We are in the Midst of a Dangerous AI Bubble - Will it Burst in 2025?

Many investors do not want to admit that a massive financial bubble has developed around Generative AI. Here are three current proof points.

A lot of people in the stock market are in denial about the fact that there's a massive financial bubble around generative AI. It's only a matter of time before it bursts and destroys a lot of fortunes. I have already discussed this danger in my last article on Nvidia shares.

However, today I would like to point out and comment 3 very recent proof points for the formation of an AI bubble. Just so that nobody can say afterwards that they couldn't have known. ;-)

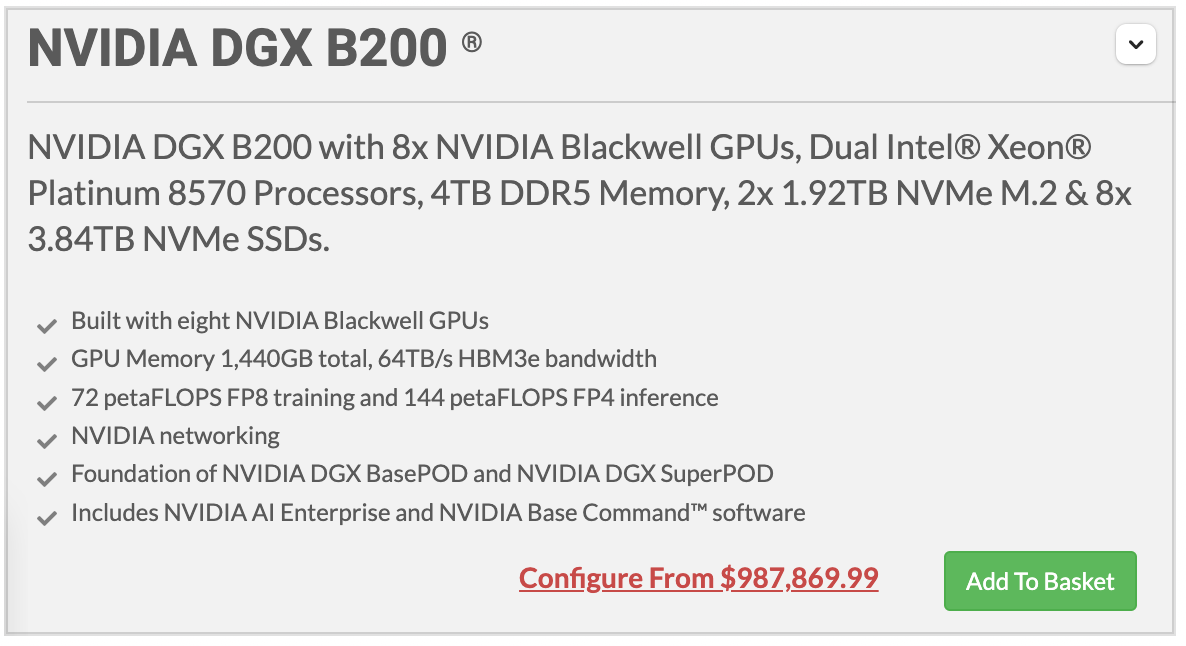

1. Moon Prices for AI Infrastructure

The hopes of the AI industry are currently pinned on the new Nvidia Blackwell GPUs. These components are the fastest processors for training and running generative AI, and they are extremely scarce, i.e. the demand for these chips is much higher than the supply. Nvidia can therefore currently charge "moon prices" for them. An AI server with 8 of these chips currently costs at least 1 million USD.

These are the prices that are currently allowing Nvidia to achieve truly fantastic margins of well over 50%. These are cheered by Nvidia shareholders with new highs in the Nvidia stock price and marveled at by the rest of the market.

Of course, the temporary defacto monopoly helps Nvidia to achieve incredibly good numbers and especially fantastic margins. But is this a sustainable long-term business model for Nvidia?

At this point, I would like to reiterate that it is still completely unclear where the 600 billion USD in AI sales - that would be required to make the current investments in AI infrastructure profitable - would come from. You can read the details here.

Personally, I believe that the prices of the latest Nvidia GPUs have now reached a level that is not justified by the actual benefits of these chips.

Nvidia is still first and foremost an extremely cyclical semiconductor company. No wonder that Nvidia is trying everything to increase the software share of its own value added and thus avoid the next downward trend in this AI cycle. The company even recently introduced its own Nvidia Open Source language model, which puts it in direct competition with its own major customers such as Meta and OpenAI. Is that how you build long-term successful partnerships?

2. AI Adjusted Earnings

OpenAI has just successfully closed a 6.6 billion USD pre-IPO funding round. The company emphasized to investors a new profitability metric called "AI-adjusted earnings". This excludes some large cost, such as the billions the company spends annually to train its LLMs. According to this fanciful figure, OpenAI expects to be profitable in 2026.

And what is the reality? OpenAI's real numbers predict a loss of 14 billion USD in 2026, even according to the optimistic projections in its own business plan! In total, losses of 44 billion USD are expected to accumulate by 2028.

It is ridiculous for an AI company to simply exclude a significant cost block that affects the core of its business model from its profitability analysis. The LLMs are not a one-time cost, because OpenAI will need to keep training new, better, and bigger models to stay competitive.

I don't think Sam Altman currently has a solid plan for how he will ever make OpenAI profitable. Should there ever be a public IPO prospectus for OpenAI, the SEC will not allow such illusions. Therefore, I do not believe there will ever be an OpenAI IPO. See my article on the situation at OpenAI after the mega funding round.

3. Revenue-Less AI Startup Funding

In Silicon Valley and far beyond, a veritable AI gold rush has broken out among venture capitalists. New companies with no revenue are being funded with hundreds of millions of dollars from the start, simply because the founders are well-known AI experts from big tech companies.

These usually extremely capital-intensive AI companies promise their investors revolutionary innovations towards a superintelligence superior to humans, but end up building products based on Gen AI and huge language models for which there is not a large enough market to justify the high investments.

Why else has no AI startup other than OpenAI achieved significant 9-digit revenues?

In my opinion, it is in the nature of things, because GenAI has nothing to do with real artificial intelligence in the sense of cognitive thinking. Rather, it is a simulation of intelligence that can significantly increase the efficiency of office work.

But it is by no means the case that we are facing the greatest transformation on the planet, as some AI gurus claim. For that to happen, there would have to be further breakthroughs towards true AGI. However, these are not foreseeable and certainly cannot be planned for in the coming years - neither for OpenAI nor for the countless other AI start-ups funded with billions of dollars.

History Repeats Itself

The older among you will remember that we have seen all this before: Defacto monopolies by technology leaders (like Cisco), scarcity pricing for infrastructure components, creative financial reporting, venture capital for startups with no revenue. It all happened 25 years ago. The parallels to the dotcom bubble after the invention of the Internet are unmistakable.

For those of you who still believe that everything is different this time, here is another review of the recurring patterns and characteristics of financial bubbles. Understanding these patterns can help you spot speculative bubbles before they burst.

The Most Common Phases and Characteristics of Financial Bubbles

1. Innovative or new developments

In many cases, a financial bubble starts with a new, promising product or technology that offers great economic opportunities (like tulips during the tulip mania, railroads during the railroad bubble, or the Internet during the Dotcom bubble). Currently, it is the breakthrough in Generative AI, visible to all through the invention of ChatGPT.

This innovation is considered revolutionary and attracts a lot of attention. Investors and the public tend to overestimate the potential impact of the new development and underestimate the risks. This over-optimism leads to a wave of investment (see the AI startup funding mentioned above) and rapid price increases (see the pricing of Nvidia GPUs).

2. Increase in speculation

Once the second phase kicks in, people get really excited and start investing in the new good or market. More and more people want to make money from the rising prices, and players who wouldn't normally invest jump in. For example, during the dotcom bubble, lots of people invested in technology companies without any technical knowledge, just because they were hoping to make a quick profit.

Today, many professional and private investors are investing in the supposedly winning AI stocks, even though they do not really understand how Generative AI works and what its limitations are. The rising prices of AI stocks are driven more by speculative intentions than by real economic fundamentals. This creates a "FOMO" (Fear of Missing Out) - investors are afraid of missing the opportunity and invest even though valuations are already unrealistically high.

3. Extreme price increases and overvaluation

Prices reach levels that far exceed the true value of the asset (e.g., Nvidia AI chip) or the investment (e.g., Nvidia stock). The price/performance ratio is often no longer justified. One example: During the tulip mania in the 17th century, a few tulip bulbs fetched the price of a whole house.

It becomes increasingly irrational, as price movements are driven solely by expectations of future profits. The fundamentals hardly matter anymore. People believe that prices can only go up, even when there are clear signs of overvaluation.

4. Warning Signs and First Doubts

The first signs of overheating are emerging. Growth is slowing and doubts are emerging as to whether the extreme prices are justified. Warning voices from economists, analysts, and industry experts are emerging, but these warnings are often ignored. In my opinion, we are now at this point in the AI hype cycle.

Markets are becoming more volatile and there are sudden price swings. Some investors are starting to take profits and sell their positions, adding to the uncertainty in the market.

5. The AI bubble bursts.

There is usually a tipping point where the market loses confidence and prices suddenly and dramatically fall. Often an event (such as bad news or new regulations) triggers the crash.

In a stampede, investors try to sell as quickly as possible to avoid losses. This leads to massive oversupply, causing prices to fall even faster.

6. Aftermath

The fall in prices and the bursting of the bubble often lead to a wider economic crisis. People lose their wealth, companies go bankrupt, and there is a crisis of confidence in the stock market. In severe cases, this can lead to prolonged economic depressions. In the case of the AI bubble, I expect that technology stocks as a whole will become less popular and once again be seen as particularly risky by the public. Those of you who are older have already seen this happen after the Dotcom bubble burst.

Conclusion

No one can predict when a financial bubble will burst. But there are ways to recognize a bubble.

When the price of an asset rises sharply for an extended period of time without the underlying fundamentals improving, it is often a warning sign. For me, the extreme scarcity pricing of Nvidia GPUs is such a warning sign until it becomes clear that these chips are creating extraordinary value.

When more and more people enter the market who would not normally invest in this space (e.g. individuals with no expertise or experience), it is a sign of speculative overreaction. Meanwhile, Nvidia stock has become one of the most popular stocks for individual investors.

Statements like "this time it's different" or "prices will only continue to rise" are typical warning signs of overvaluation and the risk of a collapse. I hear voices like this all the time right now.

By paying attention to these patterns, you can better identify potential financial bubbles and prepare for their eventual collapse. In my own portfolio management, I am currently assuming that the AI bubble could burst in 2025. Unless everything is different this time and the invention of a true AI (i.e. AGI) is actually imminent. But there is no evidence for that.

If you want to follow the development of the AI hype with me, you can

*Disclaimer: The author and/or associated persons or companies do NOT own shares in Nvidia. This article is an expression of opinion and does not constitute investment advice.

Thank you. We all need to take a step back and reconsider our positions in the big tech.