Duolingo Stock: What's next for 2023's high-flyer?

The Duolingo language learning app is addictive - and in this case, that's a very positive thing for both users and investors.

I particularly like to invest in companies whose products I can evaluate from a customer or user perspective in the real world outside of the stock market. Legendary fund manager Peter Lynch sends his regards: Duolingo's stock DUOL 0.00%↑ is a prime example of the 'eyes and ears investing' he propagated many years ago.

The company makes language learning easier and more fun via smartphone. Since its launch 11 years ago, the Duolingo app has become the world's most popular online tool for learning 40+ different languages, with 800 million downloads and 83 million monthly active users.

Duolingo was founded in 2011 by Luis von Ahn and Severin Hacker, who continue to lead the company as CEO and CTO. Luis is an experienced founder, having successfully sold a start-up (reCAPTCHA) to Google just two years after its launch in 2009. With Duolingo, the two have bigger plans: they make no secret of their ambition to take their gamification approach to other areas of the online learning market in the long term.

The global go-to-market strategy is also remarkable. Duolingo is not limiting itself to a few easily monetized countries, as is typical for a company of its size. More than half of its $500 Mio. revenue comes from outside the US. The company is even active in emerging markets like India and China.

However, it is extremely difficult for US companies to do business in these countries, and you have to monetize in a completely different way, because the subscription model does not work well there. Duolingo recognized this a long time ago and introduced a completely decentralized pricing strategy and in-app purchases.

If the company is ultimately successful in these countries despite the difficulties, it will open up huge additional potential. However, this is not necessarily part of my investment case today, but rather an additional fantasy.

I first presented the Duolingo investment story on my German High-Growth-Investing blog in late 2022. At that time, Duolingo's share price was a good $70, well below the initial offering price of $102 at the time of the IPO in mid-2021. That is now a thing of the past. Duolingo's share price has more than tripled over the course of 2023. This makes Duolingo the most successful stock in my portfolio this year.

So I'd like to use this article to critically question whether now might be the time to take profits. Or can the rally continue into 2024?

Duolingo in practice

As is often the case when investing in a consumer product, I have extensively tested the Duolingo product myself over the past year.

After months of sporadic use of the free version of Duolingo, I was so annoyed by the in-app ads that I switched to the paid version. For a small additional fee, I got a few more licenses to give to family members.

And that's when the Duolingo gamification worked its magic: Today, 4 family members (including my 80+ year old mother) do their daily Duolingo lessons in 3 different foreign languages and remind each other of their regular practice in a fun way. My own streak (that's what they call the duration of uninterrupted use while learning) is now over 130 days long, and I've learned 500 words of Spanish playfully.

The app is addictive - and in this case, that's a very positive thing!

Interestingly, older users are more serious about their Duolingo streak than younger users. Who would have thought?

After this user experience, I understand why Duolingo does not have a problem with excessive churn, as some critical analysts feared after the IPO. At least in our family, Duolingo is here to stay.

Duolingo is a mass phenomenon

The rapid growth of Duolingo's user base confirms my personal customer experience. The number of daily active users (DAUs) of the Duolingo app has grown by 63% to over 24 million by the end of September 2023. This means that within one year, 10 million additional people have become regular Duolingo learners. In recent months, 1 million new DAUs have joined every month.

In total, Duolingo users complete 10 billion language lessons in just a few minutes each week. With the data collected on user behavior, the company is building an unrivaled understanding of how people learn languages.

Duolingo's recipe for success is its freemium business model. The free (ad-supported) app serves as a kind of gateway drug. However, the annoying ads make it nowhere near as fun as the ad-free version, and that drives monetization.

With this strategy, Duolingo has been able to increase its penetration rate (i.e., the percentage of paying users in the total user base) year after year. Currently, 8% of the 83 million monthly active users pay, which translates to 5.8 million paying subscribers.

The Duolingo Business Figures

Duolingo has once again delivered an outstanding set of Q3 2023 numbers that significantly exceeded expectations.

Revenue in Q3 2023 grew 43% year-over-year to $138 million. Even more impressive, bookings ahead of revenue increased by +49% to $154 million.

At least as important as revenue growth for growth investors in these times is improving profitability.

Duolingo's gross margin is around 74%. This is a bit lower than is typical for top-tier SaaS companies. This is due to the high fees Duolingo has to pay to Apple and Google for their payment services in the app stores. If these fees are reduced in the coming years due to pressure from regulators (which I expect they will be), Duolingo would benefit directly.

Despite the rather mediocre gross margin (for a cloud company), I know of few companies with such good operating leverage as Duolingo, i.e. the rapid revenue growth translates very nicely into an increase in operating income.

The reason for this is that the cost ratios for sales & marketing (S&M) and general administration (G&A) are falling significantly. I don't know of any other fast-growing B2C company that spends only 16% of revenue (GAAP) on sales and marketing. This is because the growth is largely organic, meaning the Duolingo app is spreading like wildfire in many different countries through viral distribution and effective social media support. Paid performance marketing (i.e. buying users from Google, Meta, etc.) plays a minor role.

Duolingo continues to spend an incredible amount of money developing its product portfolio. Although the corresponding R&D expense ratio is declining significantly, at 37% of revenue (according to GAAP), it is still significantly higher than most other software companies.

Because of this cost structure, Duolingo could be much more profitable than it is today if it decided to reduce this investment to a more normal level in the future.

However, this is not necessary at the moment: the free cash flow margin increased from 6% to 24% in one year.

The bottom line for Q3 2023 (as in the previous quarter) is even a small GAAP profit of $3 million for the first time, after a loss of $18 million in the same period last year. This also shows impressive operating leverage!

Cash on the squeaky-clean balance sheet of the debt-free company grew from $608 million to $702 million in the first nine months of 2023. Remarkably, Duolingo's cash balance has continued to grow quarter after quarter since its IPO in the summer of 2021. It almost seems as if the founders Luis von Ahn (CEO) and Severin Hacker (CTO) themselves are surprised by the viral success of their app: they have not needed the $500 million in equity from the IPO to date to drive Duolingo forward.

The secret to their success is their incredibly efficient user growth: In the third quarter of 2023, DAUs (daily active users) grew 63% year-over-year and paying customers grew 60%, while non-GAAP sales and marketing expenses grew only 16%!

Duolingo seems to be one of the few companies immune to the weak economy that many other SaaS companies were complaining about in 2023.

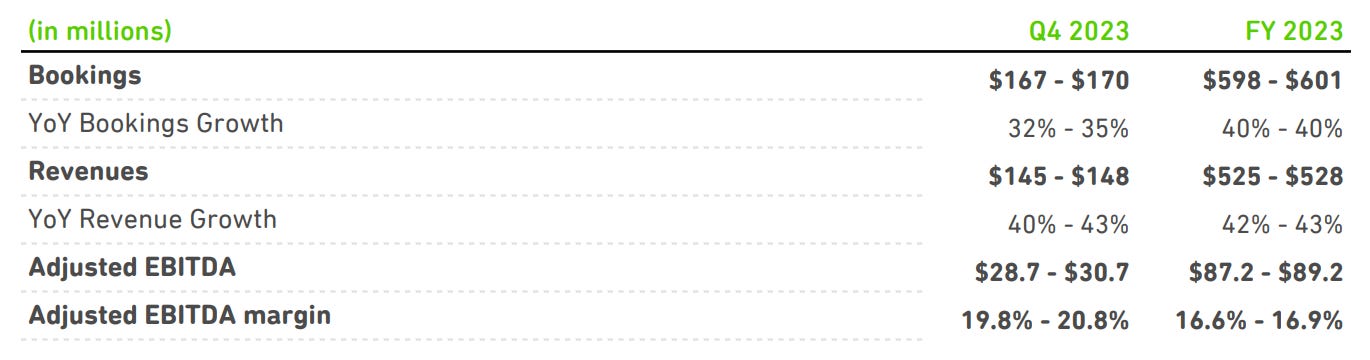

Duolingo Guidance

With the announcement of its Q3 results, Duolingo has raised its guidance significantly for the third time this year. Revenue is now expected to grow by at least 42% to over $525 million in 2023. Bookings are expected to grow by 40%. EBITDA margin is expected to increase from 4% to approximately 17% (non-GAAP).

It is safe to assume that management is still overly cautious. Both the paid user trajectory and overall user engagement on the Duolingo apps point to continued strong organic growth in Q4 2023. Personally, I expect the company to outperform this guidance and once again expect (purely organic) revenue growth in excess of 43% for 2023.

Duolingo and the AI hype

Duolingo has been partnering with OpenAI since 2021, whose AI technologies have been all the buzz since the meteoric rise of ChatGPT (starting in late 2022).

Duolingo uses OpenAI technologies extensively to develop new content for its language courses. The breakthrough in Generative AI has significantly increased the efficiency of Duolingo's product development.

For some time now, Duolingo has been using OpenAI's language generation capabilities to develop an entirely new product called Duolingo Max, which goes far beyond the current Duolingo app, which is designed more for beginner language learning.

With the help of AI, Duolingo Max aims to provide advanced English learners with a language assistant that comes as close as possible to a human English teacher at a higher price. Duolingo's management has repeatedly emphasized that this upcoming AI product will not be revenue-generating for the foreseeable future, and that the company will take its time to bring it to market.

However, the prospect of Duolingo Max has certainly played a role in the performance of Duolingo stock in 2023. Duolingo is seen as an AI winner, at least by investors, even if management has fortunately not actively done anything to fuel the AI hype.

Duolingo Math and Duolingo Music

Duolingo's mission statement reads quite confidently:

"Our mission is to develop the best education in the world and make it universally available."

Although the size of the addressable market (TAM) for foreign language learning alone is $60 billion, the company has been working intensively for some time on other education apps beyond language courses.

In contrast to earlier product plans, however, Duolingo management has now decided not to launch the new courses for learning math and music as stand-alone products, but instead to add these courses to the Duolingo app.

If you want to try it out for yourself, the math and music courses are already available to all Duolingo users.

Currently, the Duolingo Math course "only" addresses basic math deficits. It is basically designed to practice math in a playful way with children of elementary school age. Higher math skills cannot be acquired with the app.

The Duolingo Music course is also aimed at beginners who want to learn the basics of reading music or try out playing simple melodies on a smartphone keyboard. So nothing particularly exciting, which is why it makes a lot of sense not to monetize these new courses directly.

The valuation of the Duolingo share

After the share price explosion so far this year, Duolingo is valued at an Enterprise Value of $9 billion. This corresponds to an EV/Sales ratio of 17 based on expected 2023 revenues.

2023 is the first year in which Duolingo can be meaningfully valued on the basis of cash flow multiples. I estimate free cash flow in 2023 at $120-130m, which would be an EV/FCF ratio of around 70-75.

After the sharp rise in the share price, this is now an extremely sporty price. It would be desirable for the Duolingo share to take a deep breath, and a substantial setback in the share price is also conceivable at any time.

But considering the strong growth momentum and the high operating leverage, I cannot see any extreme overvaluation in the current prices above 200$ that would call for profit-taking.

I will continue to hold my position, which has become quite large in the meantime. Because Duolingo has what it takes to grow into this valuation and well beyond over the next couple of years.

If you would like to follow Duolingo together with me in the future, you can subscribe to my free Substack here:

Disclaimer

The author and/or associated persons or companies may own shares in Duolingo. This article is an expression of opinion and does not constitute any investment or financial advice.