Warner Bros. Discovery: Is the Stock a Real Bargain or is it a Value Trap?

Warner Bros. Discovery is struggling with a declining TV business, but HBO Max is thriving as the central hope for its future.

Three years after the merger, Warner Bros. Discovery ( WBD 0.00%↑ ) is still caught between hope and uncertainty after years of restructuring. Its quarterly report for the first quarter of 2025 shows positive developments in the streaming segment and declining trends in linear TV and the studio segment, as well as a persistently difficult macroeconomic environment.

Given the company's significant underperformance compared to Netflix and Disney, the question arises: is the WBD stock undervalued, or is it a value trap?

Over the past three years, Warner Bros. Discovery shares have lost nearly half their value and are currently trading at around $10 USD. This is due to ongoing doubts about the growth story, high debt levels, and uncertainties surrounding the shrinking linear TV business. Even the increasingly positive momentum from the streaming sector has not yet initiated a sustainable turnaround.

Revenue Development

In the first quarter of 2025, Warner Bros. Discovery (WBD) generated a total of $8.98 billion in revenue. This represents a -10% decline compared to the previous year. Two divisions were responsible for this decline. In the "Studios" segment, revenue fell -18% to $2.31 billion. The reasons for this included the disappointing theatrical release of "Mickey 17" and the lack of new game releases. WBD also recorded a -7% decline in revenue to $4.77 billion in the "Global Linear Networks" segment due to falling advertising income and the continued loss of subscribers in the traditional pay-TV business.

In contrast, the streaming segment showed positive development, with revenues increasing by +8% to $2.66 billion. This increase is primarily due to the international expansion of the Max platform and the addition of 5.3 million new subscribers.

Lower Losses - But Again in the Red in Q1 2025

Warner Bros. Discovery's earnings performance in the first quarter of 2025 shows a mixed picture. Although the company reported stable adjusted EBITDA of $2.1 billion, the same as in the same quarter of the previous year, it posted a net loss of $453 million. While this was significantly lower than the previous year (Q1/2024: USD -966 million), it indicates that the company is still facing structural challenges.

Non-cash expenses of approximately USD 1.6 billion were once again a key negative factor. These expenses primarily consisted of amortization of intangible assets and restructuring costs. These costs reflect the ongoing consequences of the multibillion-dollar merger between WarnerMedia and Discovery.

Despite the net loss, Warner Bros. Discovery generated positive cash flow in the first quarter of 2025. Operating cash flow was USD 553 million, a -5% decline compared to the same quarter of the previous year. The decline in free cash flow was more pronounced: At $302 million, it was 23% below 2024 in the first quarter, which is usually the weakest quarter of the year in terms of seasonality.

This was primarily due to higher spending on content and production rights. Expanding the Max platform into new international markets and the ongoing filming and pre-production of films and series led to a significant outflow of funds. At USD 251 million, capital expenditures (CapEx) were nearly one-third higher than the previous year due primarily to the expansion of digital infrastructure.

Despite these challenges, Warner Bros. Discovery was able to consistently pursue its debt reduction strategy. In the first quarter, around USD 2.2 billion in debt was repaid.

By the end of the quarter, the company had cash and cash equivalents totaling USD 4.0 billion. However, debt remains high (gross: USD 38.0 billion). More on this later.

A Closer Look at the Segments

To understand the WBD investment case, it is essential to examine the development of the three distinct segments. The segment analysis for the first quarter of 2025 reveals a mixed picture at Warner Bros. Discovery, with clear winners and losers. While the streaming business is thriving, the studios and traditional TV business were struggling with declining trends, though the latter remains highly profitable.

Streaming

The upward trend in the streaming segment continued. Revenue increased by +8%, reaching a total of USD 2.66 billion. Advertising revenue, in particular, surged by +35%, reaching USD 237 million. This clearly indicates the growing importance of ad-supported subscription models ("Ad-Lite") on the Max platform. Distribution revenues from subscriptions totaled 2.33 billion USD.

The number of global streaming subscribers increased by +5.3 million, reaching a total of 122.3 million users during the quarter. However, average revenue per user (ARPU) declined: by -9% globally to $7.11 USD and by -5% in the USA to $11.15 USD. This decline is due to WBD's deliberate acceptance of lower prices in new markets to increase reach.

Nevertheless, the segment significantly improved its profitability. Adjusted EBITDA increased from $86 million USD to $339 million USD year-on-year - evidence that Max's global expansion is gaining momentum, despite the streaming service's absence in major markets like the UK and Germany. Hits such as The White Lotus (Season 3), The Last of Us (Season 2), and The Pitt made strong contributions to subscriber loyalty and brand awareness in the past quarter.

Studios

By contrast, the Studios segment showed significantly weaker momentum. Revenue fell -18% to $2.31 billion USD. This decline is primarily due to a decrease in content revenue from theatrical films (-27%) and games (-48%). This operational decline is less due to quality issues than to the strong performance of the previous year, which included titles such as “Dune: Part Two” and “Hogwarts Legacy” generated massive revenues.

Despite the revenue decline, adjusted EBITDA increased by +41% to $259 million, as the group operated much more efficiently in terms of costs. There were no significant investments in games in the current quarter, and film expenditures were reduced as well.

The Studios outlook for the second quarter of 2025 is promising, with blockbusters such as A Minecraft Movie (already earning over $900 million at the box office with a production budget of $150 million) and Sinners ($340 million vs. $100 million) expected to significantly increase revenue and profitability.

At the beginning of the third quarter, this will be followed by the release of the new Superman film, which is considered a potential megahit. The film reportedly had a production budget of around 350 million US dollars.

With such a high budget, it is one of the most expensive superhero films ever made. Therefore, the success of the film will be decisive for the future direction of the DC Universe under James Gunn's leadership.

It should be noted that, three years after Warner's merger with Discovery, the first films and series planned and produced entirely under the new management will finally be released in theaters and on television. It will only now become clear whether it will be possible to breathe new life into the legendary Warner Studios with a new team and lead it back to profitability.

The Legacy TV Business

Despite structural declines, the third major segment, Global Linear Networks, remains a reliable source of cash flow. Sales fell -7% to $4.77 billion. Advertising revenues were particularly affected, dropping -12% overall. Distribution revenues decreased by -9% due to the decline in traditional pay TV subscriptions (cable TV).

Nevertheless, the segment achieved an impressive adjusted EBITDA of $1.79 billion, though this figure was 15% below that of the previous year. The high EBITDA margin of over 37% shows that the linear business continues to deliver high contribution margins despite shrinking.

To counter this trend, WBD is implementing targeted measures, such as increased integration of sports rights. Formats such as the French Open, NASCAR, and the Champions League aim to monetize linear programming further and make it more appealing, especially for live content.

Overall, it is clear that future growth will come primarily from the streaming segment. The studios segment will remain cyclical, and linear TV will continue to decline. Nevertheless, linear TV's high profitability gives Warner Bros. Discovery the operational flexibility necessary for its transformation into a digital platform.

The Debt Burden Remains High

Warner Bros. Discovery will probably remain a highly indebted company for the foreseeable future, despite repaying an additional $2.2 billion USD in debt during the first quarter. As of March 31st, 2025, the company's gross debt totaled USD 38 billion. The average remaining term of the bonds is around 14 years, and the weighted average interest rate is 4.7%.

Net leverage is currently 3.8 times adjusted EBITDA, which is still well above the target range of 2.5 to 3.0 times, three years after the merger.

As an investor, however, I am not overly concerned about the debt. In my opinion, the interest burden is manageable. Unfortunately, the scope for aggressive investments or share buybacks remains limited for the time being.

Apparently, the rating agency S&P takes a more critical view of the debt situation and has downgraded WBD's rating to BB+, particularly in view of a possible future spin-off of the linear TV business.

Outlook for Warner Bros. Discovery Shares

Although cautious, Warner Bros. Discovery's outlook for 2025 is optimistic overall. The company expects positive momentum in several areas, particularly from major content releases and the expansion of its streaming offerings.

The company is focusing on the July release of "Superman", which is considered the most significant franchise release since the commercial success of "Batman". Given the strategic realignment of the DC universe under James Gunn's direction, the film will likely be a crucial test of the relevance and commercial viability of WBD's planned IP-based theatrical productions.

Another important growth driver for WBD is the continued international expansion of the Max streaming platform. After recently launching in Australia and Turkey, the next markets on the agenda are the UK and Germany, which are expected to launch at the beginning of 2026. This expansion is crucial for continuing global subscriber growth and opening new advertising and licensing markets.

Warner Bros. Discovery has set ambitious financial goals for 2025. The company aims to generate at least USD 1.3 billion in streaming EBITDA and around USD 3.0 billion in Studios EBITDA.

Regarding free cash flow, management is targeting a range of $4.0 billion to $4.5 billion due to increased investments. This would not represent a significant change compared to 2024.

Strengthening (HBO) Max

A central component of Warner Bros. Discovery's long-term growth strategy is consistently monetizing iconic content and franchises that have built global brand awareness over decades. The focus is on the globally popular Harry Potter universe and the DC franchises featuring Superman, Batman, Wonder Woman, and others.

A series adaptation of the "Harry Potter" novels is currently in development. This reimagining of the story will be available exclusively on Max, with an expected release date of early 2027.

Meanwhile, WBD is pursuing ambitious plans for the DC Universe. In addition to Superman, the sequel "Batman 2" has already been announced for 2026. The company is also developing a number of new series for the DC Universe. Under the creative direction of James Gunn, the goal is to develop a cohesive, long-term DCU storyverse comparable to Disney's Marvel Cinematic Universe.

Alongside Disney, Warner Bros. Discovery arguably has the strongest IP portfolio in the entertainment industry. Its content ranges from global blockbusters to series favorites with loyal fan bases. However, as is often the case in the media world, commercial success depends less on the brands' potential than on their skillful implementation, content quality, and timing. With this IP offensive, Max has the chance to become a premium provider in the streaming market — provided the planned projects deliver on their promises.

Warner Bros. Discovery has announced that the streaming service "Max" will be rebranded as "HBO Max" in summer 2025. This decision reverses the 2023 rebranding, when the original name, "HBO Max," was abandoned in favor of the shorter "Max." It was an expensive mistake, as we now know.

Valuation of WBD Stock

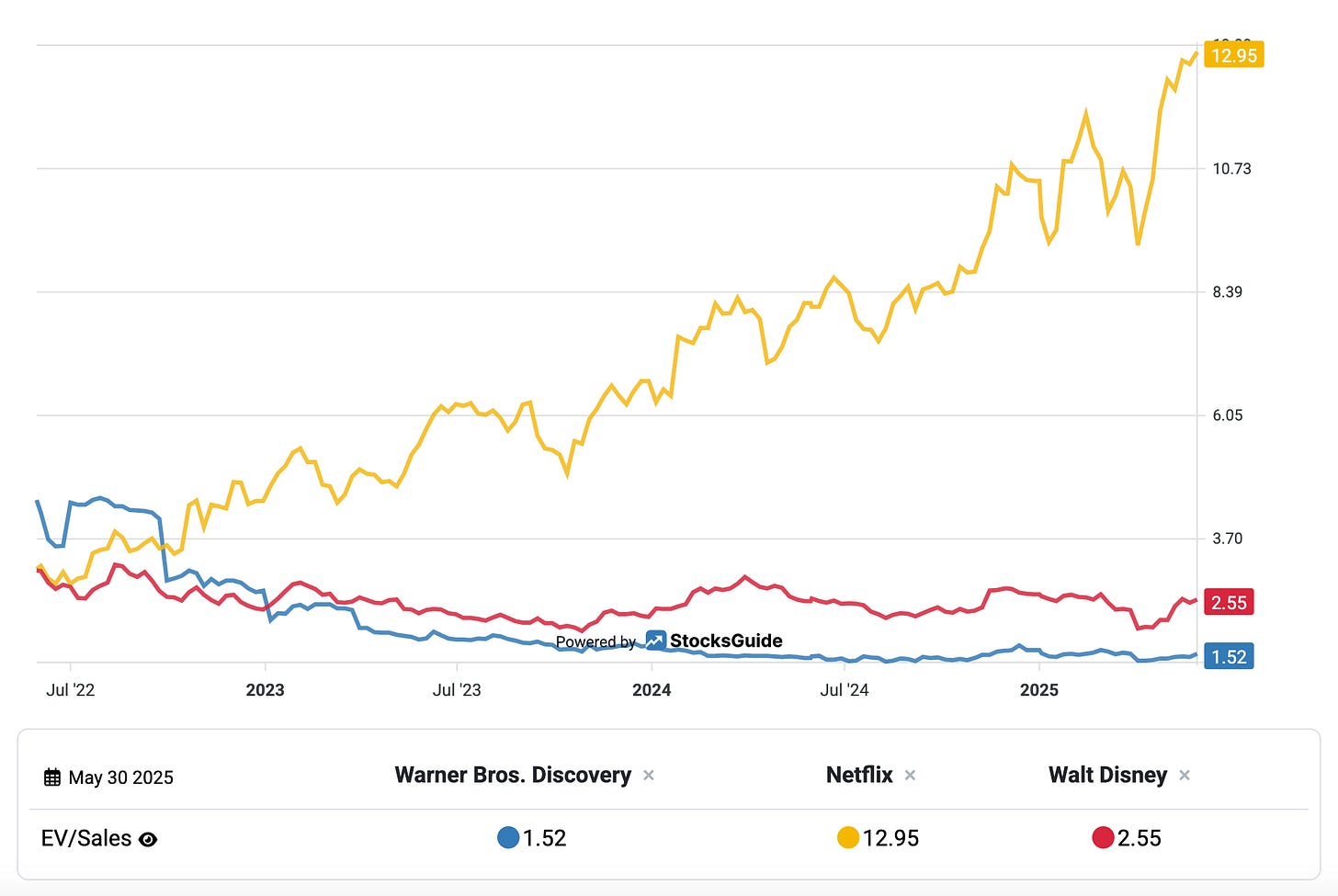

A look at the current valuation ratios clearly shows that the capital market values Warner Bros. Discovery (WBD) much lower than its two major competitors, Disney and Netflix.

WBD's market capitalization is around 24 billion U.S. dollars, while Disney's is around 204 billion U.S. dollars, and Netflix's is over 534 billion U.S. dollars.

There are also significant valuation discounts at the operating level. Based on the expected figures for 2025, the following picture emerges:

In terms of enterprise value to EBITDA, WBD is trading at around 5x, while Disney is trading at around 11x, and Netflix is trading at around 18x. A similar pattern emerges for the EV/FreeCashflow ratio: at around 13x, WBD is well below Disney (22x) and Netflix (70x).

The difference in EV/Sales ratio (simply explained here) is even more drastic. Here, WBD is at just 1.5x, while Disney is at 2.5x, and Netflix is at a high 13x.

At first glance, this data leads to an obvious conclusion: WBD appears to be fundamentally undervalued. However, as is often the case in the stock market, valuation reflects not only current financial figures but also investors' expectations regarding future growth, risk profile, and strategic direction.

Netflix is considered the growth leader in the streaming market. It has excellent global brand awareness, a strong technology platform, and pricing power. Disney, on the other hand, is more broadly diversified than WBD. In addition to streaming, its business includes theme parks, cruise ships, merchandise, film studios, and linear television. This multi-pillar strategy gives the Disney Group resilience.

In contrast, many investors see WBD as a conglomerate with more structural legacy issues. Its high level of debt, shrinking linear TV business, and complex group structure make communicating with investors difficult. Many investors are skeptical that the streaming, studios, and networks divisions can be unbundled as planned.

I am more optimistic on WBD and can only repeat myself: "A sale, merger, or spin-off of Linear Networks seems quite likely to me in the medium term."

Conclusion

My WBD investment case is based on the assumption that, in a few years, the financial market will value the promising areas of streaming and studios significantly higher than they are valued in the current group structure. I believe that we, as WBD shareholders, will need to stay patient.

But who knows? Perhaps WBD will report a net profit already in 2025. Analysts currently predict that WBD will continue to lose money not only this year but also in subsequent years. However, I am cautiously optimistic that the constant amortization of legacy assets will soon end and the positive cash flow will turn into real profits. This would be a significant surprise compared to the consensus and could result in a revaluation of WBD stock before the end of the year.

I will, of course, remain invested and watch the further developments with patience and confidence. If you would like to follow Warner Bros. Discovery stock with me, subscribe to my 100% free SubStack here:

*Disclaimer

The author and/or related persons or companies own shares of Warner Bros. Discovery. This article is an opinion piece and does not constitute investment advice.