Nvidia Stock - When will the AI Bubble Burst?

A remarkable critical voice comes from Silicon Valley.

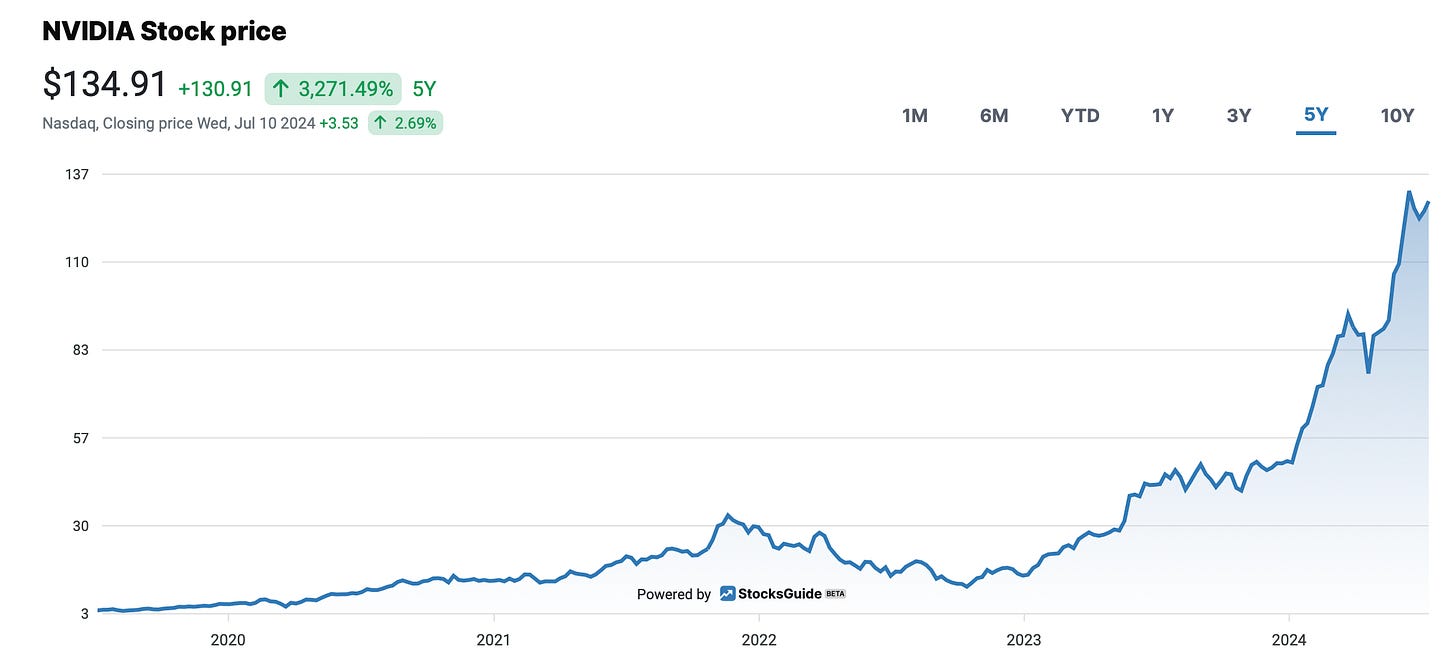

I have been warning about an impending AI bubble in the stock market for at least a year. So far, I have been completely wrong with my critical assessment of Nvidia, and NVDA 0.00%↑ share price has risen another 165% so far in 2024!

The stock market has so far ignored all warnings of an AI bubble. There are reasons for this that have less to do with fundamentals and more to do with the peculiarities of the capital market:

Institutional fund managers "have to" be invested in Nvidia and Big Tech in general in order not to lag too far behind the incredible performance of the major US indices. In this environment of historically high market concentration, hardly any fund manager can afford to make counter-cyclical investment decisions without putting his job at risk. The performance pressure is too high, and the outflows from many active funds are a further factor.

Instead of active funds, more and more money is flowing into ETFs, e.g. on the S&P 500 or the Nasdaq 100 index, which are performing excellently. These passive investments track the major indices with their high concentration of the Magnificent 6 (Nvidia, Microsoft, Apple, Alphabet, Meta, Amazon). This is another reason why more and more money is flowing into Big Tech. Many ETF investors are not even aware that they have a corresponding cluster risk in their portfolio.

The bull market is reinforcing the bull market, and no one knows when this trend will end.

All these developments are fueling the emergence of a bubble that has not been seen since the Dotcom bubble 25 years ago.

Sequoia's 600 billion USD question

A remarkable warning about the AI bubble comes from Sequoia. After all, Sequoia is one of Silicon Valley's leading venture capitalists (VCs) and was even the first VC to invest in Nvidia back in 1993.

Sequoia is an investor that should be making a lot of money right now funding young AI start-ups - or so you would think. But even Sequoia is now very sceptical about whether the extremely high investments in AI data centres that Nvidia is making a fortune in will provide a positive return on investment.

In order for Nvidia's revenues to be sustainable and continue to grow in the coming years, money must eventually be made from AI applications. If these returns do not follow, investment in AI infrastructure will decline. With foreseeable negative consequences for Nvidia and the other shovel manufacturers in the current AI gold rush.

How much money are we talking about?

Currently, Sequoia estimates that Nvidia's datacenter segment will generate 150 billion USD in revenue in 2024, which is even higher than analysts' current revenue expectations for Nvidia.

We can assume (as shown in an Nvidia investor presentation on page 14) that Nvidia's customers, who are currently building AI cloud services and buying their GPUs, will again spend at least the same amount on energy, construction and operation of data centres, including the network. In 2024, it is estimated that a total of 300 billion USD will be invested in AI data centres.

At a gross margin of 50% (which is low for the software-as-a-service industry), the providers of the new AI applications, who rent the GPUs from the cloud providers, would have to turn over 600 billion USD for these investments to ultimately pay off for everyone involved.

Where will this AI revenue come from on the application side?

Last quarter, about 50% of Nvidia's revenue came from hyperscalers. Its largest customer, Microsoft, alone accounted for an estimated 20% of Nvidia's revenue in the financial year 2024, which ended at the end of April.

Hyperscalers like Microsoft are currently building huge AI capacity in anticipation of booming demand for AI services based on Nvidia chips. These capacities will be used by their own AI products (e.g. MS Office Copilot, GitHub Copilot, Google Gemini,...) and especially by third-party AI services. ChatGPT, Salesforce Einstein,... and countless AI start-ups are run by hyperscalers in the public cloud and are expected to generate corresponding revenues.

And therein lies the problem:

There is currently only one AI company with revenues in the billions. This is OpenAI - the inventor of ChatGPT and a key strategic partner of Microsoft. OpenAI's annual revenue was last reported at 3.4 billion USD by CEO Sam Altman.

According to Sequoia, all other high-profile AI start-ups backed by billions in venture capital are still struggling to scale their revenues beyond 100 million USD.

And what about established SaaS application vendors? Almost all of these software companies have started their own project developments around the LLMs (Large Language Models) of Generative AI. Gradually, Gen AI-based functionalities are being integrated into the corresponding software products of Salesforce, Adobe, CrowdStrike, ZoomInfo,...

Monetizing AI applications

These Gen AI features really do add value for the end user. For my work on this Substack, I appreciate the new AI features for image creation and editing in ChatGPT and Canva and would not want to be without these new capabilities. I am convinced that GenAI will massively change the working world of knowledge workers on this planet in the coming years. Some job profiles will change massively or disappear completely.

But are we, as end users, really prepared to spend significantly more money on our software for these new AI capabilities and software products? Will the number of software licences required by an enterprise customer increase dramatically, boosting the revenue of application software vendors?

I don't think so. Especially since these AI features will quickly become a commodity, i.e. they will no longer be a unique selling point in the competitive environment. And the number of employees required is likely to fall anyway, if the efficiency gains promised by AI actually materialize.

The capital market seems to recognize these difficulties in monetizing the new AI applications. There is no other explanation for the fact that the Nasdaq Cloud Index, which includes about 80 leading cloud software providers such as Adobe, Salesforce, ServiceNow and CrowdStrike, has lost 45% over the past three years and is down about 10% so far this year - in complete contrast to the Nasdaq 100 Index.

Sequoia estimates that application software vendors (including Hyperscaler's own AI applications) can generate a maximum of 100 billion USD in total revenue from Gen AI.

This means a huge gap of 500 billion USD in missing AI revenue, which would be needed in addition to justify the heavy investment in Nvidia GPUs.

If this revenue gap on the application side is not closed quickly, it does not bode well for AI cloud providers (Nvidia's customers). Demand for GPU capacity will fall far short of their optimistic plans in the medium term. The price of GPU capacity in the data centers of Microsoft, Google and others, and ultimately the price of Nvidia's GPU chips, is also likely to come under pressure.

How can Nvidia continue to grow in the coming years?

The majority of the financial markets and analysts expect Nvidia to continue to grow its revenues and profits significantly in the coming years. This is essential to maintain the current stock price.

In my opinion, such a development is only conceivable in the medium term if there are groundbreaking developments in AI research beyond Generative AI that enable the creation of AGI (Artificial General Intelligence). And if Nvidia, as a quasi-monopolist, can really provide the infrastructure for AGI in such a (so far fictional) scenario.

I wouldn't bet on it.

In my view, there is no reason to believe that an AGI breakthrough is imminent in the next few years. Fundamental problems, for example in energy production, need to be solved first. See also:

Conclusion on the AI bubble

Investors should prepare themselves today for the fact that AI will fall far short of current inflated expectations in the coming years.

For my own tech portfolio, this means largely reducing my own positions in AI winners. After significant profit-taking in Arista Networks, CrowdStrike, Pure Storage and Alphabet, these stocks now account for less than 10% of my portfolio. I am not invested in Nvidia anyway.

This counter-cyclical positioning away from the AI hype means that I have to accept that my portfolio will underperform the major US indices until the AI bubble bursts. I can and must live with that. Fortunately, I am not an externally driven fund manager and can keep an independent head and swim against the tide from time to time.

If you are interested in my opinion on the developments around tech stocks, you can

*Disclaimer

The author and/or associated persons or companies do NOT own shares in Nvidia. This article is an expression of opinion and does not constitute investment advice.

Good point about whether these AI software features will drive end users to pay significantly more, especially as these capabilities quickly become commoditized and are not unique selling points. Having said that, I believe hyperscalers will still continue to invest heavily in chips even without seeing short-term and even mid-term returns, which should keep Nvidia relatively safe in the short term.