Will Uber Become the Ruler of Robotaxis?

Uber has recently entered into several forward-looking strategic partnerships. Here is an overview.

Since my last analysis of the Uber stock a good six months ago, not much has changed with the Uber share price at just over 70 USD.

However, the mobility platform has made enormous progress so far in 2024 - especially in terms of forward-looking strategic partnerships.

Why I am very optimistic not only about Uber but also about the IAC stock in my portfolio is the subject of this article:

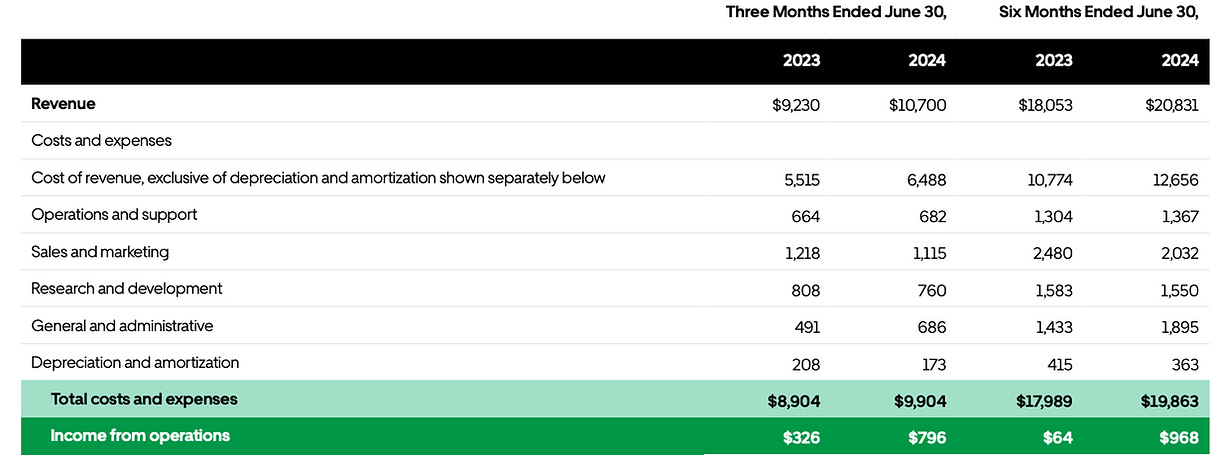

Excellent business figures for the first half of 2024

Uber can look back on an excellent first half of 2024: the number of active users continues to grow at a double-digit rate to 156 million at last count. These users are using Uber more and more, with the number of trips growing by more than 20% per annum for many quarters, as is the volume of business (gross bookings).

Revenue growth in the first half of the year was a good 15%. And this despite a significant 18% reduction in sales and marketing expenditure!

No wonder operating profits have multiplied from a low base.

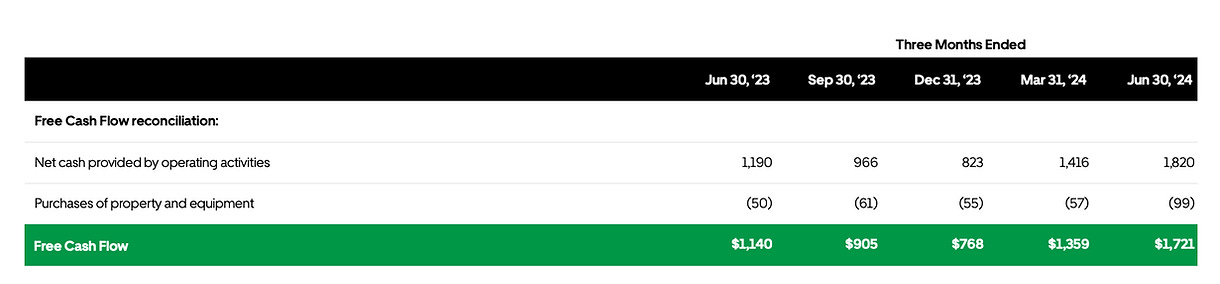

The Uber platform is becoming a real cash machine. Free cash flow rose to over 3 billion USD in the first half of 2024, significantly more than analysts and I had previously expected.

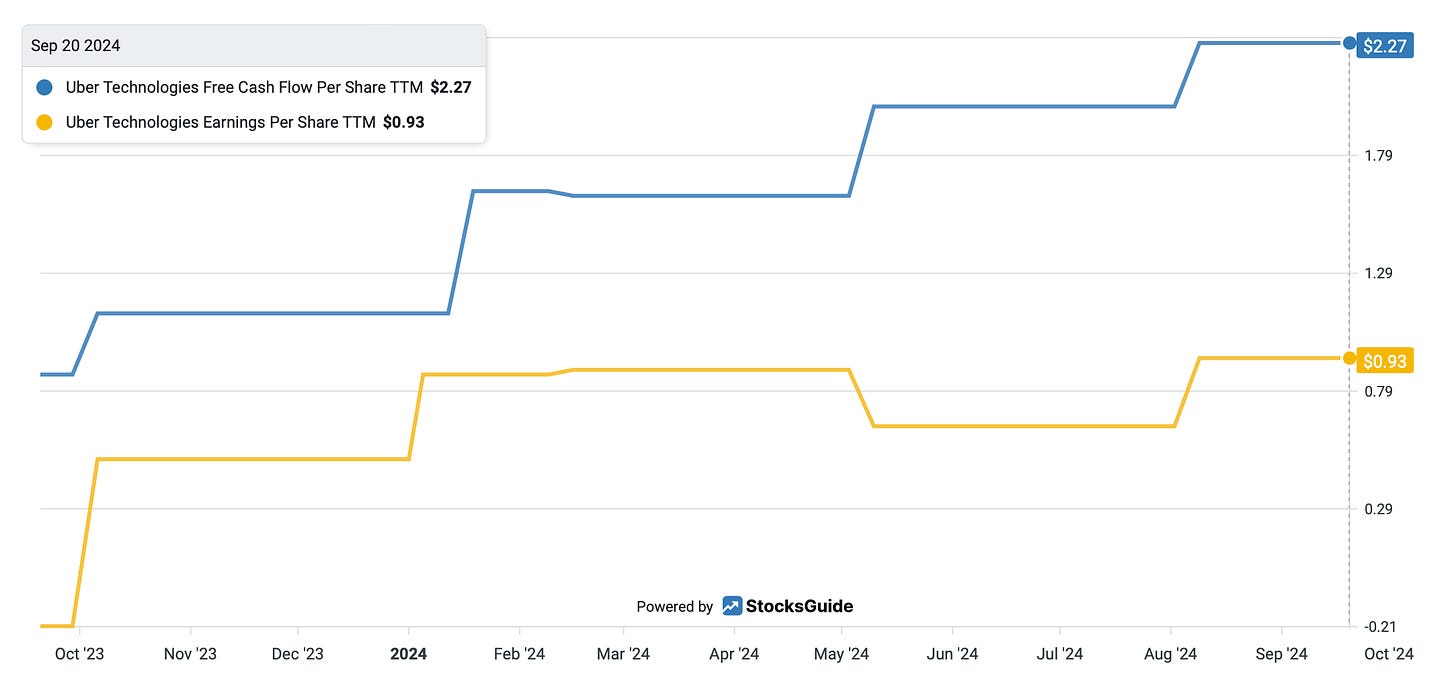

Free cash flow per share increased by 165% to 2.27 USD over the last 12 months. Net profit is significantly lower, mainly due to high share-based compensation (SBC).

The CEO has made it very clear that he now wants to stop the dilution of the Uber share, which has been above 3% p.a. in recent years. Going forward, a multi-billion-dollar share buyback program will ensure that the number of shares remains stable or even decreases in the medium term.

In Q2 2024, Uber bought back 325 million USD worth of shares for the first time. The company can afford such buyback programs. The company had 6.3 billion USD in cash and cash equivalents at mid-year.

Uber as the leading robotaxi provider

Uber came under pressure in the first half of the year as some investors feared that the company could be disrupted in the medium to long term by robotaxi companies (e.g. Tesla?).

It is now becoming increasingly clear that the opposite will be the case. Uber doesn’t have its own autonomous driving technology since 2021, and the competitiveness of Uber's Aurora subsidiary is at least questionable in my view.

However, Uber is keen to enter into interesting partnerships with a number of leading AV (autonomous vehicle) providers.

Uber and Waymo

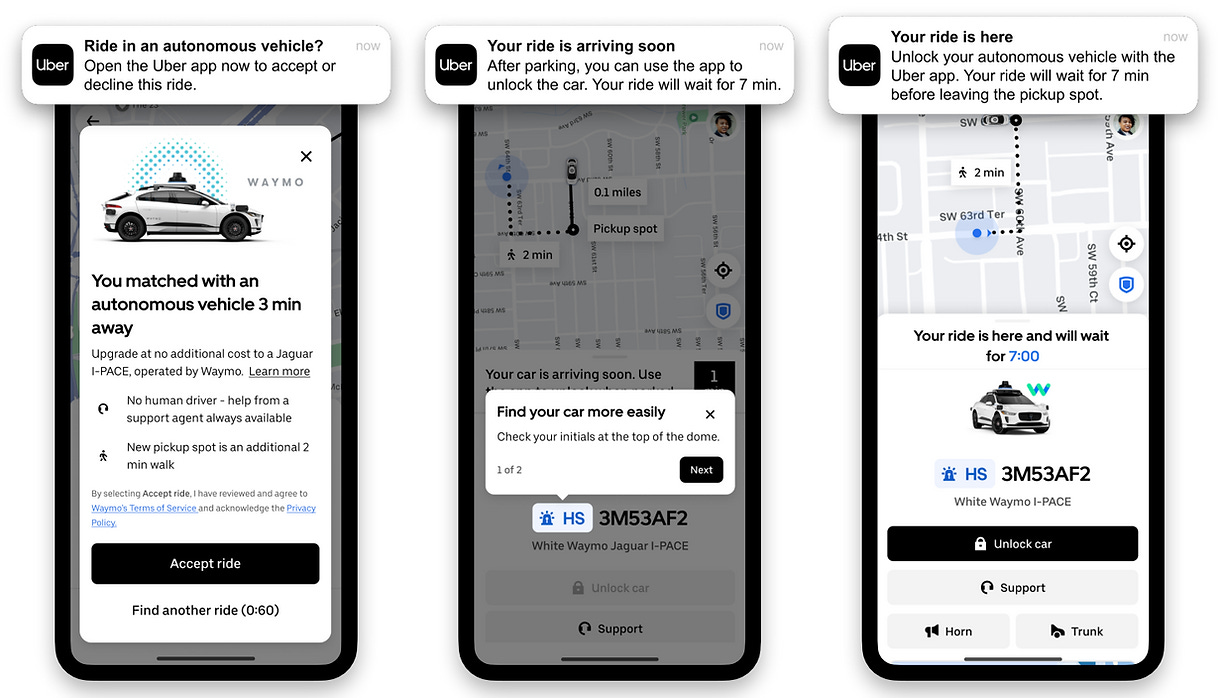

Last week, the expansion of a collaboration with Alphabet subsidiary Waymo made headlines:

Following a successful pilot in Phoenix, Uber will offer driverless Waymo robotaxis in Austin and Atlanta from 2025. The surprising thing about this partnership is that, unlike the Phoenix project, the Waymo fleets in Austin and Atlanta will only be available to Uber users via the Uber app.

This means that, at least in these cities, Waymo is not expanding its own robotaxi service (Waymo One), but sees itself in this partnership as a technology supplier for Uber. Uber will be responsible for fleet management, i.e. dispatching, cleaning and repairing the vehicles. The hardware, sensors and software technology will continue to be managed by Waymo. In the medium term, Uber plans to operate hundreds of Waymo vehicles in the two cities.

Uber and Cruise (GM)

Just a few weeks ago, a similar partnership was announced between Uber and GM subsidiary Cruise. Their AV ambitions suffered a major setback at the end of 2023, when Cruise's autonomous vehicles were banned from the streets of San Francisco following a fatal accident. After a cautious return to the streets in 2024 (with safety drivers on board), a commercial relaunch with Uber is now planned for 2025.

Uber and Wayve

Uber's strategic partnership with British start-up Wayve is also exciting. In contrast to Waymo, Cruise, Mobileye and others, the British company is developing AI technology that is not based on maps, but will enable autonomous driving in any environment in the future. Wayne sees itself as a technology provider or supplier to car manufacturers, and high-profile investors such as Softbank and Nvidia have invested alongside Uber. As part of Uber's partnership with Wayve, it has now been agreed that future vehicles equipped with Wayve's AI will be bookable through the Uber app.

Uber and BYD

What the announced partnership between Uber and BYD means is still not entirely clear to me. Is it really primarily about offering Uber drivers 100,000 Chinese electric cars (outside the USA) at special rates? Why would Uber be interested in helping the Chinese bring their electric cars to the European market?

In addition to the current sales cooperation, the press release above also mentions that future BYD autonomous vehicles will be available for booking through the Uber platform.

The two companies will also collaborate on future BYD autonomous-capable vehicles to be deployed on the Uber platform.

Further details have not yet been announced. However, I suspect that the foundations have been laid for an alliance to compete with Tesla's announced fleet of robo taxis. That is, if it's ready for the market after the big promises Elon Musk is expected to make in the coming weeks.

One more thing

Alongside these major partnerships with leading AV players, another Uber collaboration has almost flown under the radar, but is of particular importance to my portfolio.

At the beginning of September, Uber agreed a partnership with Turo. This means that Uber will integrate the services of the world's largest peer-to-peer car sharing platform into its offering by the beginning of 2025.

Turo has been described as the "Airbnb for cars". It now has 365,000 cars listed and 3.5 million active users in the US, UK, Canada, Australia and France.

For Uber, the partnership is simply a complement to its own car rental service, Uber Carshare. For Turo, however, it is a big step that should help the company gain more exposure and accelerate revenue growth.

What does this have to do with IAC, the problem child in my sample portfolio?

IAC is by far the largest shareholder in Turo, currently holding 32% of the company. Recently, IAC exercised an option negotiated years ago and increased its stake at a valuation of 2 billion USD. Turo has been preparing for its own IPO for some time, and the Turo IPO prospectus has just been updated to include half-year figures for 2024.

In a reasonably supportive market environment, Turo's valuation should be in excess of $3 billion, given its revenue of just under $1 billion, double-digit growth and profitability.

The IAC stake would therefore be worth at least 1 billion USD. This is not insignificant given IAC's total market capitalisation of 4.5 billion USD. The significant undervaluation of IAC could finally come to the attention of investors if the value of the Turo stake were to be disclosed as part of an IPO.

However, if the IPO window for Turo remains closed, a sale of the company is a distinct possibility.

And who would be a potential strategic buyer?

Uber has been trying to enter the peer-to-peer car-sharing market with its own service for some time. In 2022, it acquired the Australian start-up Car Next Door. In 2023, after a rebranding, the new 'Uber Carshare' service was launched in the first cities in the US and Canada. Uber is clearly interested in the peer-to-peer car sharing market. An acquisition of the market leader Turo by Uber would therefore make perfect sense.

Such a Turo exit would be as good news for IAC shareholders as a successful Turo IPO. IAC and Uber already have a close relationship. Uber's great CEO, Dara Khosrowshahi, was CEO of Expedia until 2017, which he turned into one of the largest online travel companies in the world. Dara Khosrowshahi was promoted to CEO of Expedia by IAC, which bought Expedia in 2002 and spun it off in 2005.

So it comes as no surprise that there is now at least a strategic partnership between Uber and IAC's holding company Turo. Let's see what else develops.

The valuation of Uber shares

At first glance, Uber shares do not look like a bargain at current prices above 70 USD:

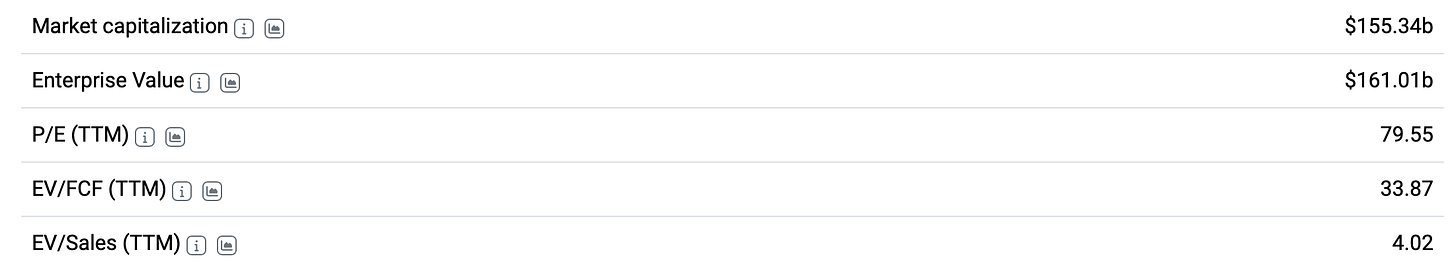

This is because the EV/FCF ratio (explained simply here) is 33. The EV/sales ratio of 4 does not directly indicate an undervaluation either; over the past two years, Uber shares have typically traded for less than three times sales.

The P/E ratio of almost 80 is almost useless for valuing Uber's stock as it is regularly distorted by write-ups and write-downs on Uber's minority stakes in other mobility providers such as Didi in China or Grab in Southeast Asia.

However, given the huge improvements in profitability and cash flow that can be expected in the coming years due to network effects, Uber's stock looks attractive to me, at least in the medium to long term, even at its current price.

Conclusion

The numerous new AV partnerships in recent months prove that Uber is the ideal go-to-market partner for autonomous vehicle providers. This is because Uber brings to these partnerships its huge network of over 150 million active customers and therefore a huge demand for these vehicles. Obviously, it is incredibly attractive for robotaxi providers to make their vehicles bookable through the Uber app and thus better utilize their capacity.

“Uber can provide enormous demand without AV players needing to invest capital toward acquiring customers or building the marketplace tech that delivers reliability at the standard that consumers have come to expect”

Dara Khosrowshahi

More and more vehicles on the Uber platform, and more and more users, mean more and more network effects. For Uber, how quickly (or how slowly) autonomous vehicles disrupt passenger transport and delivery services is of secondary importance. Uber always wins.

In my view, Uber is already unassailable as a global player in the passenger transport sector and will continue to be the leading platform in the age of the robotaxi. I am more convinced than ever that this is a powerful mobility giant of the future.

For this reason, I have carefully increased the position in Uber shares in my portfolio.

If you would like to follow the development of Uber and/or IAC with me in the future, you can

*Disclaimer: The author and/or related persons or companies own shares in Uber and IAC. This article is an expression of opinion and does not constitute investment advice.

Uber will win!