Uber Stock Analysis - What will 2024 bring after last year's doubling?

Many people only know Uber as the taxi alternative app. But the investment case is much bigger than that.

At the time of Uber's IPO in 2019, who would have thought that I would one day be a happy Uber shareholder? I certainly didn't.

I have been a satisfied Uber customer since 2015, and have found the Uber service to be a superior alternative to taxis and hired cars on many trips in Europe and North America, both for business and pleasure.

But until early 2023 I was never interested in buying Uber shares because of the company's years of heavy losses. In fact, at the time of the IPO, I was quite negative on Uber stock.

I first added Uber shares to model portfolio in August 2023, following compelling business figures. At the time, Uber's share price was very close to its IPO price in May 2019, when Uber shares were offered at an issue price of 45 USD per share.

The timing was very good. Just six months later, I can calebrate a book profit of 60%+ and Uber shares are trading at an all-time high of 70 USD.

Reason enough to use the presentation of the business figures for 2023 to examine whether the stock is still worth owning.

But one thing at a time. Many people only know Uber as the taxi alternative app. To understand the investment case, it is important to realize that Uber has now evolved into a true mobility platform company, offering much more than the familiar passenger transport service.

The history of Uber

Uber was founded in San Francisco in March 2009 by Travis Kalanick and Garrett Camp. Their idea was to create a digital platform that would allow users to book private drivers for rides through an app as a low-cost alternative to taxis. Uber launched in San Francisco and quickly expanded to other cities and countries. By 2012, it was operating in London, Paris, Sydney and Toronto, among other cities. By 2015, just 6 years after it was founded, Uber had already reached a billion-dollar turnover.

In addition to disruptive growth and technological innovation, Uber's development has always been marked by legal disputes and controversial discussions about the company's business model. In my home-country Germany, for example, the taxi lobby has successfully fought Uber for many years.

To date, Uber has encountered regulatory problems in Germany due to its use of unlicensed drivers, which conflicts with existing passenger transport laws. As a result, Uber currently only arranges rides for licensed car rental companies in Germany and has not yet been able to realize its full potential. The same is true for several other European countries.

How does Uber earn its money?

The business model of the Uber platform is based on 3 main segments:

Uber Mobility - passenger transport

Uber Delivery - delivery service for food and groceries

Uber Freight - logistics platform

Common to all of these business areas is that Uber does not own any physical assets (such as cars or trucks) and generates revenue only through commissions for the platform it provides.

Essentially, Uber is the middleman between the supply side (drivers, couriers, freight forwarders) and the demand side (customers), making the connection and retaining a portion of the revenue paid by the customer for the service. The take rate is typically around 25-30%.

Uber passenger transport (Mobility)

Uber's main source of revenue, accounting for 53% of total revenue in 2023, is the ride-sharing service that made the company famous in the first place. Uber has few competitors in the ride-sharing industry, as it was the first to enter the market and has since successfully maintained its leading position through its strong brand name and aggressive advertising. Today, Uber operates in over 70 countries and more than 10,000 cities worldwide.

A duopoly has emerged in the most important US market. Uber has gained significant market share over the past years and now has 75% of the market, while its challenger Lyft has to make do with 25%.

Uber Delivery

Uber's second major source of revenue, accounting for 33% of total revenue in 2023, is the Delivery segment. At the heart of this is Uber Eats, the restaurant delivery service. However, Uber also offers its customers the option of having food delivered to their homes without having to leave.

The food delivery market is much more competitive than the ridesharing market. In the US Uber controls 23% of the market with its Uber Eats brand, while market leader DoorDash has a staggering 66%. In Germany, Lieferando is (still) the undisputed market leader. Uber Eats only entered the market there as a challenger in 2021.

Thanks to its huge reach, Uber is also interesting as an additional distribution channel for the large restaurant chains that operate their own delivery services. Domino's has announced an exclusive global partnership with Uber in 2023.

Uber Logistics (Freight)

Uber Freight was launched in May 2017. It is a logistics platform developed by Uber and complemented by the billion-dollar acquisition of Transplace. It connects freight forwarders and shippers to make the transport of goods and freight easier and more efficient.

The cyclical Freight segment's share of revenue declined from 18% to just 14% in 2023 in a weak market environment.

Uber Freight operates in a similar way to the traditional Uber model, but focuses on the freight and logistics industry. It aims to optimize and improve the process of matching available truck capacity with companies' shipping needs.

This is how Uber Freight works:

Shippers post loads to be transported on the platform. They enter information such as the type of freight, pick-up and delivery locations, delivery timeframe and other details. Freight forwarders (truckers or carriers) can browse and select available loads that match their capacity and routes.

Prices for transport are displayed on the platform. Carriers can accept or reject the prices and the exact conditions for the load. Once a carrier accepts a load, the contract between the shipper and the carrier is concluded via the platform.

During transport, shippers, carriers and consignees can track the progress of the delivery in real time. The platform also enables communication between all parties involved to share information and make any necessary adjustments.

After successful delivery, payment is processed by Uber Freight. The platform takes care of the payment to the carrier according to the agreed terms.

With its digital offering, Uber Freight is successfully disrupting processes in the logistics industry that were previously often still analogue. Shippers can instantly book the load they want to transport at the touch of a button in the app. And thanks to the up-front price, forwarders always know how much revenue they will generate from the transport.

Legacy and management issues

Co-founder Travis Kalanick served as Uber's CEO for a long time. However, in 2017, he came under fire amid various controversies and internal issues. These controversies concerned issues such as company culture, business practices and his personal behavior. Due to increasing pressure from investors, Travis Kalanick stepped down as CEO in June 2017 and also left the board in 2019.

The current CEO, Dara Khosrowshahi, is doing an excellent job in my opinion. He joined the company in 2017 from Expedia, where he was previously CEO, and was chosen to take the leadership of Uber at a time of restructuring.

In the midst of this restructuring, the Corona pandemic hit and Uber struggled with plummeting ridership. During this time, Uber Eats became increasingly important. After the pandemic, the new management quickly put Uber back on a very profitable growth path. But more on that later.

Advertising on the Uber platform

For some time now, Uber has been discovering advertising as an additional source of revenue for its platform. Just three years after its launch, advertising in various formats (in the Uber app, on and in Uber cars) is expected to generate more than 1 billion USD in revenue for the first time by 2024, representing around 3% of revenue.

Advertising becomes a very interesting add-on business for the Uber platform, monetizing the enormous reach of over 130 million monthly active end users.

Uber partnership with Waymo

From 2015 to 2020, Uber attempted to develop its own autonomous vehicle (AV) technology. However, Uber's efforts in autonomous vehicles ultimately failed due to technical challenges. In December 2020, Uber sold its loss-making AV division to Aurora and has held a stake in it ever since.

In 2023, Uber entered into a strategic partnership with Waymo, with the aim of using the Google sister company's leading AV technology on the Uber platform. This partnership provides a glimpse of Uber's long-term future in the AV age.

Uber management has made it clear from the outset that this is not an exclusive partnership with Waymo, meaning that Uber intends to enter into such collaborations with many other AV providers in the future.

In the AV era, the driver will no longer receive up to 75% of the fare for transporting passengers with Uber, but the money will be split between the AV fleet provider (in this case Waymo) and Uber.

I expect Uber's overall gross margin (currently around 30%) to increase in the long term, partly due to the transition to such an AV business model. However, it will probably take many years for this effect to be reflected in the company's financials.

Uber business figures 2023

While the journey to driverless Uber will be very slow, Uber's management can already report decisive progress towards becoming a profitably growing mobility giant.

For a long time, many market observers (myself included) were unsure whether Uber would ever become sustainably profitable, given its low gross margins and expensive marketing. This has changed fundamentally over the last 12 months.

Now that the legacy issues have been successfully resolved and the pandemic has been overcome, we can see that Dara Khosrowshahi and his team have indeed managed to create a real cash machine, despite all the difficulties and additional regulatory obstacles.

Uber's revenue grew by 17% to 37.3 billion USD in 2023, with the three segments performing very differently. The main Mobility segment (passenger transport) grew by more than 30% to reach 19.8 billion USD in revenue. In contrast, the delivery segment grew at a much slower rate to 12.2 billion USD, while the logistics segment (Freight) suffered a significant decline in revenue to 5.2 billion USD.

The improvement in profitability is much more impressive than the revenue trend. Operating profit improved by almost 3 billion USD, from a loss of 1.8 billion USD to a profit of 1.1 billion USD.

Impressively, the 17% sales growth was achieved despite a reduction in sales and marketing costs of almost 10%. General and administrative costs fell from 9.8% to 7.2%. Hats off to this cost discipline!

At 1.8 billion USD, Uber's net profit was significantly higher due to write-ups on the value of its investments in other mobility services. These include China's Didi (12% stake), Asian delivery service Grab (14% stake) and the aforementioned Aurora (21% stake).

Uber's free cash flow multiplied to 3.4 billion USD in 2023 compared to the previous year and further increases are expected. I expect the Uber platform to generate an average of more than 1 billion USD in cash flow per quarter from 2024 onwards.

Uber's balance sheet already shows a cash position of 5.4 billion USD at the end of 2023. The obvious question is what to do with all that money. It would not be surprising to see a first share buyback program launched soon, following the example of other tech giants.

The valuation of Uber stock

Of course, Uber's impressive turnaround has not gone unnoticed by investors and is reflected in a significant rise in the share price. When I bought in just two quarters ago, the company was trading at an enterprise value (EV) of 96 billion USD. Now, at a share price of 70 USD, the enterprise value is 152 billion USD, implying an EV/sales ratio of 4.

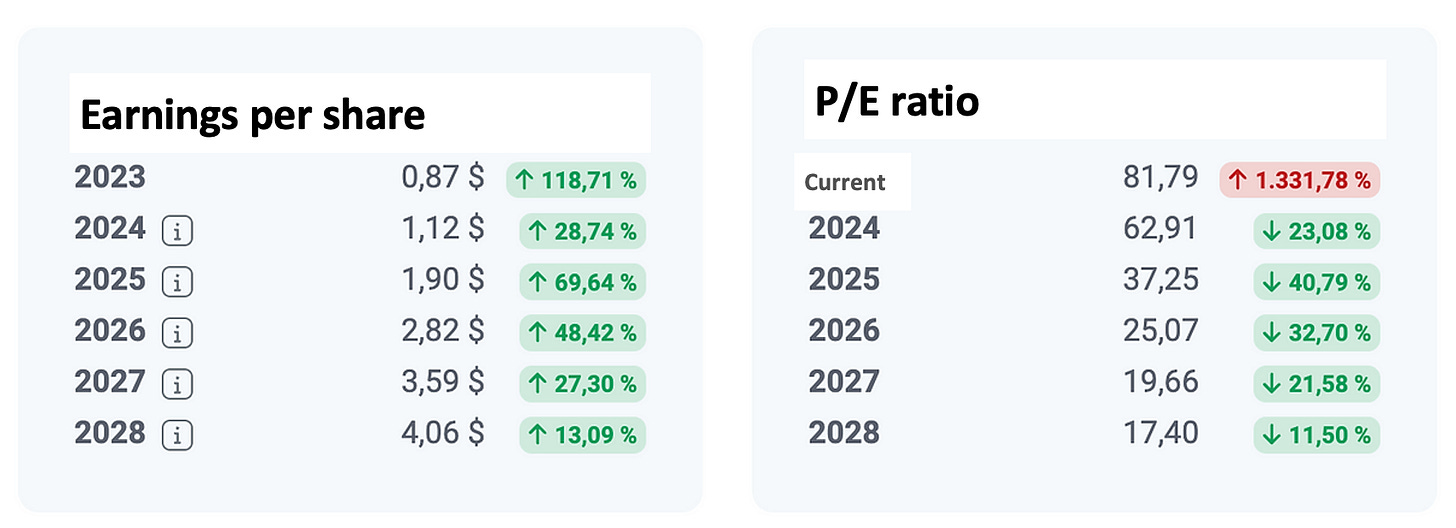

The cash flow multiple is 45. The P/E ratio for 2024 is a good 60.

These valuations are certainly not bargains. But it is also not too expensive, given the earnings leaps that analysts are forecasting over the next few years.

This is made possible by Uber's strong position in the mobility market, with its strong brand and huge network effects. Their business model offers great operating leverage, provided the company can maintain revenue growth at +15% without significantly increasing its marketing and administrative budgets.

Conclusion

After Airbnb, in 2023 I have also added Uber, the second market leader in the sharing economy, to my model portfolio. I believe that their huge network effects provide these market leaders with a valuable moat, which will make Uber and Airbnb difficult to attack in the foreseeable future.

Shareholders should not expect too much from either investment after the price rises in 2024, as these shares are already fairly valued. Like Airbnb, Uber is not a bet on a quick double at these levels.

Rather, these stocks are intended to add some stability to my tech portfolio and to become long-term holdings with a target return of around 15-20% per year.

If you would like to follow the development of Uber and Airbnb with me in the future, you can

*Disclaimer:

The author and/or associated persons or companies own shares in Uber and Airbnb. This article is an expression of opinion and does not constitute any investment or financial advice.