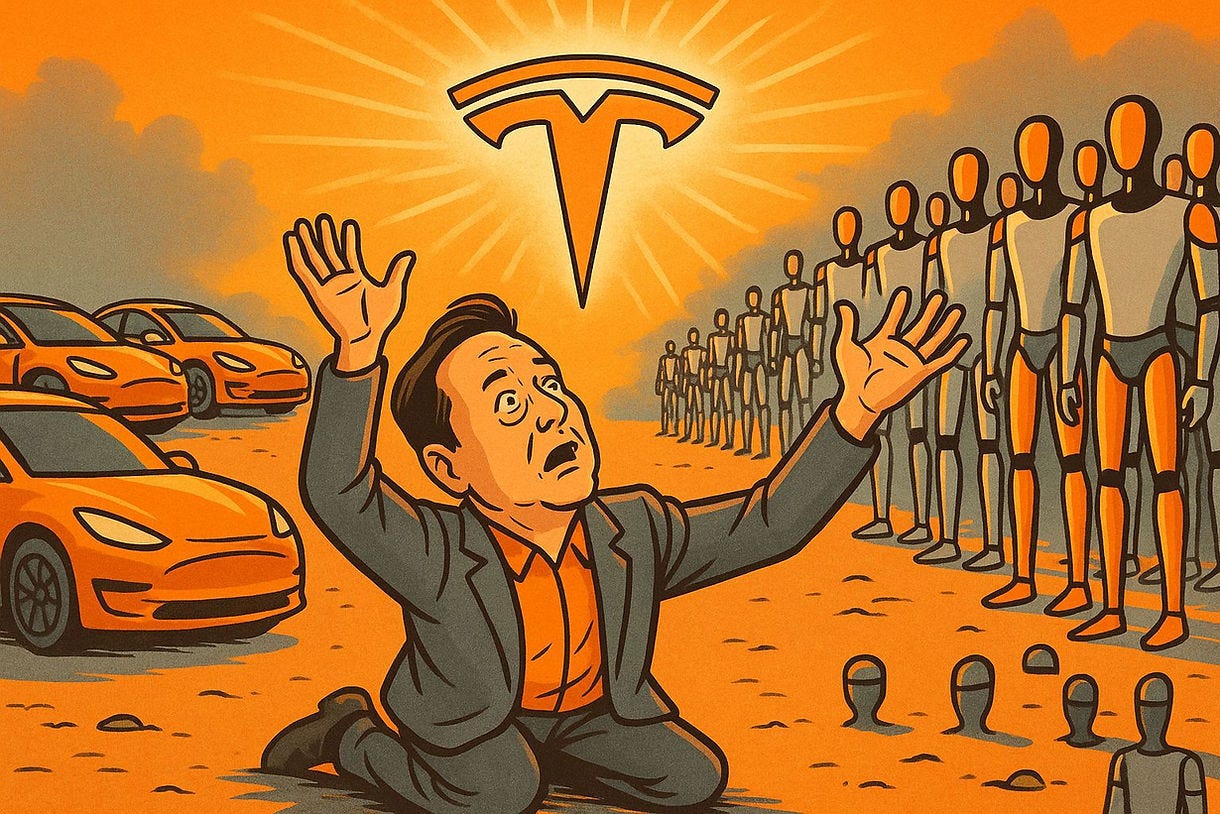

Tesla Stock: Not An Investment, But A Matter Of Faith

Tesla reported disastrous Q1 2025 numbers - and its share price is rising. How is that possible? Find out here.

Tesla is unique and unlike any other company on the planet. If there is any doubt about that, Tesla's Q1 2025 quarterly report is the proof:

Tesla's Q1 2025 numbers were as disastrous as one might have expected given the already known delivery numbers, and they fell far short of analyst expectations.

Revenues in the core business (electric cars) plummeted 20% in Q1 2025 compared to 2024, and were even lower than in 2023. Is this a growth blip or a negative trend?

Operating profit has plunged by two-thirds. Tesla has even slipped into the red in its operating car business.

The current quarter Q2 is likely to be even bleaker, and losses look increasingly likely as the year progresses. As a result, Tesla's management refuses to provide an outlook for the current fiscal year.

At any other company, such numbers combined with a lack of guidance would cause the stock to plummet.

This is not the case with Tesla stock. Despite these numbers, the already triple-digit P/E and other valuation multiples continue to rise. The Tesla stock is now about 70% higher than it was a year ago and continued to rise immediately after the Q1 numbers were announced.

The reason for this is that Elon Musk has pledged to work three to four days a week as Tesla's CEO in the future and to withdraw himself a little from politics. Well then...

From the analyses of well-known Tesla bulls such as Cathie Wood, Dan Ives (Wedbush) and Adam Jonas (Morgan Stanley), I have learned a long time ago that I should not view Tesla as a normal electric car manufacturer, but rather as a leading provider of AI, robotaxis and humanoid robots.

OK. I listened to Tesla's 86-minute post-Q1 analyst call in order to better understand why the Tesla stock is rising despite its disastrous quarterly results. By the way, on the call the financial numbers were only mentioned in passing, and critical questions from analysts on the subject were not even allowed.

Tesla And Robotaxis - The Showdown Is Coming

Tesla is about to launch its robotaxis in Austin, Texas. Elon Musk just confirmed the "start in June" schedule. However, he also had to admit that it will not be the legendary Cybercab without steering wheel or pedals that will hit the road, but rather a small fleet of 10 to 20 Tesla Model Y vehicles that will begin test operations in June and will be supported by (remote?) human operators. He also admitted that Tesla is currently training a fleet of vehicles specifically for the restricted test area in Austin.

This is a big difference from his previous claims that virtually any conventional Tesla vehicle could drive fully autonomously almost anywhere in the world. Regardless of the Austin project, there is still a long way to go. Ultimately, Tesla is now following the playbook that Waymo has been executing for nearly a decade: tackling one city at a time and getting it approved for autonomous operation.

With one big difference: Tesla still claims it can do without the expensive LIDAR sensors in its vehicles, and operate its autonomous vehicles (AVs) using cameras and AI alone. That's probably a leap of faith. Many experts say it's not possible to get by with so little hardware in practice. We'll see.

I am curious to see how Tesla's test operation in Austin will look like starting in June. There will probably be no human safety drivers on board the test vehicles, otherwise it would not be the big breakthrough Elon Musk is hoping for. He will probably make a big splash celebrating when the first paying customers take their first rides in a Tesla robot taxi at the end of June.

It will be exciting to see how the Tesla driving experience compares directly with the Waymo/Uber offering. Waymo's autonomous vehicles, based on the all-electric Jaguar I-PACE, are already in service in Austin and can be booked using the Uber app. This means that a direct comparison will be possible under similar (optimal) conditions. One thing is certain: Tesla will enter the market as a price breaker. Elon Musk estimates the cost of Tesla's robotaxis at only 20-25% of Waymo/Jaguar's vehicles.

Even more exciting than the test run in ideal weather and stable conditions in Texas is the question of whether millions of Tesla robotaxis will actually be on the road by the end of 2026. The claim is that every current Tesla model will become fully autonomous via a software update.

"By the second half of next year, millions of Teslas will be driving autonomously."

- Elon Musk

I have been hearing this statement for many years. Elon Musk has now reiterated that by 2026, only regulatory hurdles could prevent Tesla from dominating over 90% of the rapidly growing AV market.

New Affordable Tesla Models

Well, okay then. If there are delays - remember that the one million pre-orders for the Cybertruck turned out to be a mirage - Tesla would have an existential problem as an electric car manufacturer. Because there is no Plan B. The more affordable Tesla vehicle expected in the coming months is likely to differ only slightly from the existing Model Y. It will be built on the same production line, and expectations for it were muted rather than enthusiastic in the post-Q1 analyst call.

"Full utilization of our factories is the primary goal for these new products. And so flexibility of what we can do within the form factor and the design of it is really limited to what we can do in our existing lines rather than build new ones.”

- Lars Moravy, VP Vehicle Engineering at Tesla

Optimus Is The Hope For Tesla

Elon Musk continues to claim that Tesla has the potential to become by far the most valuable company in the world. The reason is his boundless optimism about Optimus. The name says it all. By 2025, several thousand of the humanoid robots will be built and used in Tesla's production facilities.

From 2026, within a few years, this is supposed to become the most valuable business the planet has ever seen. Elon Musk believes that by 2030, more than a million Optimus robots will be sold annually, with Tesla leading the global market. How big will this market be and which customers will buy millions of robots in a few years? As far as I know, there is no information on such details.

However, when asked, Elon did not hide the fact that there are currently some difficulties that need to be resolved, such as the fact that the production of the Optimus relies on some export-restricted components from China, but China refuses to grant the necessary export license for fear that the Optimus could be used for military purposes.

Elon dismissed that as complete nonsense. So I guess ultimately it's a matter of faith. I'm definitely a skeptic, because why couldn't you put a weapon in the hands of the Optimus if it's as good, strong, and versatile as Elon says it is?

Tesla's Numbers For The First Quarter Of 2025

As a non-believer, I'm going to take a closer look at Tesla's numbers, even if Tesla bulls dismiss it as unimportant and nitpicky.

Tesla's total revenue dropped by just under 10% in the first quarter. Its core electric car business, which still accounts for 72% of total revenue, was down 20%. We will see in the current second quarter how much of this was due to the production switch to the latest version of the Model Y in the first quarter.

Tesla's energy storage business is booming, growing 67% to $2.7 billion in the first quarter. It now accounts for 14% of total revenue, but will likely be negatively impacted by Chinese tariffs later in the year, as the batteries used are manufactured in China.

Tesla's operating income plunged by two-thirds in Q1 to just under $400 million. Net income was only slightly higher. Only the 35% increase to nearly $600 million in vehicle emission credits that Tesla receives from other automakers due to environmental regulations prevented Tesla from reporting an operating and net loss in the first quarter.

The Valuation of Tesla Stock

At this point, I think it will be very difficult for Tesla to avoid sliding further into the red in the current second quarter. Not surprisingly, Tesla management has not provided guidance for the current quarter or even for the full year 2025. Given the considerable uncertainty caused by the erratic policies of the Trump administration, I find this entirely understandable.

Tesla currently trades at an enterprise value of about $800 billion. Maybe 10% of that is justified by the electric car business. The other 90% is a bet on robotaxis/cybercabs and Optimus. Apparently, there are still a large number of investors who believe that Elon Musk can leapfrog Waymo and other AV providers with a revolutionary approach and create the next big thing with AI-based humanoid robots.

I am not one of them and believe that Tesla stock will come under significant pressure in the coming quarters. Analysts will contribute to this by having to lower their overly high revenue expectations. Personally, I now even expect Tesla to report losses for the full year 2025.

Given the recent rally, I have added to the Tesla short position in my public long/short portfolio, betting on falling prices. However, one should never underestimate Elon Musk and always expect him to pull new rabbits out of his hat. For example, he could announce at any time that he is entering the drone manufacturing business. A MAGA drone "Made in America". The flying cybercab, so to speak.

Now, how did I come up with that one?

Here is his remarkable closing comment from the Q1 analyst call:

"Any country that cannot manufacture its own drones is doomed to be the vassal state of any country that can. And we can’t America cannot currently manufacture its own drones. But that’s again, unfortunately. So, China, I believe, manufactures about 70% of all drones. And if you look at the total supply chain, China is almost a 100% of drones, all have a supply chain dependency on China. So, China is in a very strong position.”

- Elon Musk

In any case, it remains exciting, and you could almost laugh at these entertaining Tesla stories if it weren't so serious. If you would like to follow the events surrounding this unique company with me, you can subscribe to my free newsletter here:

*Disclaimer: This article is an expression of opinion and does not constitute investment advice. The author and/or persons or entities associated with him hold short positions in Tesla stock (as of April 27, 2025). The author and/or persons or companies associated with him are affiliated with eToro through an affiliate partnership and through the Popular Investors Program. Copy trading is not investment advice. The value of these investments may rise or fall. Your capital is at risk. 61% of retail CFD accounts lose money at eToro.