Vimeo Stock: Testing the Patience of Shareholders

Despite its turnaround, the SaaS video platform Vimeo is only valued at one times its revenue. An assessment of a forgotten share.

Investing in second- and third-tier tech stocks can be challenging and nerve-wracking. While the big names such as Apple, Microsoft and currently Nvidia get all the attention from investors, many other tech stocks are still in the shadows.

Hardly any equity investors are interested in them any more. Calls with analysts are sometimes cut short after just a few questions due to a lack of interest from institutional investors. This is also a great opportunity for anti-cyclical private investors, as these forgotten stocks are often rediscovered sooner or later. A revaluation can then take place in a flash, provided it is fundamentally justified.

The video platform Vimeo VMEO 0.00%↑ is one of the software stocks that crashed hard in 2021/2022. The chart looks disastrous and the stock has been stuck at a low level for more than a year. Nevertheless, I bought Vimeo in 2023 after the +90% crash and added it to my investable model portfolio.

As a reminder: Vimeo was one of the coronavirus winners in 2020 and 2021, growing by 45% and 38% respectively, then went public on the Nasdaq as a spin-off from Internet Holding company IAC 0.00%↑ at a completely overpriced price and has been in a downward spiral of share price losses and collapsing revenue growth ever since. After 11% growth in 2022, the company even had to report a 4% decline in sales for 2023. And it is unlikely to return to growth in 2024. But more on that later.

Vimeo quarterly numbers for Q4 2023

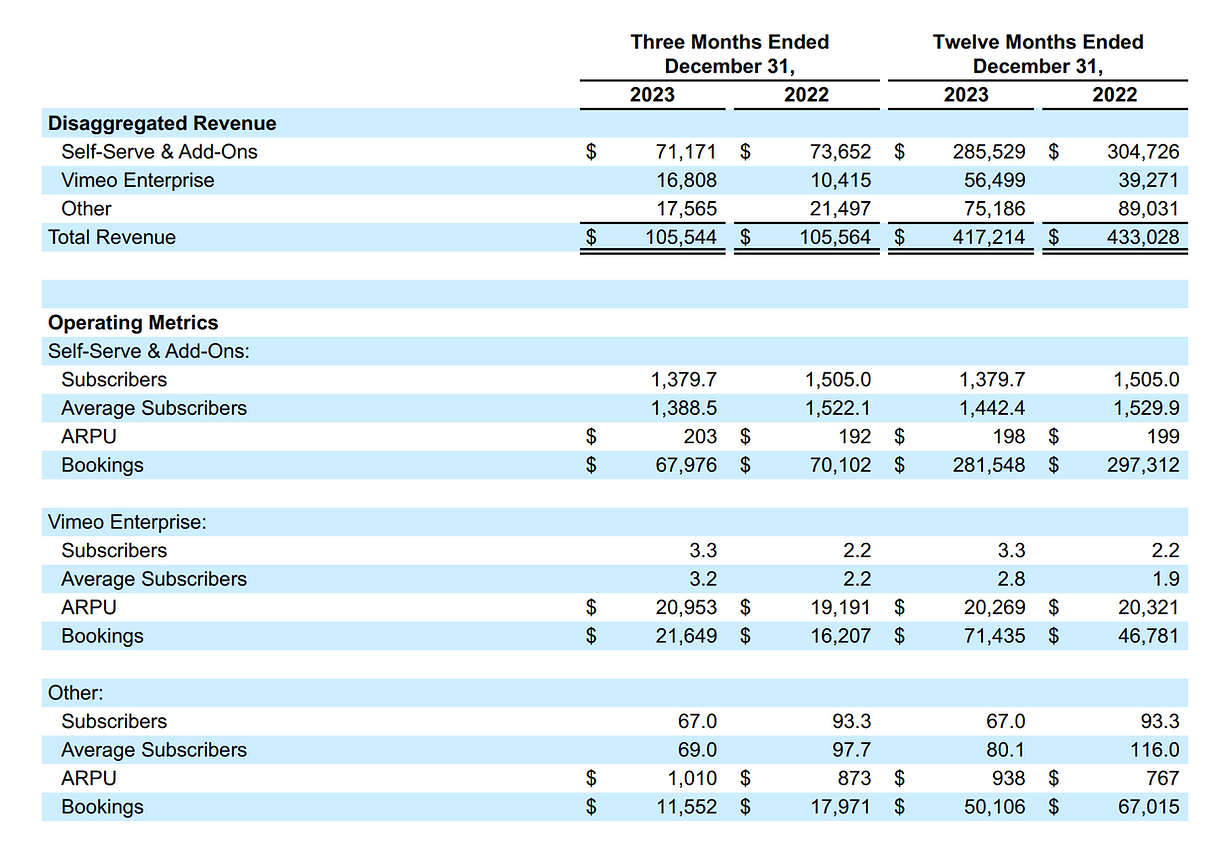

Decent numbers were reported for Q4 2023, beating analyst expectations and the company's own guidance. Revenue stagnated at 106 million USD compared to the same quarter last year, while bookings fell by a further 3% to 101 million USD.

To understand the current evolution of Vimeo's business, it is important to take a closer look at its 3 different revenue streams, which are evolving very differently:

1. Self-Serve & Add-Ons

By far the largest and most important business area is the direct monetization of the self-service platform vimeo.com. Here, users can subscribe to various packages of the Vimeo software for little money. The average subscription price is just over 200 USD per year and is paid by around 1.4 million subscribers. In total, the Vimeo platform has a massive user base of 300 million.

During the coronavirus pandemic in 2020 and 2021, this self-serve segment experienced exceptionally strong growth and is the dominant source of revenue for Vimeo, accounting for over 2/3 of the total. After the pandemic, the video platform's traffic is now returning to normal. Many users who used video out of necessity during the pandemic have now returned to offline activities. As a result, bookings and revenues in the self-serve segment have declined -3% in 2023, as have subscriber numbers (most recently in Q4, -8% year-on-year).

Perhaps the company's most important goal is to stop the decline in self-service bookings and subscribers by 2024 and return to a long-term positive trend.

2. Vimeo Enterprise

Vimeo's Land+Expand sales model is designed to identify those self-serve customers who want to deploy Vimeo tools on a large scale with many users in their organization. The Vimeo Enterprise Suite, which has been expanded to meet the requirements of larger customers, is then sold to these enterprise customers with the support of a traditional sales team.

Vimeo Enterprise is still a relatively small but fast-growing revenue stream. Its share of revenue grew in Q4 from 10% to 16% within a year. Its share of bookings is already 21%. However, bookings growth in this segment was only 34% in Q4, down from over 50% in each of the previous quarters.

Nevertheless, these figures are proof that the Land+Expand sales strategy is working and that Vimeo should return to growth in the medium term, supported by the fast-growing enterprise business. Impressive new customers such as Porsche, Philips and Whole Foods in Q2, Boston Consulting Group, Shutterstock and Forrester in Q3 and Domino's, Toyota and Hermes in Q4 complete the positive picture of this enterprise business.

3. Other

The significant decline in sales and bookings from the "Other" segment still speaks against a rapid return to growth. This segment includes products such as VHX, OTT, LiveStream and Magisto, which were acquired in recent years in order to integrate their functionality into the Vimeo platform. With the exception of OTT, there is no longer any investment in the standalone versions of these legacy products and some products are being discontinued. Accordingly, revenues in this 'Other' segment fell by 15% year-on-year in 2023. The decline in revenues accelerated to 25% in Q4 due to deliberate management decisions.

The share of this dwindling revenue stream was still 17% in Q4. In terms of bookings, 'Other' accounted for only 11% in Q4. This means that from now on the positive trend in the Vimeo Enterprise segment will more than compensate for the revenue and bookings losses from the legacy business.

Profitability through cost discipline

Over the past 18 months, Vimeo's management has successfully switched from growth mode to a strategy that prioritises profitability (primarily measured by free cash flow). The new CFO, Gillian Munson, has been in place since 2022. She put the brakes on costs, Vimeo had to lay off a lot of staff and at the end of 2024 it had 1,070 employees, 13% less than the year before. Some marketing and administrative staff were also let go at the start of 2024.

The gross margin (GAAP) has increased from 75% to 78% over the last two years.

Operating costs have been significantly lowered in all areas of the business, with the cost base reduced by almost 25% in 2023 as a result of the cost reduction measures.

This has enabled an impressive turnaround in profitability:

In Q4 2023 (as in Q3), a net profit of 8 million USD was reported after a loss of 5 million USD in the same quarter last year. Vimeo also achieved a net profit of 20 million USD for the full year 2023, compared to a loss of 80 million USD in 2022.

Operating cash flow turned significantly positive in 2023, from -37 million USD to +38 million USD. In the second half of the year alone, free cash flow was 27 million USD, a clear double-digit return.

That's what I call an impressive turnaround. These figures are great proof of how well such SaaS companies can be turned around very quickly in crisis situations because of their high gross margins.

The success of Vimeo's emergency turnaround is clear to see. The company is now clearly cash flow positive and should remain so in 2024 and beyond. The debt-free company has a cash reserve of more than 300 million USD as of 31 December 2023, or 3/4 of one year's revenue.

Now that the business has stabilized, Vimeo can operate from a position of financial strength. The next step is to reverse the trend in bookings in 2024 and then, probably not before 2025, the negative trend in revenues.

Vimeo's guidance for 2024

Vimeo's management has disappointed me with its guidance for 2024. Revenues are expected to decline by a further 4-8% to 385-400 million USD, whereas I had previously expected at least stable revenues, as did the analysts. One reason for this disappointing revenue forecast is probably that Vimeo is deliberately reducing legacy revenues from the "Other" segment faster than before in order to focus on more forward-looking activities.

Vimeo expects an operating loss of 5 million USD in 2024, down from an operating profit of 13 million USD in 2023, which is weaker than expected; I had also previously expected EBIT to stabilize in positive territory.

I could imagine that this initial guidance is also very conservative with regard to the appointment of a new CEO, in order to give him or her the potential for positive surprises. It will be interesting to see who is appointed as the new CEO following Anjali Sud's departure. Her successor Adam Gross, who took over September 2023, has so far only been presented as an interim CEO.

The valuation of Vimeo stock

Even if the stock price chart suggests otherwise: Vimeo is a stable company with a strong balance sheet (301 million USD in cash as of end of 2023, no debt). Vimeo is by no means a bankruptcy candidate. I now expect revenues to decline slightly in 2024 and then turn positive again as Vimeo Enterprise becomes more important.

At Vimeo's current share price of 4 USD, its enterprise value is less than 400 million USD, which is roughly one times its expected revenues in 2024.

Under normal circumstances, this is far too little for a profitable SaaS company with a 78% gross margin and a double-digit cash flow margin.

Personally, I believe that the medium-term targets for sustainable, profitable, moderate revenue growth (from 2025 on?) are entirely realistic. I believe that in such a scenario, Vimeo's EV/sales ratio will rebound to at least 3 over the next 3 years.

In other words: In my investment case, I see the fair enterprise value of Vimeo - in a few years' time - at well over 1 billion USD. This therefore corresponds to a medium-term triple-digit share price potential.

Vimeo in the age of AI

Vimeo's share price is also currently suffering from the fact that the financial market is probably prematurely viewing the company as a loser in the age of AI. New challengers from the AI start-up scene are seen as disruptors to established video software solutions such as Vimeo due to their impressive technical capabilities in video production.

One thing is often forgotten: Vimeo - like YouTube or Adobe - has an important competitive advantage over all the young attackers from the AI scene: it already has a huge user base that can be directly monetized. And Vimeo's comprehensive platform is about much more than just video production functionality.

So I do not see GenAI models for video production, such as OpenAI's Sora, as direct competitors to Vimeo in the future. For Vimeo, as for most other software vendors, it will be a matter of forging clever partnerships with the providers of these LLMs and increasing the conversion of freemium users into paying customers through convincing AI integration.

In the short term, it will be particularly important to see whether the new AI capabilities in Vimeo's Video Creation Suite can help turn around the core self-service business. There was an important indication of this in management's recent Q4 comments: for the first time in a long time, retention rates are trending positively again, i.e. customer satisfaction is increasing and customers are not churning as frequently as before. Unfortunately, I do not have more precise figures on this.

Conclusion

After the crash, I patiently and carefully built up a position in Vimeo for my model portfolio and intend to hold it for at least 3 years.

The company is struggling with operational issues, which I believe can be resolved. I have the impression that the new management is on the right track. What is important to me is that they now want to invest more in product development and further reduce marketing expenses in 2024.

Unfortunately, the general perception is that Vimeo is on the wrong side of the current AI hype. But even this hype will pass, and investors will realize that companies like Vimeo have a future, provided they integrate the new capabilities of AI into their products in a sensible way.

If Vimeo's share price does not recover in the foreseeable future, Vimeo could also become a takeover candidate due to its undervaluation. I would not be surprised if a new CEO is installed with the aim of preparing the company for a withdrawal from the stock market. For the sake of all Vimeo shareholders, I hope that doesn't happen. Although a private equity takeover would certainly be sweetened for us shareholders with a tidy premium.

If you would like to follow the development of Vimeo with me in the future, you can

*Disclaimer:

The author and/or associated persons or companies own shares in Vimeo. This article is an expression of opinion and does not constitute any investment or financial advice.

Was there a reason for the dip yesterday?

A good entry opportunity and I have built up a first small position