What do Nvidia and Flying Taxis have to do with Uber's Stock Price?

As we enter 2025, there has been some notable news from Uber. So here is an update on the Uber investment case.

Uber UBER 0.00%↑ is one of the few US stocks in the S&P 500 Index which didn't have a good year on the stock market in 2024, with a performance of -2%. In my own portfolio, the mobility giant was a clear underperformer.

The reasons are easy to see: Uber's relative weakness was not fundamentally due to the business numbers, but rather the result of fears that Uber could be disrupted by Tesla (and Waymo) in the future. It was interesting to note that the Uber stock always dropped in the short term when Elon Musk once again pushed his future robotaxi.

In a previous post, I explained why I don't share these concerns and why I even expect Uber to be one of the big winners as autonomous driving continues to evolve. Read more here: Will Uber Become The Ruler Of Robotaxis?

Towards the end of 2024, I added to my Uber position with another purchase. At the beginning of the new year, there was a series of remarkable news from Uber, which caused the share price to rise by 10% in the first two weeks of 2025.

Time for an update:

A Mysterious Partnership With Nvidia

You may have already read that Uber is now working with Nvidia NVDA 0.00%↑ to help accelerate the adoption of autonomous driving on a global scale.

“By working with NVIDIA, we are confident that we can help supercharge the timeline for safe and scalable autonomous driving solutions for the industry.”

- Dara Khosrowshahi, CEO of Uber.

However, the press release from Uber and NVIDIA at CES 2025 raises more questions than it answers. It remains unclear what exactly the deal would entail. And how does this match up with the fact that Uber already stopped developing autonomous vehicles in 2020 and sold this division?

Here's my interpretation:

Uber is now partnering with NVIDIA to accelerate the introduction of autonomous vehicles. This collaboration is based on the use of a NVIDIA simulation environment that enables highly realistic virtual testing of autonomous vehicles. The goal is to improve the safety, efficiency, and scalability of autonomous driving without having to test entirely on public roads. The NVIDIA platform can simulate complex traffic situations, varying weather conditions, and potential safety issues.

Uber's goal with this technology is to make autonomous driving services available more quickly and reliably. However, this does not change the company's strategic realignment after it sold its own autonomous vehicle division to the startup Aurora in 2020. Instead of developing its own vehicles, Uber has since focused on partnering with leading technology companies such as Waymo and now NVIDIA. These partnerships should allow Uber to continue to play a major role in the future of autonomous driving without having to bear the high costs and risks of developing its own technologies.

Uber has not provided details on how it plans to use the NVIDIA tools. My guess is that Uber will contribute its extensive data on how and where people use transportation and delivery services to the development of NVIDIA's simulation environment. This would fit perfectly with its strategy of not developing its own AV technology and instead taking an asset-light approach by partnering with others.

The goal of the NVIDIA collaboration is not to develop Uber's own autonomous technology. Rather, the partnership is intended to help integrate Uber's autonomous driving platform with third-party providers. This would make it easier to include autonomous vehicles from different manufacturers in Uber's network, which could ultimately improve the scalability and availability of such services.

But perhaps Uber is just in it for the money. After all, no one knows what the financial details of the deal will be. Nvidia cannot develop such a simulation technology without an appropriate amount of data. The company is loaded with cash and could potentially pay Uber a pretty penny for its data. But that's pure speculation.

Electric Air Taxi with Uber

At CES 2025, Uber also announced a multiyear exclusive partnership with Delta Air Lines, allowing members of their SkyMiles frequent flyer program to earn miles when traveling with Uber or ordering delivery through Uber Eats. The agreement marks the end of a partnership between Delta and the Uber rival Lyft, which has been in place since 2018. The partnership's impact is likely significant, as SkyMiles reportedly has over 90 million members.

TechCrunch speculates that the Delta collaboration could be a first step in connecting the airline and Uber with Joby Aviation, a NYSE-listed air taxi provider (see Joby shares at stocks.guide) whose shareholders include both Uber and Delta ( as well as Toyota as the largest investor).

Delta's existing partnership with Joby means that Delta customers will be able to use Joby's electric air taxi service, which is expected to launch in New York and Los Angeles in 2025.

Even more extensive is the partnership between Uber and Joby: Joby acquired Uber Elevate, Uber's air mobility division, back in 2020. Part of the deal was to integrate each other's services into each other's apps, creating a more seamless connection between ground and air transportation. In addition, Joby's air taxi software, which came out of the partnership with Uber, promises on-demand mobility similar to ordering a ride from Uber.

Last October, Uber and Delta joined Joby at an event in New York City to share their vision of connected mobility. Joby has yet to receive the necessary certifications to operate an electric air taxi service, but is reportedly aiming for a commercial launch of Joby in New York, Los Angeles, Dubai and Abu Dhabi by the end of 2025.

I wouldn't read too much into Joby's ambitious timeline. However, after its recent major funding round, it seems clear that unlike some of its European competitors, Joby is not short of cash. With the support of Uber, it seems only a matter of time before Joby's electric air taxis are launched. Uber will benefit massively - not only financially, but also in terms of its perception in the capital markets as a future-proof mobility platform.

Accelerated Share Buyback

One annoyance for Uber shareholders has been the dilution of the company's shares through 2024, caused by the issuance of more and more shares. This is set to come to an end with the announcement some time ago of a massive share buyback of up to $7 billion. This will now be accelerated due to the current depressed share price. A few days ago, the company announced that it would transfer $1.5 billion of its ample cash flow to the Bank of America for this purpose.

More important to me than the share buyback was the confirmation in this announcement that the company expects its cashflow to continue to grow substantially through 2025. It also believes that its own shares are undervalued.

„We enter 2025 with considerable momentum and expect to continue to scale up our free cash flows significantly...Our stock is undervalued relative to the strength of our business.“

- Prashanth Mahendra-Rajah, CFO of Uber

Valuation Of The Uber Stock

Over the next 12 months, analysts see an average upside to the Uber stock of approximately +37%. With the exception of AMD, there are no U.S. companies valued at more than $100 billion that analysts believe are as undervalued.

I'm not a fan of the sell-side analysts, but in this case I can understand their optimism:

Uber wants to grow its revenue by +15% annually for the next few years. I think that's very plausible. At the same time, the EBITDA margin is expected to grow by about +2% year-over-year, which would provide enormous leverage to cashflow and earnings.

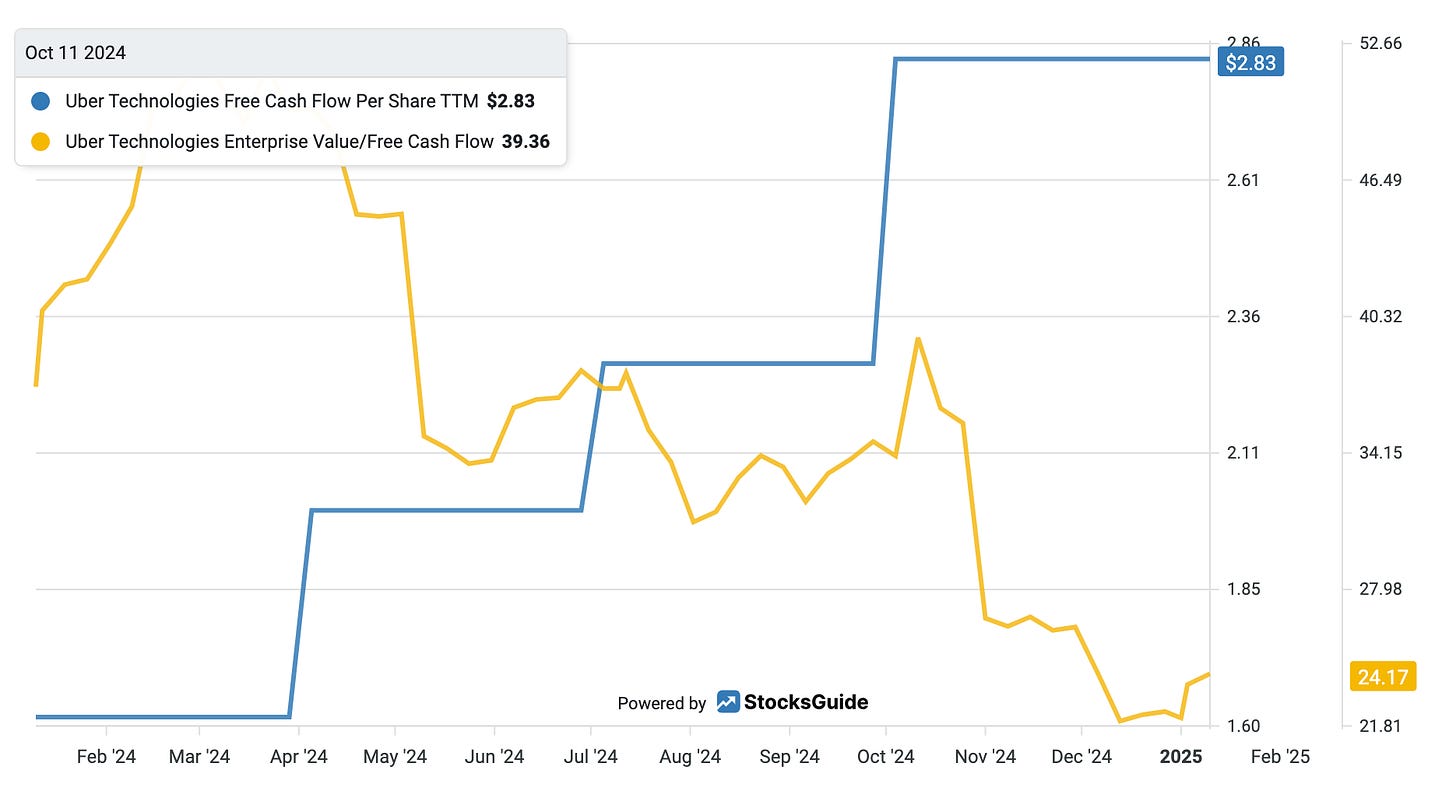

The Net income is expected to more than double by 2024 numbers, while free cash flow per share is up +75% over the last 12 months. And there is no end in sight to the earnings growth.

Uber's valuation has become much more attractive over the past 12 months due to strong cashflow growth and a flat share price. A cash flow multiple of 24 (TTM) is not too expensive for the leading mobility platform with an asset-light business model at 15% annual growth.

As a result, I have further increased the position of the Uber shares in my sample portfolio (High-Tech Stock Picking Wikifolio). I am very optimistic that we as shareholders will have a lot of fun with the Uber stock in the years to come.

If you would like to follow the development of Uber with me in the future, you can subscribe to my free newsletter here:

*Disclaimer: The author and/or affiliated persons or companies hold shares in Uber. This article represents an expression of opinion and not investment advice.

Uber has >2bn shares outstanding and every year shareholders get diluted by addtional c100m shares. The buyback you mention buys back 20m shares, that is next to nothing. No thanks!

Great analysis. FSD and flying taxis will take longer time to diffuse than many think. I remind people that Tesla hasn't started FSD in the wild yet. Flying taxis sound cool, but at the same time, how long will it take to mature into a meaningful business?

I also note the UAE. The Middle Eastern country wants to participate in all things new and cool. Where is Europe? Why can't, for example, German politicians attack the ball more? German politicians want to pass the ball to players' feet. This is not how Meinschaft has won the World Cup. The ball has to be passed in rooms that your team members can exploit. Germany is standing still.