Lyft Stock: The Underrated Uber Rival as a 100% Opportunity for Patient Investors

Why the stock market is not accurately reflecting the fundamentals of the company.

It's been almost six months since the last addition to my model portfolio. That was my entry into the Twilio stock. The timing was fortunate, and today I can celebrate with you a +130% price gain in the Twilio stock!

Since then, I have considered - and ultimately rejected - a number of potential investment cases. So I am all the more pleased to finally present you with a new addition to my portfolio in this Lyft stock analysis.

The ride-hailing company LYFT 0.00%↑ is hardly known as a taxi alternative in my home country Germany and across Europe because, unlike Uber, the company has not internationalized outside of North America. In the U.S. and Canada, Uber and Lyft dominate the ride-hailing market, with Lyft clearly being the number two behind Uber. Exact market shares are unclear, but it is estimated that Lyft has a market share of around 20-25%, while Uber is almost three times larger.

As a result, Lyft is often portrayed as a loser in the public perception on at least two levels: first, Lyft is the loser in the battle against the overpowering arch-rival Uber. Second, Lyft, along with Uber, is supposedly a loser in the AI revolution, as ride-hailing companies could potentially be disrupted by robotaxis.

All of these concerns, along with homegrown operational issues, have caused Lyft's stock price to drop more than -80% since its IPO in 2019. Looking at the price, you might think that Lyft is a company doomed to fail.

But this is not the case. The stock market is not accurately reflecting the fundamentals of the company. In my opinion, Lyft is worth significantly more than the stock is trading at. But one thing at a time.

Management Change

Like many other technology companies, Lyft, a high-growth company at the time, went public in 2019 at an IPO price of $72, which was far too expensive. In an era of cheap money, the previous management pursued a "growth at any cost" strategy. Then the covid pandemic hit, revenue growth plummeted, and the firm reported multibillion-dollar operating losses for years. A leadership transition was initiated in late 2022, and by then the stock price had fallen to $10.

The pivotal leadership change at Lyft occurred in spring of 2023, when the company's two co-founders and previous top executives, Logan Green (CEO) and John Zimmer (President), stepped down from their leadership roles. David Risher, an experienced technology executive and former Amazon employee, took over as Lyft's CEO in April 2023.

Lyft was finding it increasingly difficult to compete with Uber, especially in terms of market share, profitability, and diversified services (e.g., food delivery). Investors called for a realignment to make the company more efficient and competitive. David Risher decided to strengthen Lyft by focusing on its core ride-hailing expertise, reducing operating costs, improving profitability, and expanding partnerships.

The leadership transition marked a turning point for Lyft, and was the first significant leadership change since the company's inception in 2012. The focus was on regaining investors confidence and stabilizing the company's competitive position, supported by a strict cost reduction program. The new management has implemented a restructuring program over the past two years and has already achieved a lot: more than 25% of the workforce has been laid off, and despite these cost-cutting measures, Lyft has remained a true growth company to this day.

Lyft now runs a massive platform: 5.5 million active passengers use Lyft weekly, transported by 500,000 weekly active drivers. Two million rides are arranged daily. The total number of customers is approximately 50 million. Gross bookings grew by approximately 17% year-over-year to over $16 billion in 2024. Lyft's revenue from these bookings will be around $6 billion. The free cash flow margin (as a percentage of revenue) is already in double digits, although there could still be a small net loss in 2024 (possibly for the last time).

And profitability?

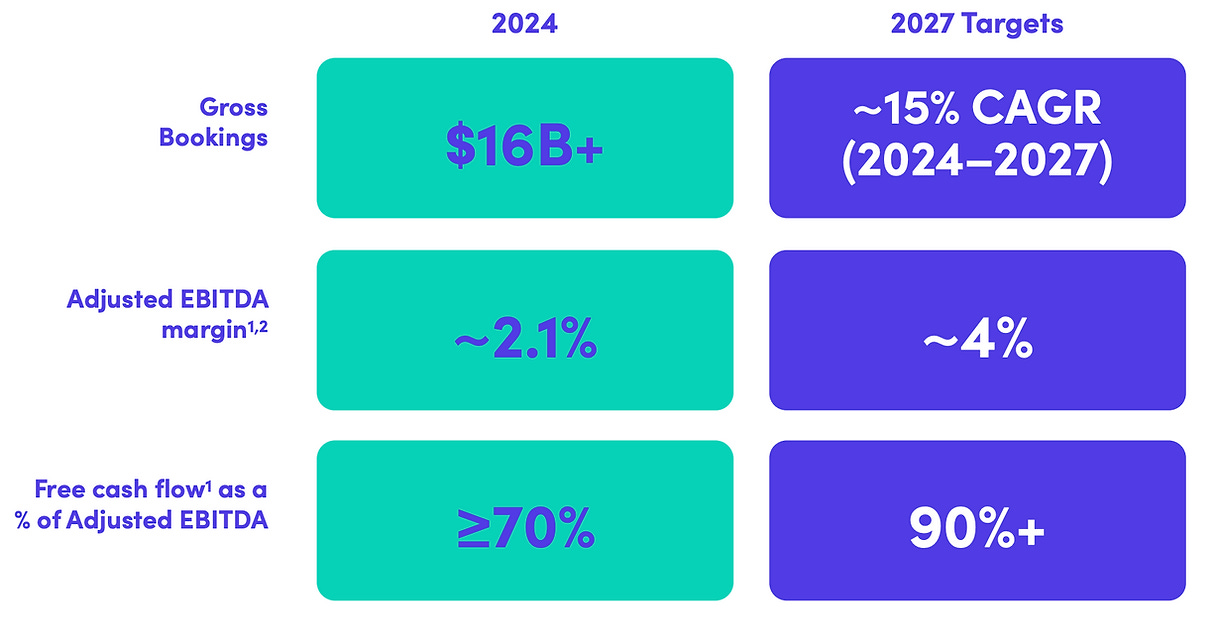

The key metric for Lyft's profitability is its adjusted EBITDA margin, which the company calculates as a percentage of gross bookings rather than revenue. This metric first turned positive in 2023, at 1.6%. This EBITDA margin will reach at least 2.3% in 2024 and is expected to increase to 4% by 2027.

On a revenue basis, that would mean a double-digit EBITDA margin. Lyft, like Uber, operates a business that is not particularly capital intensive. As a result, more than 90 percent of EBITDA is expected to remain as free cash flow until 2027.

With a few key points from the currently communicated corporate goals, it is easy to calculate what a cash flow machine Lyft is likely to become by 2027:

Gross Bookings are expected to increase to approximately $25 billion.

EBITDA should be $1 billion.

Free Cash Flow (FCF) should exceed $900 million.

I now consider these mid-term targets, which were communicated at the Investor Day in June 2024, to be too conservative. In Q3 2024 alone, FCF was $243 million, and over the past 12 months, it was $641 million.

I see no reason why Lyft shouldn't reach an EBITDA margin of 5-6% by 2027. Its big competitor, Uber, is at over 8% in its comparable mobility-as-a-service segment. That would mean free cash flow of $1.1 billion to $1.35 billion for Lyft, a 100% increase by 2024.

Valuation of Lyft Shares

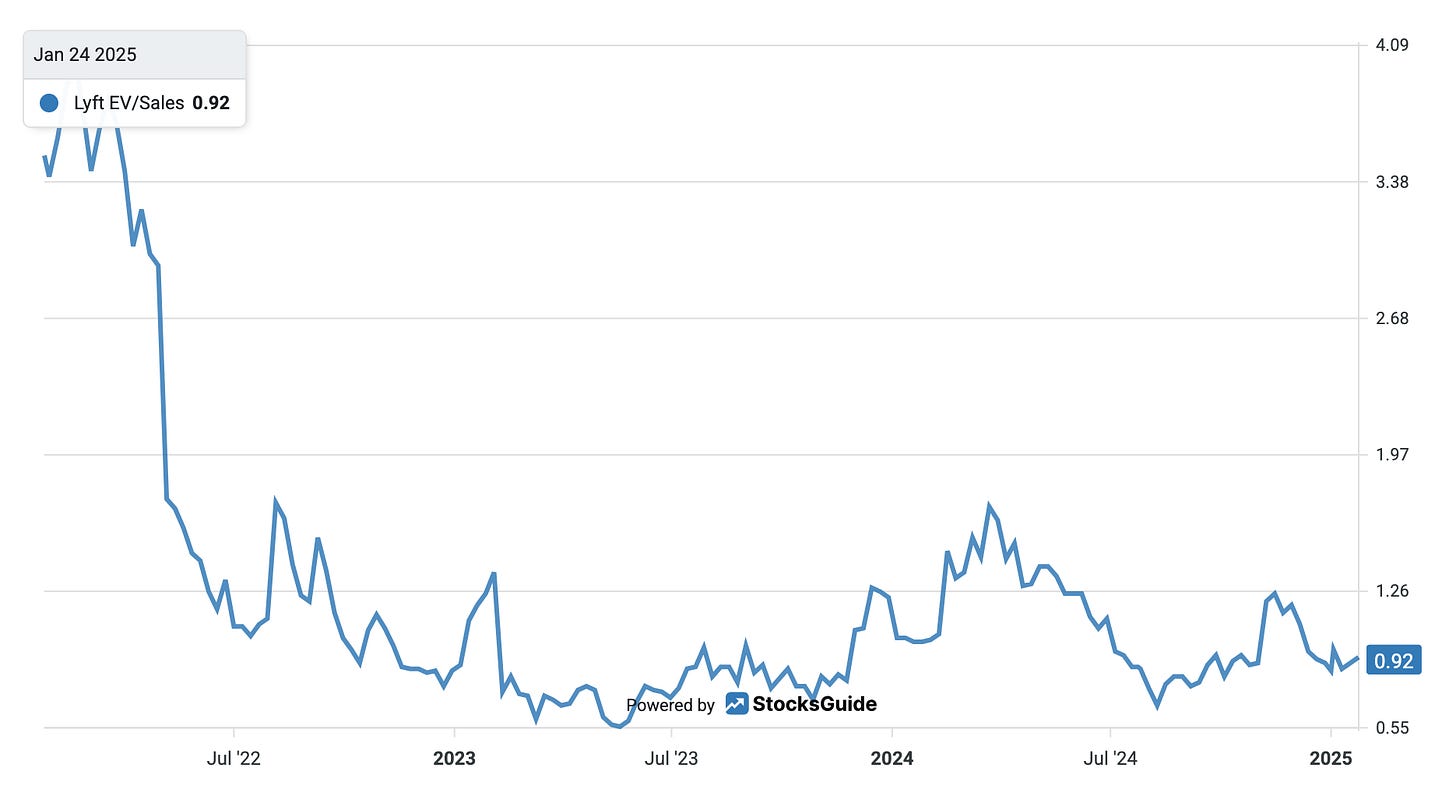

Lyft is currently valued at $5.0 billion, which is less than 8 times trailing 12-month free cash flow. The revenue multiple is currently less than 1, which is far too cheap for a profitable digital platform company.

If Lyft achieves its mid-term company goals by 2027, the Lyft stock should at least double in value.

Why Is The Lyft Stock So Cheap?

Apparently, many investors believe that Lyft, like other ride-hailing companies, will be disrupted by autonomous vehicles (AVs) and will not be able to successfully execute its business plan. Lyft is seen as a victim of the supposedly imminent robotaxi revolution, which I think is nothing more than a concrete expression of the AI hype we are in.

I don't see AV providers like Waymo (or Tesla?) dominating the ride-hailing market on their own. Lyft's management never tires of emphasizing that, much like Uber, it sees itself as a partner to AV providers that has a lot to offer in the areas of demand generation (generating a critical mass of users), marketplace management (matching vehicles to customers), and fleet management.

Over the course of 2024, Lyft has already announced several partnerships with AV providers (Mobileye, May Mobility, Nexar). However, a big name like Waymo or Tesla, which would have had a decisive positive impact on the Lyft image among investors, has not yet been announced in these collaborations.

In recent weeks and months, Waymo in particular has been celebrated for its rapid market share gains in AV pilots like San Francisco, while Uber/Lyft shares have been punished. However, the data shows that Waymo's entry is more likely to create additional volume in the mobility market and is unlikely to take any business away from traditional ride-hailing providers (i.e. Uber and Lyft).

I expect the market to realize sometime in 2025/2026 that it will take many years for robotaxis to actually replace human drivers on a widespread basis, which is the core of my Lyft investment case. I expect that there will be hybrid ride-hailing platforms that provide both human drivers and, where available, robotaxis for at least 20 years. The Lyft stock should be one of the winners from this new perception.

But perhaps all it will take for investors to regain confidence in the Lyft stock is not new information about robotaxi integration, but just a simple leap into the black (including on the bottom line). In 2025, I expect Lyft to report significant net income under GAAP for the first time. For many investors - especially institutional investors - breaking even on the bottom line is extremely important.

As a growth investor, free cash flow is much more important to me. And Lyft's free cash flow is already sustainably positive, with a double-digit margin even today.

Lyft as a Takeover Target

At least since the management change in early 2023, Lyft has been considered a takeover candidate. Uber as a buyer is certainly out of the question, as even a takeover-friendly Trump administration would prevent such a dominant market position for a single player.

But there are a few other candidates for a strategic acquisition of Lyft:

1. Amazon

The scale of Lyft's existing ride-hailing platform (as of Q3 2024, Lyft had 24 million active passengers) could be the key for Amazon to commercialize its own autonomous vehicles.

As a reminder, in 2020, Amazon bought its own autonomous driving startup, Zoox, for more than $1 billion. The company has been testing Zoox vehicles in several major American cities, and Amazon recently announced that it will soon offer its first rides to the public.

Amazon's acquisition of Lyft would make Zoox's robotaxis an immediate and serious threat to Waymo, and it's easy to imagine Amazon adding autonomous vehicles that deliver food via Zoox, much like Uber added Uber Eats.

Good to know: Lyft CEO David Risher was an early employee of Jeff Bezos, joining Amazon just three years after it was founded, where he was a key manager and trusted confidant of Bezos for many years.

Amazon is probably the most obvious buyer for Lyft. An Amazon acquisition of Lyft as early as 2025 was also recently predicted by The Information (paywall).

2. Alphabet/Waymo

Alphabet subsidiary Waymo is the clear leader in autonomous vehicle technology. By acquiring Lyft, Waymo could gain a robust ride-hailing platform to deploy its self-driving cars, leveraging Lyft's massive customer base and operational network.

3. Tesla

Tesla could see Lyft as a platform for deploying its electric cars and eventually its announced autonomous fleet, which fits with its plans for a "Tesla network" of robotaxis. Lyft's 50 million customer base could significantly accelerate Tesla's vision of monetizing its vehicles through shared mobility services.

4. Traditional Car Manufacturers (GM, Toyota, VW)

Traditional automakers are increasingly investing in mobility services as they need to adapt to changing transportation trends. Acquiring a large platform like Lyft could allow carmakers to diversify their revenue streams beyond vehicle sales.

Conclusion

In general, I would never buy a stock like Lyft just to speculate on an acquisition. But it's good to know that there are a number of potential strategic buyers if the company were to give up its independence. Such an acquisition would certainly be sweetened for Lyft shareholders with a decent premium of at least 50% in the current environment.

Lyft is the only ride-hailing platform other than Uber that has reached critical mass in North America. This has created a duopoly in which both companies stand to make a lot of money in a growing market over the next few years. The barriers to entry are very high, even for new providers of robotaxis, who are currently evaluating which market entry strategy to choose.

Uber and Lyft are wrongly seen as losers in the AI battle. For years to come, hybrid mobility platforms will be needed that offer vehicles with and without drivers, depending on the region. Lyft, along with Uber, is well positioned for this and is significantly undervalued. I will now hold the two leading providers (Uber and Lyft) in my investable sample portfolio.

If you would like to follow the development of Lyft and Uber with me in the future, you can subscribe to my 100% free Substack here:

*Disclaimer: The author and/or affiliated individuals or companies own shares of Uber and Lyft. This post is an expression of opinion and not investment advice.

There is a discrepancy b/w David's comment and the data provided by Yipit - "When Waymo launched in August 2023, Uber and Lyft were at 66% and 34% share in SF. 15 months later in November 2024, Waymo is at 22% - the same as Lyft - with Uber at 55%. "

The discrepancy probably derives from the fact that Uber and Lyft usage today involves driving outside of the city, which is unaddressable by waymo (and thus excluded from yipit analysis).

Hi Stefan,

danke für den Pitch, hatte Lyft bis dato nie am Radar! Eine kleine Anmerkung ... was Lyft bei der Conversion von EBITDA zu FCF helfen wird sind die hohen Net operating losses (NOL).

Auszug aus 10K 2023: "As of December 31, 2023, we had $7.7 billion of federal and $6.4 billion of state net operating losses (“NOLs”) available to reduce future taxable income, which will

begin to expire in 2034 for federal income tax purposes and in 2024 for state income tax purposes."

Ärgerlich ist hier allerdings die hohe Dilution mit 7% CAGR. Hast du da evtl. dazu was gelesen wie sich die Dilution lt Unternehmen weiterentwickelt könnte die kommenden Jahre?