Airbnb Stock in 2025: My Perspective as a Guest, Host, and Shareholder

Can Airbnb Finally Take Off in 2025? Here's my update on the stock after the Q1 2025 figures and the Airbnb summer release.

I have been invested in Airbnb ( ABNB 0.00%↑ ) shares for about three years. It's one of my favorite investments because I can evaluate the company and its products quite well also from a customer perspective. I have enjoyed staying in Airbnb accommodations for years while traveling. Since 2024, I have also been gaining insight into the role of an Airbnb host. I rent out our Villa Calmatzo in the southwest of Mallorca, and the experience with Airbnb has been consistently positive.

In an earlier post on the Airbnb stock, after a 60% profit in April 2024, I asked: Has the potential of Airbnb stock been maxed out?

At that time, an Airbnb share cost well over $150, and I saw little scope for short-term price increases.

Indeed, Airbnb shares are now trading lower than before, lagging far behind the S&P 500 and Nasdaq 100 performances in 2024.

In this article, I will explore whether 2025 will be a better year for Airbnb shareholders and if the announced new business areas could become a growth driver for the company.

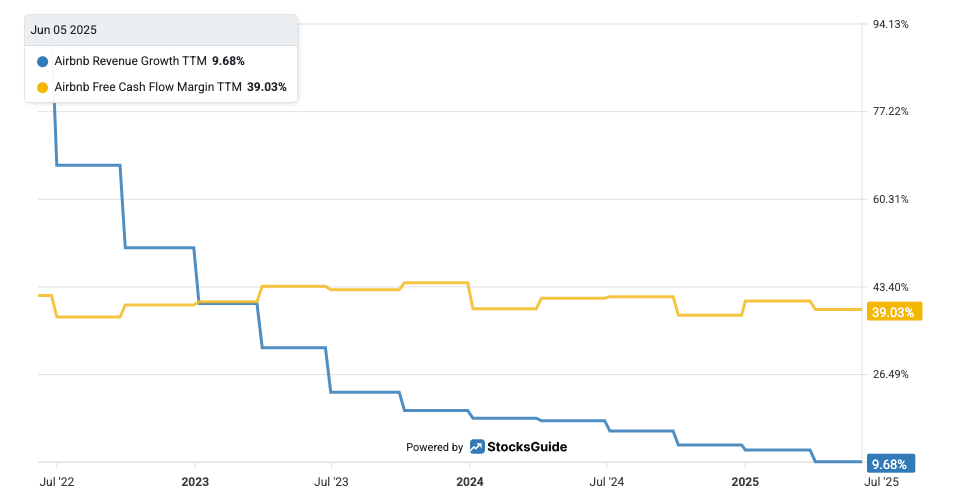

One thing is clear: Airbnb's revenue growth decreased to 12% in 2024 (down from 18% in 2023) and has recently slowed down the single digits. Is Airbnb stock still worth holding, or should I question my long-term investment case as a whole?

The Airbnb business figures for Q1 2025

Here is a brief summary of Airbnb's results for the first quarter of 2025:

In Q1 2025, Airbnb generated a gross booking value (GBV) of $24.5 billion. This represents a 7% increase compared to the same quarter last year (+9% at constant currency). The increase was primarily due to a higher number of booked overnight stays, while the average daily rate (ADR) fell slightly.

In the first quarter of 2025, Airbnb generated revenue of $2.3 billion USD. This is a 6% increase compared to the same quarter of the previous year. After adjusting for currency effects, revenue growth reached 8% .

Adjusted EBITDA was $417 million, corresponding to an 18% margin. Last year, this figure was $424 million (a 20% margin). The decline is mainly due to increased expenses for product development (up 25%) and marketing.

Free Cash Flow was strong at USD 1.8 billion in the first quarter of 2025, corresponding to a free cash flow margin of 79%. However, this extremely high margin is seasonal and not particularly meaningful on a quarterly basis.

TTM Free Cashflow, which is a much more meaningful metric, amounted to $4.4 billion. This corresponds to a margin of 39% in relation to total sales for the last four quarters, representing a 4% increase in Free Cashflow. The TTM free cash flow margin was down two percentage points from the previous year but remains at a high level.

Net profit was significantly lower at $154 million USD than the $264 million reported in Q1 2024 — a 42% decrease. The net profit margin was only 7%.

Airbnb's guidance for Q2 and the full year of 2025

For the second quarter of 2025, Airbnb expects revenue of just over $3 billion. This would correspond to growth of 9 to 11% compared year over year.

Compared to the first quarter, the company expects more moderate growth in booked nights and experiences. Booking behavior in the U.S., in particular, is weakening. Airbnb attributes this primarily to macroeconomic uncertainty. Currently, guests from abroad are traveling significantly less to the USA, and Airbnb is feeling the effects, even though foreign visitors of the U.S. account for only 2-3% of its total business volume.

Airbnb expects the absolute value of adjusted EBITDA to increase in the second quarter. However, the EBITDA margin could fall slightly compared to last year, as it did in the first quarter. This is due to higher marketing expenses and investments in the newly introduced “Experiences” and “Services” offerings as part of the “summer release.”

For the full year of 2025, the company confirms its forecast of achieving an adjusted EBITDA margin of at least 34.5%. This target shall be achieved despite planned investments of 200 to 250 million US dollars in the new business areas. Airbnb emphasizes that these investments will impact the margin, particularly in the second half of the year, but they should boost the business's growth and diversification in the medium term.

What's next for Airbnb stock?

Clearly, growth from Airbnb's core business has slowed significantly in recent years. Additionally, the free cash flow margin has recently declined slightly (on a high level though). It is reasonable to assume that this trend will continue in 2025, with Airbnb's revenue growth remaining in the single digits.

Analysts expect Airbnb's revenue to grow by around 10% in 2026 and in coming years. Airbnb is also expected to improve its operating margin further from 2026 onward as investments in new business areas made in 2025 will gradually bear fruit. Therefore, analysts are forecasting a significant, annual increase in operating profit of around 15%.

However, to achieve this growth, Airbnb must develop new business areas. This has been a subject of discussion for several years. However, diversification has been slow since the end of the pandemic.

Last year, CEO Brian Chesky announced that Airbnb would launch one to two new business areas per year starting in 2025 to develop into a comprehensive travel ecosystem. These new business units are expected to generate over one billion US dollars in revenue within three to five years.

“I think the next chapter of Airbnb is starting next May, the next chapter is really about taking Airbnb and expanding it beyond our core business…And what I expect is every year now, for the coming years, we will launch one to two new businesses that will generate $1 billion or more of revenue incrementally a year…. And over the next decade, we're going to go far beyond travel.” - Brian Chesky

Airbnb Services and Airbnb Experiences

As part of the “Summer Release 2025”, Airbnb has kept its promise and introduced the first new business areas in May 2025.

Airbnb Services

With "Airbnb Services," users can now book services that will make their stay more enjoyable and tailored to their needs. Such services were previously more common in luxury hotels. These include private chefs, photographers, massage and wellness services, personal trainers, and hairdressing and beauty services. Initially, the services will be available in more than 260 cities worldwide and can be booked independently of accommodations.

Airbnb Experiences

At the same time, Airbnb has completely restructured and significantly expanded its offerings, known as "Airbnb Experiences." In addition to the usual experiences with local hosts in over 650 cities worldwide, Airbnb has introduced the new "Airbnb Originals" format. These exclusive events feature well-known personalities, such as a cooking class with a top chef or a sporting event with a professional athlete. These experiences are intended to strengthen the Airbnb brand, appeal to additional user groups, and enhance the value of the platform as a whole.

I'm still not quite sure what to make of these highly promoted new business areas. "Airbnb Services" is a logical and practical addition to the core business because it enhances existing stays and creates additional booking incentives. At the same time, the new offering opens up new sources of income for local service providers and creates an even broader platform. However, I find it hard to imagine that "services" and "experiences" will turn into a billion-dollar business in a few years.

I had expected Airbnb to start arranging flights and car rentals or even open up to booking boutique hotels and hostels. But what has not yet been done can still be done. The Airbnb CEO has announced that their services will expand every year starting in 2025.

Nevertheless, even after the widely announced summer release, I still can't see a clear path to a Airbnb super app for a comprehensive travel ecosystem. Maybe my expectations were simply too high.

Valuation of the Airbnb Stock compared to Booking Stock

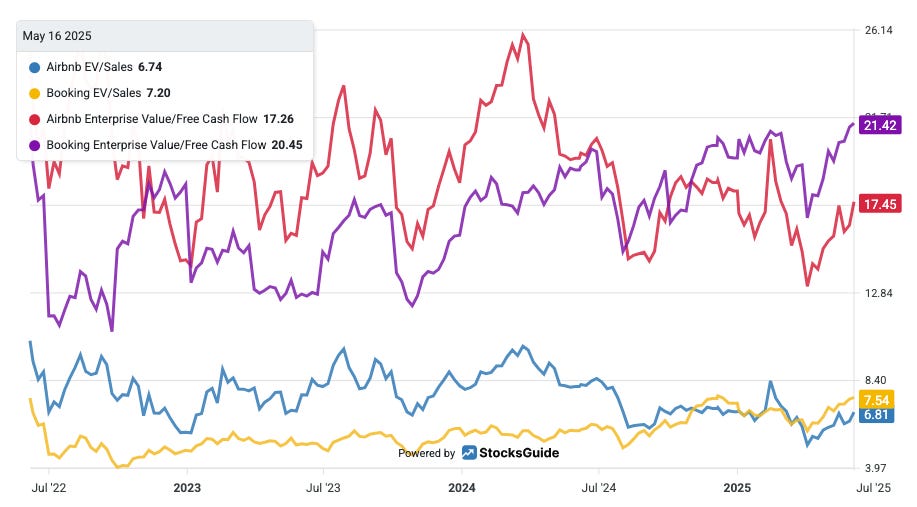

Over the past three years, Booking has clearly been a better investment than Airbnb.

What does the future hold for the next three years?

Currently, Airbnb and Booking are growing at roughly the same rate (just under 10%). It's impressive that Booking has maintained these growth rates in recent years despite being more than twice the size of Airbnb. Both companies are similarly profitable.

However, compared to its competitor, Booking, the Airbnb share is valued somewhat more favorably. With an EV/Sales ratio of 6.8, Airbnb is lower than Booking Holdings' ratio of 7.5 (TTM). Similarly, Airbnb's EV/FreeCashflow ratio is around 17, while Booking Holdings' is at 21.

These valuation differences are not the main reason I prefer Airbnb shares, though. I simply see much more long-term potential in Airbnb. Booking is an almost 30-year-old company that has already taken many of the expansion steps Airbnb, a much younger company founded in 2007, will take over the next 10 years.

Of course, it depends on how successfully Airbnb implements its long-term business plan and diversifies and expands its revenue streams. The recently introduced “Airbnb Services” and “Airbnb Experiences” can only be the beginning. They certainly won't be guaranteed to be a success.

Conclusion

In the long term, as a investor I would like to be involved with leading companies in the sharing economy. These less capital-intensive platform companies have great leverage for disproportionately rising profits. Alongside ride-hailing providers Uber UBER 0.00%↑ and Lyft LYFT 0.00%↑ , I hold Airbnb shares, even though the company's growth has slowed significantly in the past two years. The stock is currently fairly valued, but given the current single-digit revenue growth, it's not a bargain, just a solid holding.

If you would like to follow the development of Airbnb together with me in the future, you can subscribe to my free newsletter here:

*Disclaimer

The author and/or related persons or companies own shares in Airbnb. This article is an expression of opinion and does not constitute investment advice.

I have commented on BKNG and ABNB before. Both companies are toll booth or entry points to lodging industry. BKNG has a strong position against hotels, ANBN is to vacation rentals. BKNG also covers vacation rentals.

To me, ANBN has saturated the vacation rental market. BKNG has saturated many years ago, and that's why BKNG is buying back shares, to me that's a much more efficient capital allocation strategy, than trying to create a new revenue source (very difficult).

All that said, the TAM is much larger for BKNG, as it's the entry point to the entire travel industry, where ANBN is a much smaller TAM. Between ANBN, and BKNG, BKNG is very clear a winner.

Thanks for your awesome write up though, I don't agree with your point that ABNB has a longer runway simply because it's a younger company, by that logic, a new startup should always overthrown the most dominant incumbents, which is very rare in reality.

As a shareholder, I've grown slightly more skeptical of Airbnb's diversification. I agree services and experiences overall are a bit underwhelming, but I'm willing to wait and see what else Chesky's planning.