc. was officially founded as a company in the Netherlands by Sid Sijbrandij to meet growing commercial demand, and began selling enterprise licences.

Over time, GitLab has expanded its initial version control platform to include a variety of DevOps features, including continuous deployment (CD), issue tracking, code review, and many other tools integrated into the entire software development process. GitLab has always set itself apart by providing a unified solution for the entire software development lifecycle - from the initial idea to the actual running of the software.

A key milestone in GitLab's development was the inclusion of security and compliance features, marking the company's transition from DevOps to DevSecOps. GitLab has continued to evolve, investing heavily in development and incorporating new technologies and methodologies, including artificial intelligence (AI) and machine learning, to further automate and enhance software development.

GitLab Market Position And Competition

In just 10 years, GitLab has come a long way from a simple version control tool to a complete DevSecOps platform that enables organizations to develop software faster, more efficiently and more securely.

GitLab has now established itself as the leading platform in the DevSecOps space. It competes primarily with the other two major players, GitHub (acquired by Microsoft MSFT 0.00%↑ in 2018) and Bitbucket (acquired by Atlassian TEAM 0.00%↑ ), and differentiates itself through its comprehensive, integrated solution built on open source principles and a large customer base.

According to leading industry analysts at Gartner, most companies will adopt such a Dev(Sec)Ops platform in the coming years to fully control and secure their software development process. The total addressable market (TAM) is estimated at $40 billion. However, the market penetration is still low.

"By 2027, 75% of organizations will have switched from multiple point solutions to DevOps platforms to streamline application delivery, up from 25% in 2023." (Gartner)

According to the company, there are over 30 million people registered on the GitLab platform. Approximately one million of them are paying users. The customer base is mainly made up of almost 10,000 corporate customers. Of these, more than 1,100 pay GitLab an annual fee of more than $100,000. About 100 large customers pay a subscription fee of more than $1 million per year. This is a clear indication of how important the GitLab solution is to large enterprises.

A unique feature of the company is that GitLab is run as a "remote company" with over 2,000 employees from 60 countries, most of them working together virtually. GitLab does not have any major offices. The company has been led for years by co-founder 'Sid' Sijbrandij, who is respected in the industry not only as an entrepreneur, but also as a thought leader. Due to illness, Sid stepped down as CEO at the end of 2024 and is currently limiting his role to that of a Chairman of the Board.

Like many other enterprise software providers, GitLab follows a land-and-expand business model. Typically, developers bring GitLab's open source base into the company, and from there it expands to other teams and departments.

This land-and-expand strategy works very well for GitLab. The net retention rate was a whopping 124%. This means that on average, existing customers generated 24% more revenue than they did in the same period last year. The high retention rate shows that GitLab is able to successfully retain its existing customers and increase their revenue, regardless of its equally successful new customer business.

GitLab Financial Results For The Third Quarter Of Fiscal Year 2025

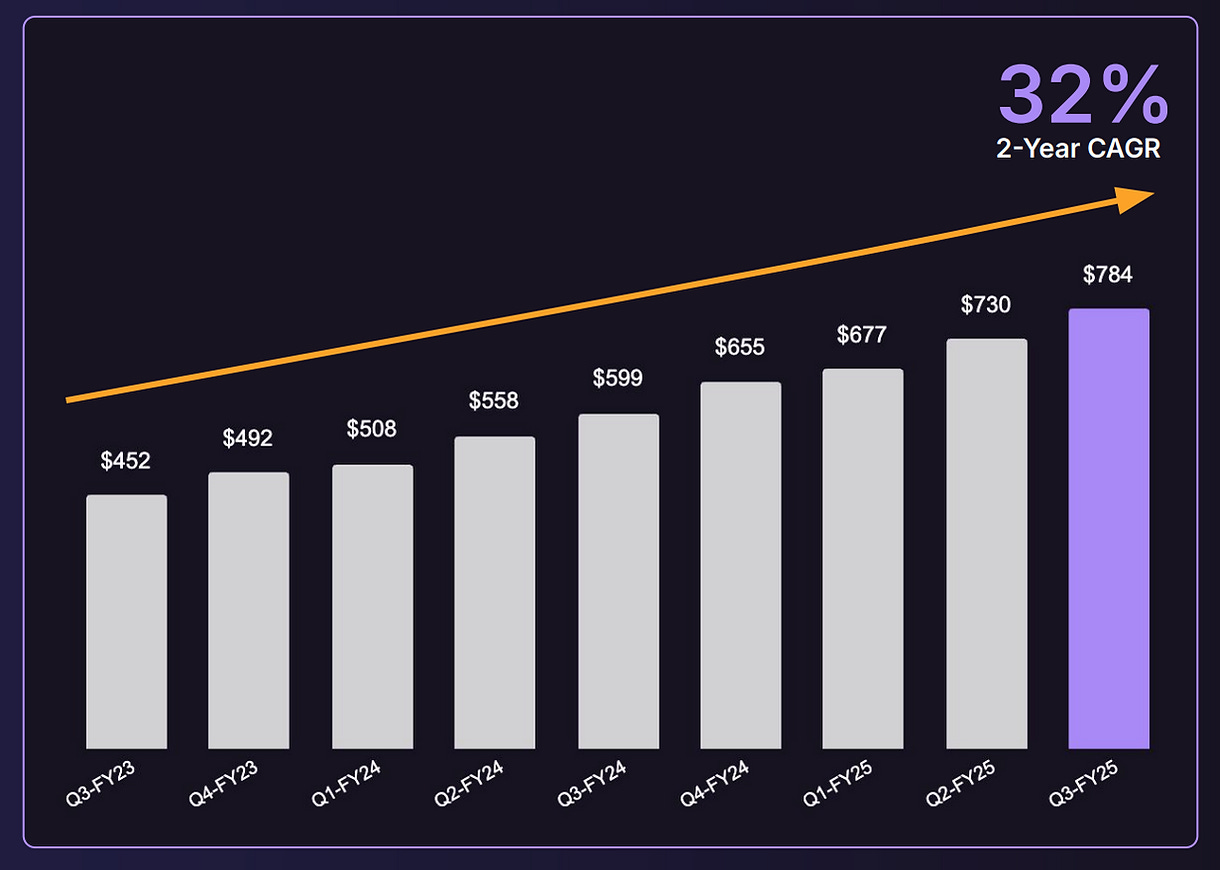

In the third quarter of fiscal year 2025, which ends in January, GitLab's revenue grew 31% year-over-year to $196 million. In the previous fiscal year, 2024, revenue growth was 37%.

However, GitLab's as yet unrealized revenue grew much faster, increasing by 48% to $812 million, suggesting that large customers are willing to commit to GitLab for the long term. After all, $515 million of these RPOs (Remote Performance Obligations - explained in simple terms here) will be recognized as revenue over the next 4 quarters, which means that about 70% of FY25 revenue is already on the books for next year.

In addition, there is the entire new customer business and the significant upsells (remember: net retention rate 124%!) into the existing customer base. To me, these numbers look very much like the significant slowdown in growth should end in the coming FY26.

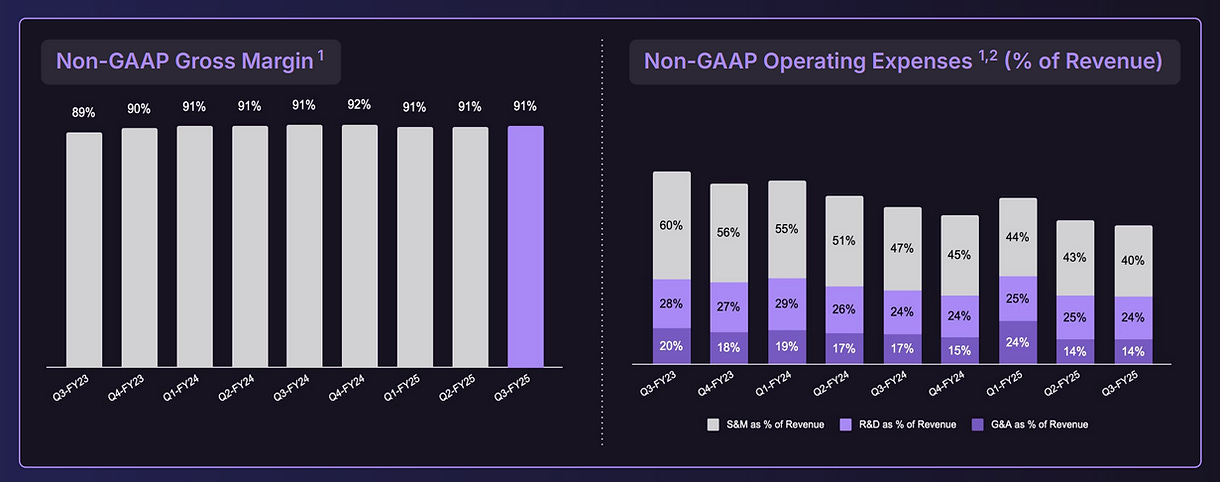

What makes GitLab's numbers particularly attractive is its outstanding gross margin of 89% (GAAP). Enterprise software companies with this kind of profile tend to become real cash machines once they reach a certain size, and the cost ratios for sales and marketing (S&M), research and development (R&D), and general and administrative (G&A) are correspondingly lower.

Marketing and sales costs as a percentage of sales have fallen from 60% to 40% over the past two years. General and administrative costs, which were 20% of sales two years ago, are now 14%.

As a result, the operating margin (non-GAAP) increased by a full 1,000 basis points year-over-year, from 3% to 13% in Q3 FY25.

GitLab achieved cash flow breakeven in FY24, one year faster than originally planned. In Q1 FY25, the free cash flow margin was already 22% compared to -9% in the same quarter last year. However, the last two quarters have been a bit disappointing with single digit free cash flow margins (non-GAAP).

The GAAP figures look much worse with an operating cash burn of $177 million in the third quarter of FY25. This is mainly due to a one-time payment of $188 million to the Dutch tax authorities in the third quarter. As a result, the company will again report a negative cash flow for FY25 according to GAAP.

GitLab's balance sheet is rock solid and beyond reproach. Over $900 million in cash is not offset by any significant long-term liabilities. Intangibles are also negligible so far, as the company has only made a few very small acquisitions since the IPO.

High SBC And Dilution Tarnish GitLab's Numbers

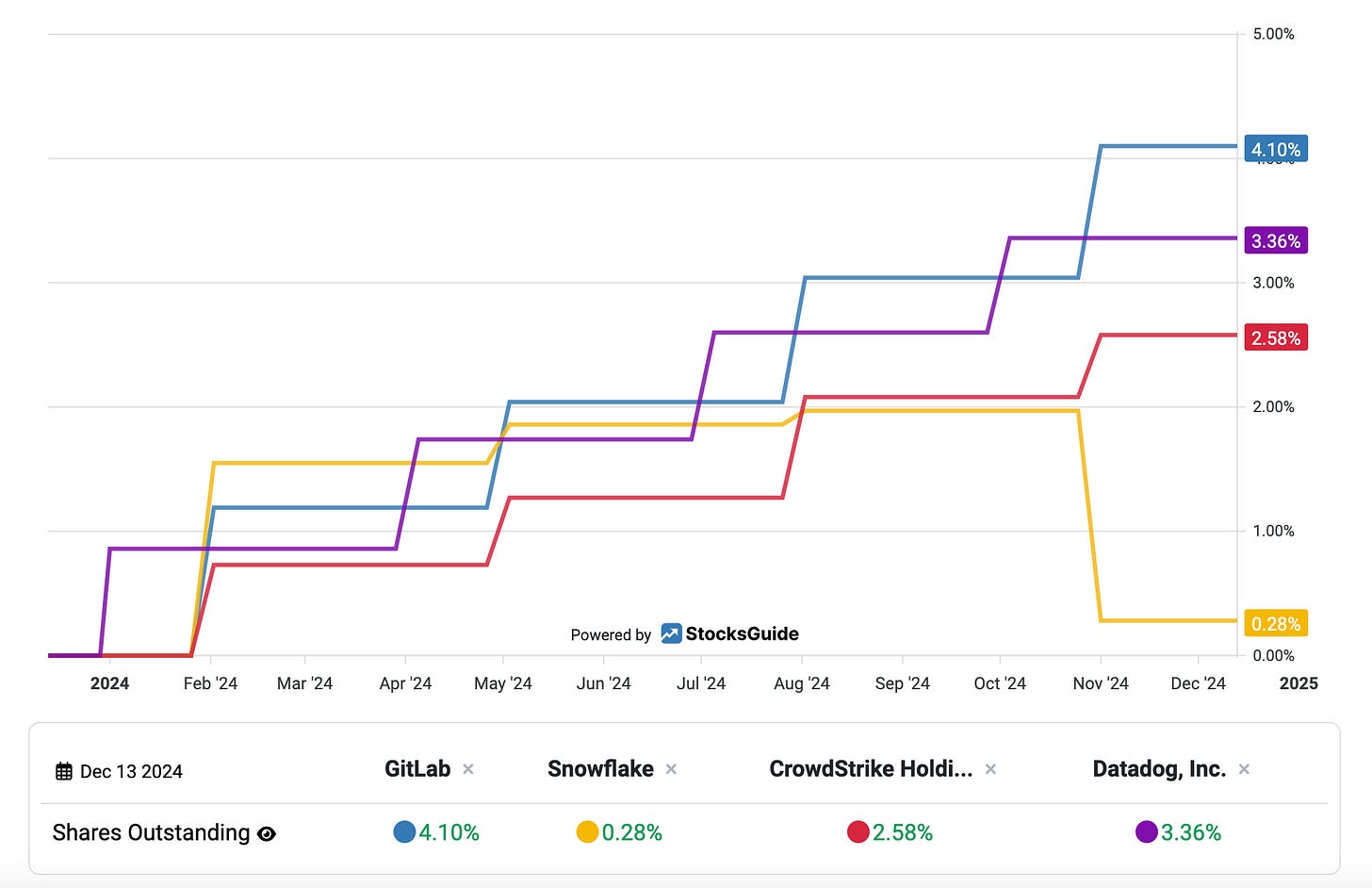

A weakness in GitLab's figures is the high (non-cash) cost of share-based compensation, even by industry standards. These SBCs (Share Based Compensation here simply explained) still amounted to 26% of revenue in the last 12 months.

Much more important to me than SBC is the dilution of existing shareholders resulting from share-based compensation. The number of outstanding stocks increased by 4% over the last 12 months. This is higher than at other software companies such as Snowflake SNOW 0.00%↑ or CrowdStrike CRWD 0.00%↑ , which have been criticized in the past for their high SBC.

I expect this dilution at GitLab to decrease significantly in the coming years. This should be the case starting in the upcoming FY 2026, when the stock option programs issued at the time of the IPO expire (usually after 4 years). Because 4% p.a. dilution is way too much for my taste in the long run.

GitLab's Guidance For FY25

GitLab's management is known for its conservative guidance since the IPO. This year we saw already three "beat and raise" quarters, and now FY25 revenue growth is expected to be around 30%, or $754 million.

The outlook for operating profit in FY25 was raised to a maximum of $70 million (non-GAAP) after Q3. As a reminder, at the beginning of the year, the operating profit result was expected to be little more than break-even.

Valuation Of GitLab Shares

Since the beginning of the year, the price of GitLab shares is down. In the first six months of the year, the share price fell by 30%, but these losses have been mostly offset since August.

The double-digit EV/Sales ratio of currently 12 (TTM) is acceptable due to the 30% growth together with excellent margin profile and good market position. It will probably take another year or two before the company can be properly valued by its cashflow.

Google Is GitLab's Largest Shareholder

The venture capital unit of Google's parent company Alphabet (GV) first invested in GitLab years ago, before it went public, and has held 8.9 million Class B shares with 10 times the voting rights from that time for years. That in itself is nothing special.

What is notable, however, is that GV bought more than 7 million Class A shares of GitLab in Q1 2024, more than tripling its stake and becoming GitLab's largest shareholder.

Most importantly, GV's share of GitLab's voting rights rose to over 25% as a result of the share purchase. This means that Alphabet can already have a decisive say in GitLab.

But that's not all: GitLab is now the largest holding in GV's entire $2.5 billion investment portfolio. I think this is a strategic investment. After Microsoft's acquisition of GitHub in 2018, it could be very interesting for Alphabet to add GitLab to the Google Cloud Platform. By the way, Microsoft paid a truly strategic price for GitHub at the time (more than 30 times revenue).

Sudden CEO Change Against A Tragic Background

Whether a takeover will actually take place is another question. Sid Sijbrandij owns the majority of GitLab's Class B shares and still controls more than 45% of the voting rights. One can only speculate about his plans for the company.

However, tragically, Sid has been diagnosed with bone cancer and is currently undergoing further treatment. His illness is also the background to the sudden change of CEO in December 2024.

Bill Staples has taken over as CEO of GitLab with immediate effect. Bill has worked at Adobe and Microsoft, and most recently served as CEO of New Relic, a SaaS company.

In his four years as CEO of New Relic, he transformed the company's business model to usage-based pricing, paving the way for the sale of the company to private equity investors in 2023.

This could be a blueprint for GitLab's coming years. As a shareholder, I certainly hope that GitLab remains an independent company for a long time to come.

Conclusion

A GitLab share price of $60 implies an EV/Sales multiple of 9x based on FY26 sales. While this is a premium price, it is still a reasonably fair valuation for a 30% p.a. growing SaaS company with a 90% gross margin.

I consider the analysts' revenue and profit estimates (FY26 revenue growth is estimated at less than 25%) to be too low and expect further positive surprises. As a result, I've been adding to my position recently.

If you would like to continue to follow GitLab with me in the future, you can subscribe to my 100% free Substack here.

*Disclaimer: The author and/or related individuals or companies hold shares in GitLab. This post is an expression of opinion and not investment advice.