LendingClub Stock After a Spectacular Recovery

The market has corrected the severe undervaluation of Lending Club stock from a year ago, with the share price nearly tripling. So what comes next?

This article is an update of a LendingClub stock analysis first published in February 2024. It has been updated and significantly expanded following the LendingClub figures for the Q3 2024.

Do you know the story of LendingClub?

Many people still believe that LendingClub LC 0.00%↑ is the peer-to-peer lending marketplace it once was, when it had its overhyped IPO back in 2014. But that's no longer the case, as LendingClub has completely abandoned the peer-to-peer lending business model it once invented.

LendingClub acquired Radius Bank more than 3 years ago, giving it a national bank charter valid throughout the US. After their pivot LendingClub is now positioning itself as a digital marketplace bank, brokering consumer loans from its over 5 million members to banks and other institutional investors. The lenders are no longer individuals as in the past.

This fundamental change in the business model is very important in understanding the investment case for LendingClub!

As regular readers of this Substack might remember, just a year ago, LendingClub was my biggest worry in my portfolio. After the Q3 2023 report, LendingClub's share price hit lows of around $5. I used the sell-off prices to increase my position. Since then, LendingClub's share price has almost tripled.

What has changed so drastically in the last 12 months?

Lending Club Q3 2024 Figures

Thanks to the pivot in its business model, the company has managed to remain profitable every single quarter (even under GAAP), in the midst of a collapsing business volume in 2022/2023, a time of rapidly rising key interest rates. There are not many fintechs in the lending business that can say the same!

LendingClub had to significantly reduce lending in 2023 due to the miserable environment. And in 2024, the volume of business is still much lower than it was in 2022, when interest rates were low. On the LendingClub platform, only borrowers with relatively high credit scores are able to get the loans they want.

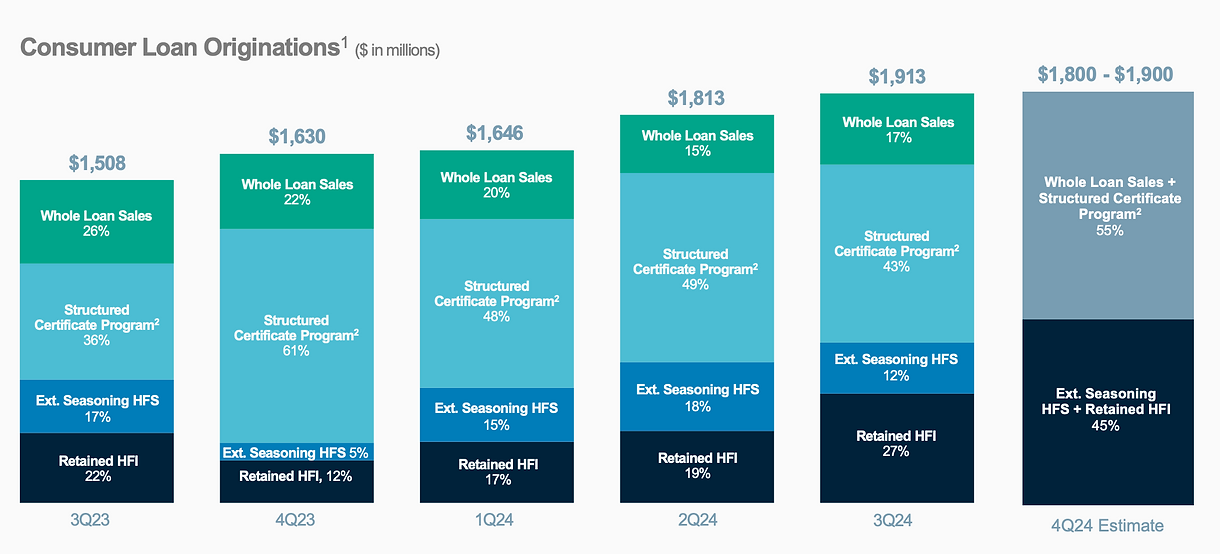

However, the volume of loans issued has been increasing for several quarters, albeit from a low level. In the most recent third quarter, loans originated totaled $1.91 billion, compared to $1.51 billion in the same quarter a year ago.

"Risk-adjusted revenue", which excludes the provision for credit losses, increased 13% to $154 million. Net income per share recovered to $0.13 from $0.05 in the third quarter.

Over the past two years, LendingClub has proven that its new business model can thrive in an adverse interest rate environment and operate profitably with a narrower interest margin. In fact, the difference between the interest earned on loans and the interest paid on deposits has dropped significantly, from 7.5% in Q1 2023 to just 5.63% in Q3 2024.

What is the reason for this?

Structured certificates are a great alternative

Given the current challenges in the platform business with banks, LendingClub management has come up with a new strategy to get the business back on track.

Towards the end of the first half of 2023, LendingClub issued its first structured certificates, which were used to securitize loans. They're kind of like a "hybrid" between traditional banking, where the risk is listed on the balance sheet, and the platform business, where the loan is transferred to investors.

These certificates are basically a two-tier private securitization. LendingClub keeps the senior debt and sells the residual certificate on a pool of loans at a set price to a buyer in the marketplace. LendingClub says this generates "an attractive return with low credit risk and without the need for prior provisions."

The new program, which isn't aimed at banks but at alternative asset managers and hedge funds, has attracted a lot of interest from investors since it was introduced. In Q3 2024, 43% of the loan volume ($830 million) was structured this way.

However, it is also clear that the terms of this certificate business are not as attractive to LendingClub as the actual marketplace business (Whole Loan Sales), which is still struggling due to a lack of interest from banks. As of Q3, this traditional business only accounted for 17% of total volume. This is because the higher risks are naturally passed on to investors at a corresponding discount compared to the traditional platform business with banks.

Nevertheless, responding so quickly to the crisis in the core business is, in my view, an outstanding achievement by management. The structured certificates created a valid alternative and thereby ensured the long-term profitability of the company even in adverse market conditions.

Meanwhile, banks are showing a renewed interest and are slowly but surely returning to the platform, which should lead to an increase in the highly profitable "Whole Loan Sales" revenue share in the coming quarters. CEO Scott Sanborn was more optimistic than he has been in a long time on the Q3 analyst call:

We sold a $75 million pool of loans to a previous bank buyer that returned to the platform, and just last week, we completed a $400 million sale to a new bank partner. Importantly, we anticipate that these banks will together purchase more than $1 billion worth of additional loans over the next 12 months.

Confidence building successful

The investment community has now been convinced that LendingClub's business model as a "digital marketplace bank" works in a high interest rate environment and that it is possible to operate profitably in such a period.

LendingClub's stock price, which had fallen to half of its tangible book value per share 12 months ago, has rebounded above that value, which currently sits at $11.19 per share. Intangible assets are already excluded from the balance sheet in this conservative book value calculation.

This “tangible” book value should normally represent a minimum level for the fair value of the LendingClub share.

The market corrected the severe undervaluation of Lending Club stock a year ago. It was inevitable: Sooner or later, a stock's price tends to converge with its true value. Convinced value investors can feel vindicated.

The secret to LendingClub's success

LendingClub is facing an historic opportunity: U.S. citizens' outstanding credit card debt has never been higher. The interest rates that banks are charging their customers for this unsecured credit card debt have risen to a record high of well over 21%, putting pressure on consumers.

This means that the need for consumers to find a lower-cost debt consolidation alternative, such as the one offered by LendingClub, has never been greater. As a result, demand for LendingClub loans, which are 7 percentage points less expensive than credit card debt, has never been higher.

This existential problem of rising household debt in the U.S. needs to be solved. And LendingClub can certainly be part of the solution in the medium and long term.

The company has a history of being able to select creditworthy customers better than most banks and fintechs, thanks to the massive amount of data it has on 5 million customers and over $90 billion in loans.

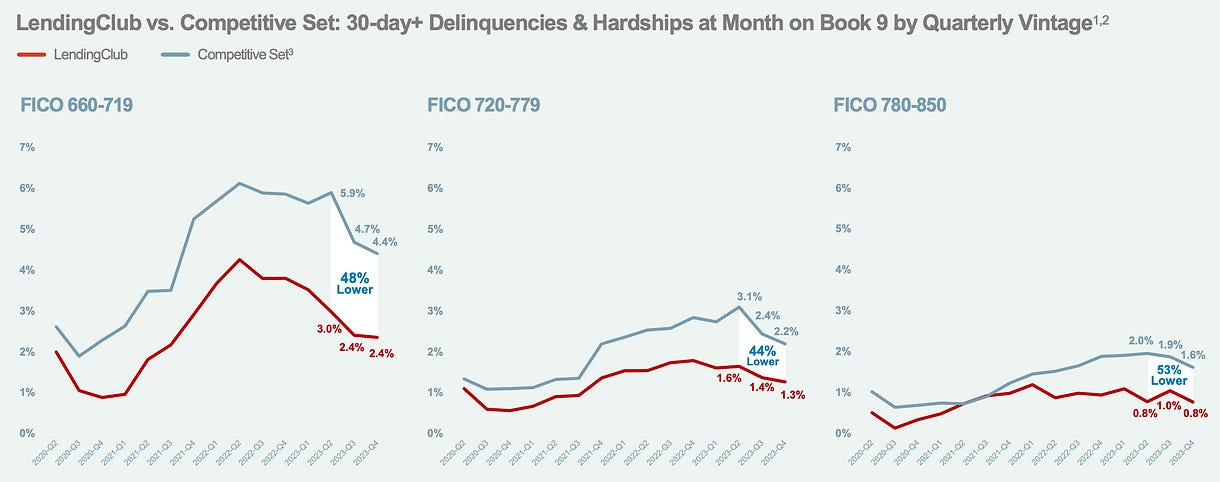

In particular, LendingClub's customer delinquency and default rates are significantly lower than those of its competitors across multiple creditworthiness cohorts.

This is ultimately the secret to the company's success - summarized here in a single graph:

The competitive advantage has continued to grow through the crisis of rapidly rising interest rates, with Lending Club loans now performing 40-50% better than competitors (from the lender's perspective).

These figures show an impressive competitive advantage. However, the company will only be able to take full advantage of this and start to generate strong profits again once banks show an increased demand for attractive alternative investment opportunities. This may well be the case in 2025 if interest rates continue to fall in the future.

DebtIQ a new beacon of hope

In mid-2024, LendingClub launched a new mobile app (DebtIQ) for its members to increase engagement and ultimately generate follow-up business. The core functionality of the new app is to monitor and manage the user's LendingClub loan. In addition, the app also offers a digital savings account with attractive interest rates.

To accelerate the development of the mobile app, Lending Club (along with Pagaya) acquired the intellectual property of Tally's loan management solution in October 2024.

This solution allows customers to consolidate their debt from multiple banks into one interface, often giving them visibility into their financial situation for the first time. For example, nearly half of U.S. citizens are unaware of the interest rates they pay on their credit cards.

Tally's technology will be integrated into the Lending Club app by mid-2025. DebtIQ will provide users with a holistic view of their credit card interest rates, outstanding balances, minimum payments and due dates. The app will offer payment strategies for repaying credit card debt and the ability to set up automated transactions and alerts to prevent missed payments.

And, of course, the app will offer seamless integration with LendingClub's banking and lending products, making it an important and highly cost-effective marketing tool.

What's next for LendingClub stock?

LendingClub stock has made a spectacular recovery and is currently the largest holding in my sample portfolio.

If the platform business with banks really picks up again in 2025, this should be reflected in the figures with a jump in revenues and profits. Earnings per share of well over $1.00 are then possible again in 2025. Even though no analyst currently dares to make such a forecast today.

As a reminder, in the exceptional year of 2022, the company had actually earned $2.80 per share before the interest rate shock.

However, the opportunity for further significant gains in LendingClub's share price is now offset by greater risks than it was 12 months ago. After nearly tripling from its lows, the apparent undervaluation has been corrected.

And let's face it, nobody (not even management) knows if and when the banks' desire to underwrite high-yield unsecured consumer loans will actually increase again. At least in the short term, LendingClub's business is heavily dependent on whether and when U.S. interest rates are lowered further and whether or not the U.S. economy slides into a recession.

I will be reducing the overweight of LendingClub shares in my portfolio due to the slightly less favorable risk/reward ratio if the price continues to rise too quickly in the short term.

So this stays exciting. I would really like to hear your thoughts on the latest developments. And if you want to join me as LendingClub continues to evolve:

*Disclaimer

The author and/or related persons or entities own shares of LendingClub. This post is an expression of opinion and not investment advice. Please note the legal information.