Teladoc Stock in 2025: Two Acquisitions as Game Changers

In light of recent developments at the virtual healthcare provider Teladoc, I have decided to invest. Here is my investment thesis on this 'fallen angel'.

I have been watching the developments of virtual healthcare provider Teladoc (TDOC 0.00%↑ ) with great interest for quite some time now. Next week, Teladoc will celebrate the tenth anniversary of its IPO. I first introduced the "fallen angel" on my watch list 12 months ago with this article:

Since then, Teladoc's share price has fallen another 20%, despite the company's significant progress.

While the company is now generating solid free cash flows from its operating business, it remains under pressure. This is due to declining revenues in the BetterHelp segment and a change in the business model. Until now, the focus has mainly been on subscriptions, but in the future, billing will be more usage-based.

Meanwhile, Teladoc is moving forward with its strategic realignment through targeted acquisitions. In this article, I explain these acquisitions and my decision to establish an initial position in Teladoc shares at this point in time.

Teladoc's corporate development in 2024

2024 was a year of transition for Teladoc Health, marked by strategic realignment and a change in management. Since taking office twelve months ago, new CEO Chuck Divita has promoted operational discipline and launched a cost-cutting program. After previous years with strong growth through acquisitions and a series of overpriced takeovers, the company in 2024 shifted its focus clearly toward efficiency and cash flow stabilization.

In operational terms, Teladoc generated revenue of $2.57 billion for the full year, representing a slight decline of 1% compared to 2023. The two main segments performed very differently:

Revenue from Integrated Care, including virtual doctor visits, chronic care, and diagnostics, grew by 4% to $1.53 billion. This growth was mainly due to increased demand for chronic care and telemedicine from the 1.1 million members enrolled in one of the company's chronic care programs.

Meanwhile, BetterHelp recorded an 8% decline in revenue, bringing it to $1.04 billion. To date, it has offered various online therapy and coaching services related to mental health exclusively to self-paying customers. Teladoc is the market leader in this segment. However, demand for such online services has declined since the end of the pandemic, particularly in the self-pay sector. This decline is reflected in price pressure and lower advertising efficiency on digital marketing channels, such as Google and Meta.

Despite stagnating revenue, Teladoc generated positive free cash flow of $170 million in 2024 through strict cost management and focusing on profitable services. This enabled the company to generate significant free cash flow for the first time in years, which was an important signal to me as a fundamentally oriented investor.

However, due to restructuring efforts and additional write-downs, Teladoc reported a net loss of over $1 billion in 2024.

Revenue and Earnings Development in Q1 2025

In the first quarter of 2025, Teladoc generated revenue of $629 million USD. This represents a 3% decline compared to the same quarter of the previous year (Q1 2024: $646 million). The two main segments continued to perform very differently. Revenue from Integrated Care increased by 3% to nearly $390 million. Meanwhile, revenue from BetterHelp in the mental health/online therapy segment decreased significantly by 11% to $204 million.

Other key figures for Q1 2025 are as follows:

The gross margin was approximately 67%, which is slightly below last year's figure.

Adjusted EBITDA decreased by 8% to $58 million, compared to $63 million in the first quarter of 2024.

Operating cash flow from operating activities was US$16 million in the first quarter of 2025, up from US$9 million in the first quarter of 2024.

Free cash flow was negative at -$16 million in the seasonally weak first quarter of 2025, compared to -$27 million in the first quarter of 2024.

The net loss was $93 million, which was again impacted by restructuring costs, goodwill impairment charges, and ongoing losses in the BetterHelp segment.

Teladoc Guidance for 2025:

Despite negative earnings, the bright spot in Teladoc's figures is its stable cash flow performance.

For the full year, revenue is expected to be slightly below the previous year's level. Adjusted EBITDA margin is expected to be around 11%, and free cash flow is expected to be at least $170 million.

The significant decline in revenue in the BetterHelp segment is expected to halt in the second half of 2025 through the integration of the Uplift acquisition into the BetterHelp platform. More on that later.

This development demonstrates that Teladoc's new management is running the operating business more efficiently than before and making significant investments in smaller yet important acquisitions without endangering liquidity.

From a Subscription model to Usage-Based pricing

A key issue in Teladoc's painful transformation is the ongoing shift from subscription-based revenue to usage-based pricing (UBP). While revenues during the virtual healthcare market boom phase of the pandemic came almost exclusively from monthly fixed amounts ("access fees"), Teladoc must now accept a monetary link to actual usage and restructure its business model accordingly.

What does this mean?

Previously, employers paid Teladoc a monthly flat fee per employee, regardless of usage. These "access fees" accounted for 83% of total revenue in the first quarter of 2025.

Under the new model, Teladoc earns money whenever patients use services, such as virtual doctor visits, diagnostics, and mental health consultations. In the first quarter of 2025, usage-based revenue increased by 16%.

The trend is clearly moving away from subscriptions. This presents new opportunities for Teladoc alongside the risks associated with less predictable revenues. Active use of the platform by customers results in higher revenue potential. Better cross-selling is possible along the “patient journey” when diagnosis, therapy, and subsequent chronic care are offered from a single source on the platform.

This is precisely what the new Teladoc management has been working toward for the past year. The two acquisitions announced in recent months should also be viewed in this context.

Strategic Acquisitions: Catapult Health and UpLift

In the first half of 2025, Teladoc made two targeted acquisitions that will directly impact the company's strategy and revenue structure.

Catapult Health (February 2025):

Catapult Health is a U.S. provider of preventive healthcare services. They specialize in virtual checkups, early disease detection, and at-home diagnostics. In other words, they bridge the gap between prevention and care, addressing many chronic diseases at an early stage.

The core product, VirtualCheckup, is a virtual health check that users can conveniently perform from home. Users receive a home test kit for blood pressure, blood sugar, cholesterol, etc., and send it to partner laboratories. A few days later, users have a virtual appointment with a doctor to discuss the results and receive advice.

The results are analyzed for common health risks, such as prediabetes, high blood pressure, obesity, and mental stress, to enable early detection and referral to structured care programs, such as Teladoc's diabetes or mental health care programs.

VirtualCheckup provides the first concrete medical data point, which is ideal for cross-selling other Teladoc services, such as chronic care, mental health care, and coaching.

The model is highly scalable thanks to its high level of digital automation. It has low variable costs and therefore aligns well with Teladoc's platform strategy. Individual health reports and medical advice have the potential to establish a high level of trust.

Catapult is active in the B2B healthcare market, offering its solutions to companies with several thousand employees. With the purchase of Catapult Teladoc's "Integrated Care" segment has been complemented with an entry point that makes it easy for patients to access care. Catapult's revenue prior to the acquisition was approximately $30 million. So the purchase price of $65 million (plus an earn-out of up to $5 million) sounds like a fair price to me.

UpLift (April 2025):

UpLift is a U.S. mental health company. It specializes in providing access to therapeutic care through health insurance, particularly for those with government-sponsored insurance, such as Medicare and Medicaid. The UpLift platform uses a hybrid approach combining therapist matching, insurance integration, and a digital patient journey.

UpLift has established contracts with major insurance companies and has access to the records of over 100 million insured individuals, including those with Medicaid and Medicare. Users can connect with licensed psychotherapists online through UpLift, and their services are covered by health insurance plans, including private, Medicare, and Medicaid plans.

Unlike many other online therapy platforms, such as BetterHelp, sessions on UpLift can be billed through health insurance and are not exclusively for those paying out of pocket. In most cases, only a copayment is required, which makes the services more affordable and significantly increases the conversion rate compared to the self-payer model.

When you register, UpLift conducts a structured analysis to select suitable therapists from its network. This matching is based on insurance networks, respective therapy focuses (e.g., anxiety, depression, trauma), language preferences, and availability.

Digital tools are also available for online programs, calendar integration, messaging systems, and more. The focus is on easy accessibility, retention, and continuity of therapy.

A key strategic benefit for Teladoc is that BetterHelp services can now be billed through health insurance for the first time. This significantly increases affordability and expands the addressable market.

The purchase price for UpLift is $30 million (plus an earn-out of up to $15 million), roughly doubling the previous revenue base. Given the strategic benefits, I think this is an attractive price.

The medium- and long-term impact of BetterHelp's business model transformation is difficult to quantify. A 1% increase in BetterHelp's conversion rate of registered prospects to customers, which is currently extremely low, would generate an additional $40 million in revenue for Teladoc.

Overall, I see these two acquisitions as potential game changers, and I expect Teladoc to resume growth in 2026.

However, the acquisitions must first be integrated into the Teladoc platform by 2025, both technologically and organizationally.

These investments will weigh on earnings and cash flow initially in 2025. Together, the two acquisitions are expected to contribute approximately $40 million to revenue in 2025. More importantly, however, they will enable cross-selling, reduce customer acquisition costs, and facilitate the inevitable transition to usage-based models.

Competitive Environment: Teladoc is Under Pressure

Although Teladoc remains a leading provider in the telemedicine market, it is facing increasing competitive pressure. There are many providers. Its competitors include specialized companies, such as American Well, MDLive, Doctor on Demand, PlushCare, LifeMD, and Doxy.me, as well as generic video conferencing tools, such as Zoom, that handle a large portion of virtual care connections via third-party applications.

Teladoc itself is estimated to have a global market share of 7–10%. While Teladoc impresses with its growing depth of segments (mental health, diagnostics, and chronic care), cheaper providers with simpler access are entering the market.

Teladoc's strengths include its extensive platform, superior to that of its competitors, its extensive partner networks (including Amazon Health and large employers), and its growing international revenue share.

However, risks arise from the potential migration of users to cheaper or more specialized offerings, as well as from the lack of genuine unique selling points of the core product (online doctor visits) compared to generic tools, such as Zoom.

Teladoc Share Valuation

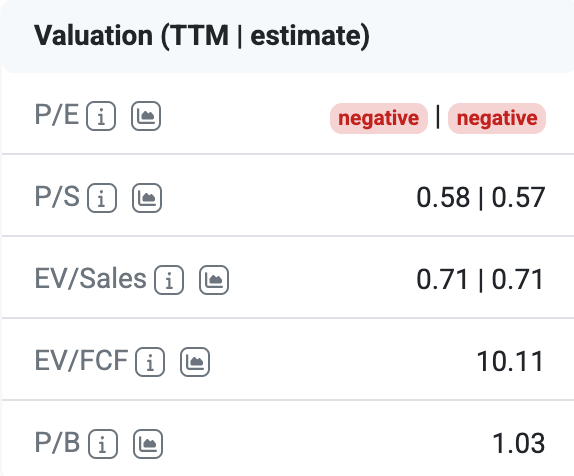

At the time of publication, Teladoc shares were trading at around USD 8, which is their lowest level since the company went public in 2015. The valuation appears attractive.

With a ratio of 0.7, the EV/Sales is well below that of other companies in the virtual healthcare sector. Although cash flow is likely to continue growing in the coming years under the new CEO, the free cash flow multiple is around 10.

Conclusion

In the first ten years after its IPO, Teladoc destroyed billions in shareholder value. Most investors are horrified when they look at the long-term share price chart and want nothing to do with this stock.

However, I am now optimistic that the new CEO will restructure the company successfully and that Teladoc will emerge asa winner from the inevitable consolidation of virtual health providers in the next ten years.

Teladoc shareholders will need patience. I have the patience necessary for this investment and have acquired an entry position. Although Teladoc shares are fundamentally cheap, the market is pricing in a risk premium due to weak earnings, intensifying competition, and major problems with the business model of the BetterHelp segment to date.

For me, Teladoc Health remains an interesting player in the changing telemedicine market. The company is showing stable cash flows and focusing on smart strategic acquisitions while further developing its business model toward usage-based platforms. I believe investing in Teladoc shares at current prices offers an attractive risk/reward ratio.

If you would like to follow Teladoc's development with me, subscribe to my free Substack here:

*Disclaimer

The author and/or related persons or companies own shares in Teladoc Health. This article is an expression of opinion and does not constitute investment advice.