Vimeo Stock: Patience is Paying Off

Vimeo, a SaaS company that is heavily weighted in my model portfolio, saw its share price rise more than 40% after reporting its Q3 2024 quarterly results. What's next?

The stock of video platform Vimeo VMEO 0.00%↑ have been bobbing along in my model portfolio for over 18 months at prices below $4. I had cautiously added shares from time to time and my portfolio ended up significantly overweight in Vimeo. My last post about Vimeo back in February was named “Testing the Patience of Shareholders” for a good reason.

Now, patience seems to be paying off: new CEO Philip Moyer has been in his position for a good six months, and Vimeo's share price has risen by more than 80% since then. In response to the Q3 2024 figures, the share price jumped by more than 40%.

Is this just speculative early praise for the new management? Or is the rise in Vimeo's share price based on some fundamental development?

Vimeo's Financial Results for Q3 2024

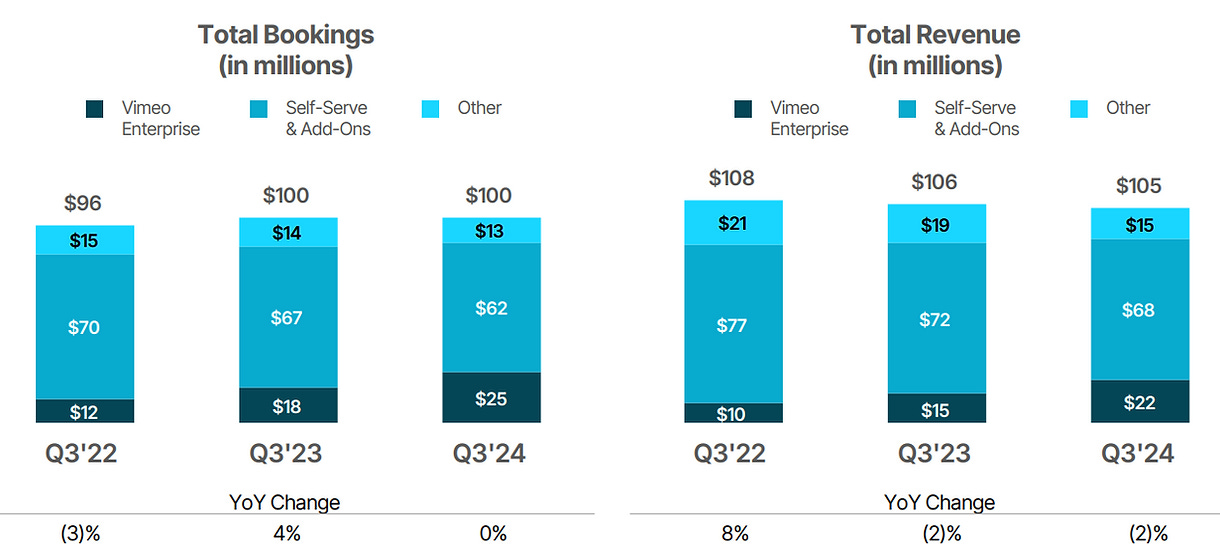

Vimeo reported Q3 2024 results that significantly exceeded its own guidance and analyst estimates. Bookings were virtually the same as last year, breaking through the $100 million mark. Revenue was $105 million, slightly below last year. The company generated a net profit of $9 million and free cash flow of $21 million.

To understand the investment case for Vimeo, it is important to look at the revenue performance of its three segments, which are evolving very differently:

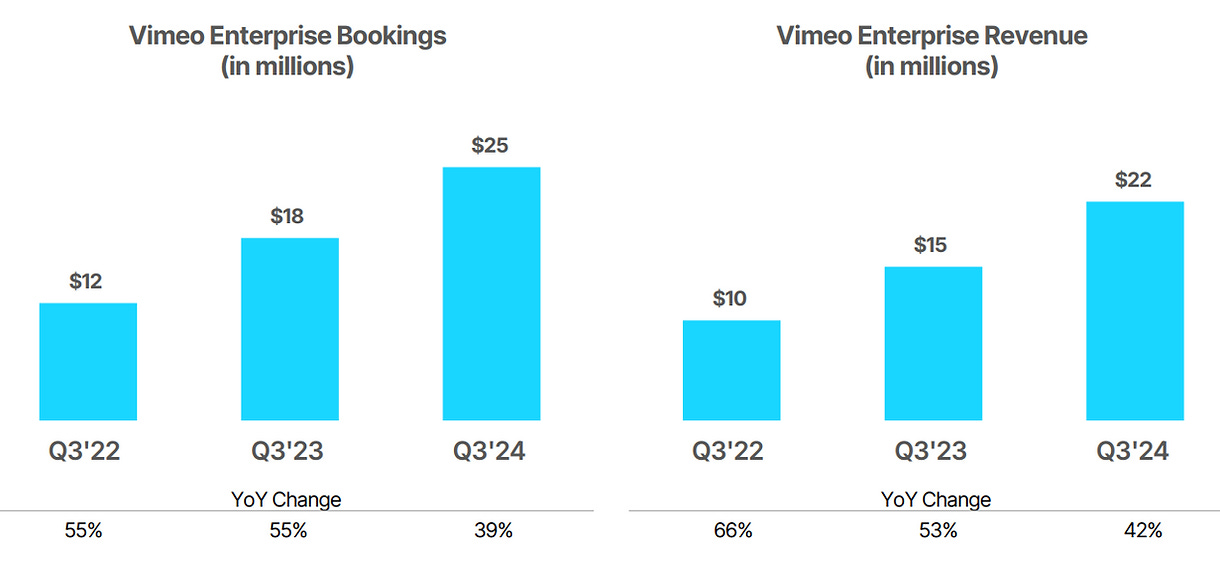

1. Vimeo Enterprise

Vimeo Enterprise is the fast-growing B2B business with medium and large enterprise customers. This segment saw an impressive 39% increase in bookings to $25 million in Q3 2024. This represented 25% of total bookings.

Enterprise segment revenue increased 42% to $22 million in the third quarter. The number of customers grew by 26% year over year to 3,800. Average annual revenue per customer increased by 11% to over $23,000.

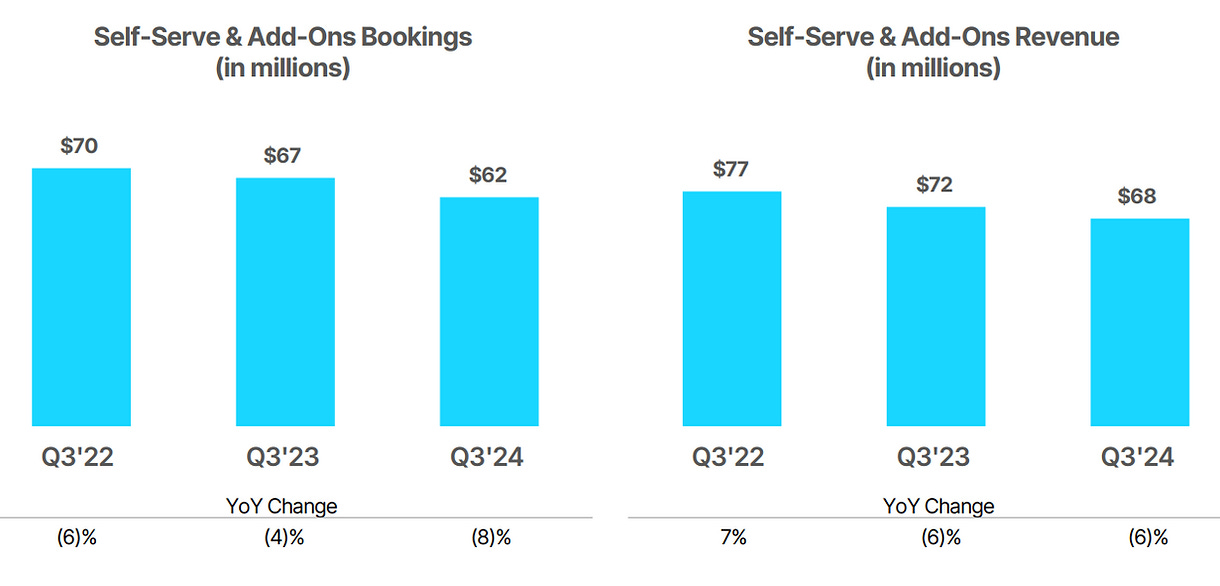

2. Self-Serve & Add-Ons

The largest business unit continues to be the online distribution of the Vimeo product for small businesses and creators. With revenues of $68 million and bookings of $62 million, this segment is the main pillar of the company, accounting for two-thirds of revenues. This unit grew rapidly during the covid outbreak, but has struggled with declining revenues since the pandemic ended.

In the third quarter, bookings in this segment declined by a further 8% year-on-year. This is an achievement considering that the corresponding advertising expenses were reduced by almost 50%. The number of subscribers decreased by 9% to 1.3 million. However, revenues declined by "only" 6%, as the subscriber decline was partially offset by a price increase.

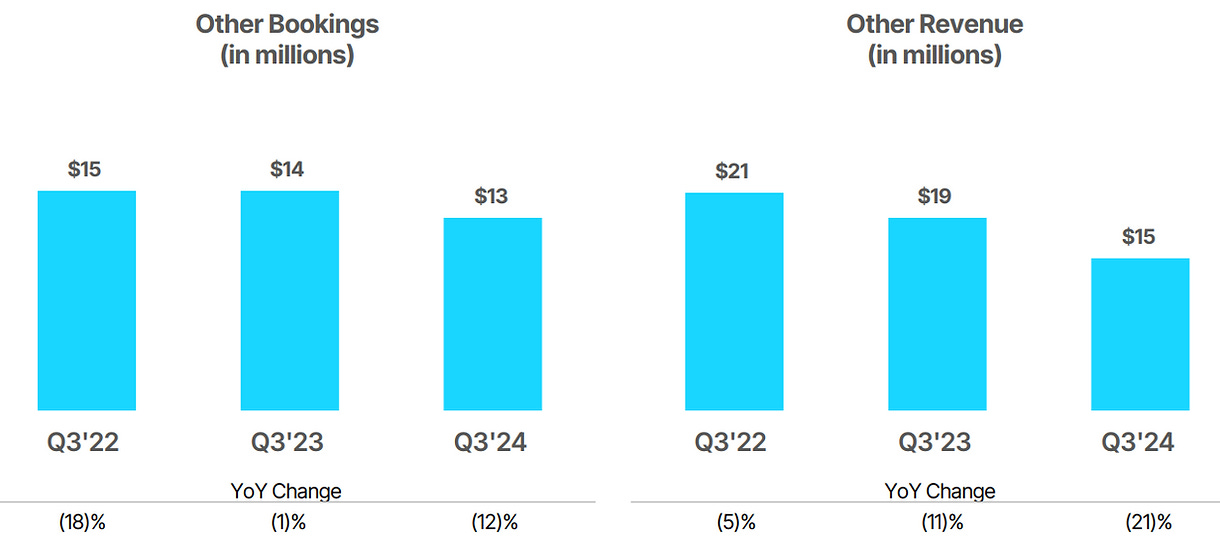

3. Others

In the "Others" segment, revenues again continued to decline by more than 20% compared to the prior year. This was due to the discontinuation of various older legacy products. Revenues were only $15 million, or 14% of total sales. Bookings, which are ahead of sales recognition as revenue, were $13 million.

The majority of this revenue (82%) now originates from the OTT product. This is the product purchased in 2016 for customers who want to monetize their video content through a subscription. OTT now accounts for 82% of revenues in the "Other" segment, up from 62% last year.

Bookings for this OTT product have remained stable recently. In the third quarter of 2024, Vimeo signed several new OTT customers paying a six-figure annual subscription fee. Important to note: Starting in 2025, the "Other" segment will no longer be a significant headwind to Vimeo's overall financial performance.

Vimeo Outlook for 2024 and 2025

After 3 quarters, it now looks like Vimeo's revenue will stagnate at around $417 million in 2024, with profitability likely to be significantly better than in 2023. In the first 9 months, the cash flow margin was 15% and the EBIT margin was around 10%. This is a lot better than the 6% revenue decline with EBIT losses that were expected at the beginning of the year.

Vimeo's management is quite optimistic about 2025 after the third quarter of 2024, predicting that the company will return to growth in 2025. However, it plans to maintain the profitability achieved in 2024, both in terms of cash flow and net profit.

The success of the Enterprise business is now such that it will increasingly be reflected in the overall figures. For example, if Vimeo Enterprise grows by 35% in 2025, that would mean a 9% increase in total revenue. In addition, the headwinds from the other two businesses will diminish significantly.

I expect self-service revenue to at least be flat. The lower number of subscribers is likely to be offset by higher prices. Corresponding packaging and pricing measures are currently being tested. The monetization of new AI features, such as AI-powered video translation, will also play a role.

I also think that the "Others" segment will provide stable revenues from 2025 onwards. After 2025, this business unit could be renamed to OTT, once all other legacy products have been phased out, to bring more clarity into reporting. After all, OTT now represents more than 80% of these former "leftover" products.

Overall, I believe Vimeo will grow at least in the high single digits in 2025. That means revenues will be around $450 million. If all goes well, there could even be a return to double-digit growth, at least in the second half of the year.

That is significantly more than analysts have been estimating so far. I expect that their 2025 revenue forecast of only $424 million will soon have to be revised upwards.

What about profitability in 2025?

I don't know what specific investments the new management has planned for 2025. It has been announced that more will be invested in both research and development and the sales organization around Vimeo Enterprise. But based on the very optimistic statements on profitability, I think the free cash flow margin target for 2025 remains unchanged at around 20%. This means that the Rule of 40 score (easily explained here) would increase to around 30 in 2025.

That would be a very respectable turnaround towards an efficient growing company. And it would also set the foundation for a much higher valuation as a growth company in the future. But that's a long way off, so let's look at the fair valuation for now.

Vimeo's Valuation

Even after the jump in the share price following the Q3 figures, Vimeo still only trades at a market capitalization of $1.1 billion at a price around $6.80. Adding in the company's debt-free cash reserves of over $300 million, the enterprise value is approximately $800 million.

In other words, for an EV/Sales ratio of less than 2, you get a SaaS company that is expected to grow solidly starting in 2025, with a gross margin of nearly 80% and a free cash flow margin of 20%. The enterprise value to free cash flow ratio (EV/FCF simply explained) is less than 15.

I think Vimeo is still significantly undervalued, even after the price jump. The company should be worth at least three times its revenues. Therefore, I believe that prices above $10 for Vimeo shares are realistic by the end of 2025 at the latest. If the company returns to double-digit growth, a much higher price target would make sense in the longer term. But we'll talk about that when the time comes.

At the moment, such a price development is prevented by insufficient investor attention. That is to say, hardly any investors are interested in the company. Vimeo's Q3 2024 earnings call was over after only 20 minutes. There were only three analysts present to ask the CEO and CFO questions. I still read that Vimeo is seen as a failed YouTube alternative and a loser in the AI age. This tells me that most investors have not looked at the business model or the business and product development over the last few quarters.

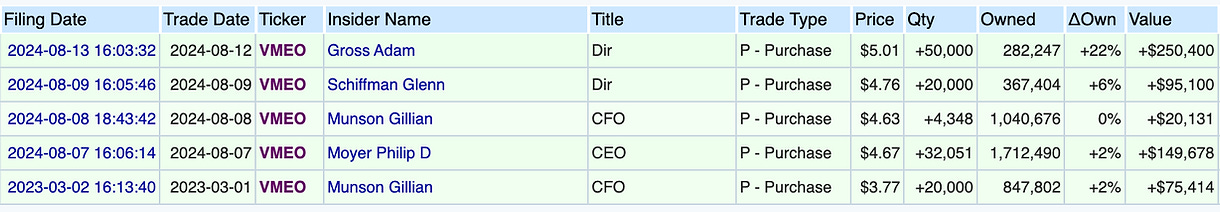

By the way, it is encouraging that CEO Philip Moyer, CFO Gillian Munson, and board members Adam Gross and Glenn Schiffman all bought Vimeo shares in Q3.

Conclusion

Vimeo delivered solid results in the third quarter of 2024. The Enterprise segment continued to perform particularly well, and the Self-Serve & Add-Ons segment also stabilized. With a focus on new AI-based product features and solid cost management, the company is well positioned to grow profitably going forward under its new management.

Vimeo's management expects to achieve bookings and revenue growth, as well as profitability and positive cash flow in 2025. I also believe that the revenue turnaround will be achieved in 2025. Vimeo will then be a growth company with a solid cost structure and a capable team. The stock could see another re-rating the moment investors share this perception.

If you are interested in following the development of Vimeo with me in the future, you can sign up for my SubStack here:

*Disclaimer:

The author and/or affiliated entities own shares of Vimeo. This post is an expression of opinion and not investment advice. Please note the legal information.