PayPal Stock : The Sleeping Giant Awakes

Why the unloved payment provider is one of my high-conviction buys at current prices.

This article is an update of a stock analysis first published in March 2024. It has been updated and significantly expanded following the figures for the 2Q 2024.

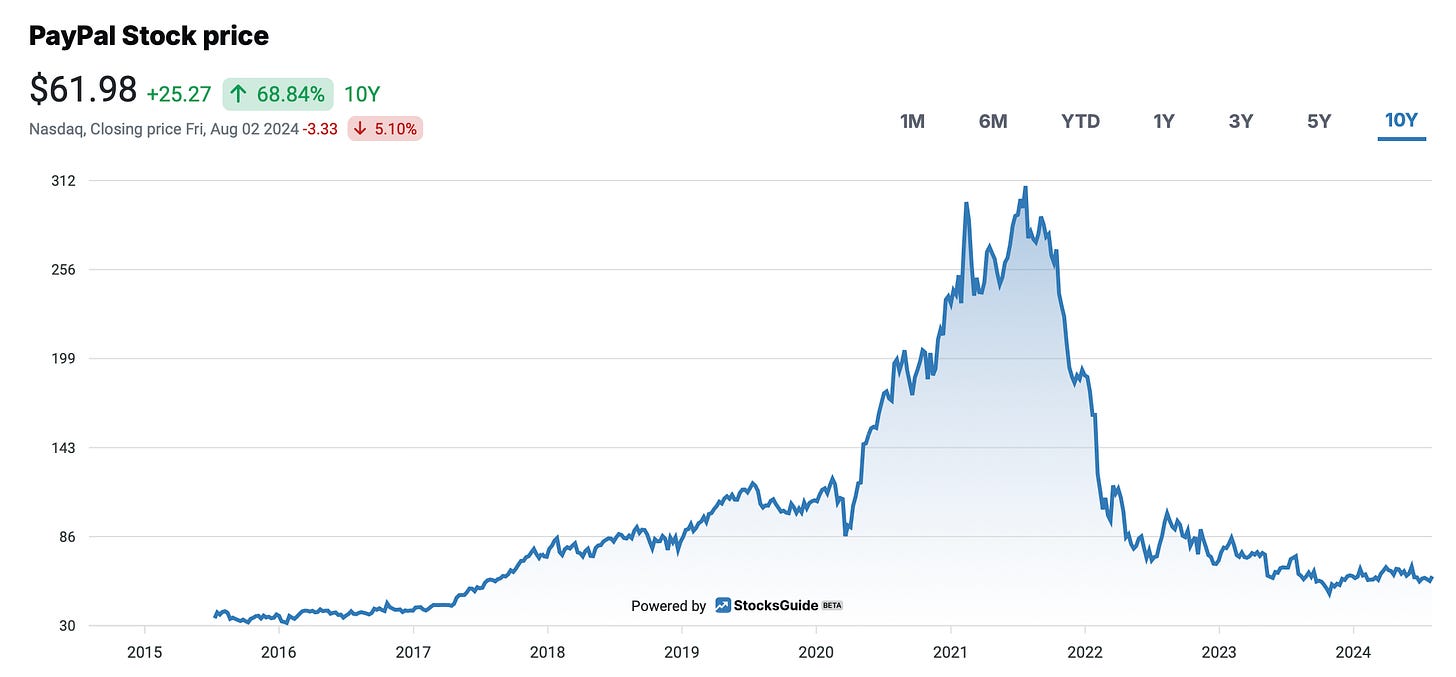

It has been almost 9 years since eBay shareholders received PayPal PYPL 0.00%↑shares in their portfolios as part of a highly anticipated spin-off. Those shareholders who have stayed on since the eBay spin-off have had a wild ride.

From 2015 to mid-2021, the value of PayPal shares rose from 35 USD to over 300 USD. Since then, PayPal shares, which are also popular with small investors, have fallen by more than 80% and can now be bought for just over 60 USD.

I had already invested quite successfully in PayPal from 2018 to 2019, although I exited far too early due to the high valuation.

Why did I reinvest in the fallen angel PayPal in the first half of 2024 and build up a sizable position over the course of the first half of 2024?

Here are my current thoughts on the PayPal investment case after their Q2 2024 earnings release:

The history of PayPal

PayPal, one of the best-known online payment systems, has a fascinating history that began more than 25 years ago with the founding of Confinity by Peter Thiel and others in December 1998. In March 2000, Confinity merged with X.com, an online banking company founded by Elon Musk.

After the merger, the company focused exclusively on the money transfer service PayPal, which quickly became the preferred payment method on the auction site eBay.

PayPal went public in February 2002, but was acquired by eBay in October of the same year for 1.5 billion USD. The acquisition helped PayPal consolidate its position as the leading online payment system at the time, particularly as it was tightly integrated with the eBay platform.

Despite the initial success of the integration, eBay and PayPal decided to separate 13 years later. In 2015, PayPal became an independent company listed on the Nasdaq in a spin-off. This move allowed PayPal to diversify its business strategy and expand its partnerships beyond eBay.

The new beginning

I haven't exactly been a fan of PayPal in recent years. I'm not a good customer myself, because although I've had a PayPal account for years, I don't use it very often. And I have not been seriously interested in PayPal stock in recent years.

What I didn't like about PayPal in all those years was the focus of long-time CEO Dan Schulman on a bunch of acquisitions, which made the sources of revenue and profit hard to understand for me. Schulman's strategy was "growth at all costs". In any case, Schulman's vision of a PayPal "super-app" has been a complete failure.

Following Schulman's full resignation on 31 December 2023, the way is now clear for the company to be refocused by new CEO Alex Chriss. He has a long and successful track record at Intuit in providing technology to small businesses and is known for his long-term thinking. Which is remarkable in today's quarterly results-driven financial world.

Since taking over just three quarters ago, Alex Chriss has already made a lot of progress at PayPal: almost the entire management team has been replaced. He has made it clear that he wants to sharpen the company's focus, invest in product innovation and possibly get rid of unimportant peripheral businesses that have been acquired.

PayPal as a two-way platform

Many of you know PayPal from your own experience as an online payment service for consumers. It faces stiff competition from Apple and Google with their own payment services. In addition, there are other innovative challengers such as Block's (Square) Cash app and, of course, the countless payment services offered by banks and financial service providers.

PayPal's shares have fallen out of favor with many investors, as the question of whether PayPal will continue to lose ground to the seemingly overwhelming Big Tech alternatives is a critical one.

At least in Europe, I am not currently worried about PayPal's competitiveness on the consumer side. The reason is our own experience: When we developed the aktien.guide platform (in German, but you can already check-out the upcoming English version stocksguide.com as a preview) for the German speaking retail investor community, we did not connect to PayPal until 2023. This was a mistake, because the PayPal payment option was massively demanded by end customers as an alternative to debit or credit cards. Since the addition of PayPal, this option has been used surprisingly often: More than 25% of all payments for this online-only business are received via PayPal - and the trend is rising.

However, the consumer business with the so-called "PayPal Branded Checkout" is only one side of the PayPal platform. Equally important for PayPal is its business with the 35 million merchants who accept card payments as well as PayPal using PayPal's Braintree software. Braintree is PayPal's business offering, competing with Stripe, Adyen, Square (Block) and others.

As a result of competition, payment providers' take rates tend to fall. This refers to the share of the total payment volume that is collected by the payment providers. Specifically, PayPal's take rate has fallen from 2.2% to 1.9% over the past three years. This headwind is more than offset by the overall increase in online payment volume, which is still growing at a double-digit rate, even for PayPal.

PayPal Q2 2024 financials

PayPal recently reported strong Q2 2024 financials, and in particular a significant increase in guidance for the full year 2024.

There were no major surprises on the revenue and volume side, with Q2 2024 revenue up 8% to 7.9 billion USD and total payment volume up 11% to 417 billion USD.

Profitability grew much faster than revenue, with adjusted earnings per share up 36% to 1.19 USD. Free Cashflow was 1.4 billion USD in the second quarter.

GAAP earnings per share for the full year are now expected to be just under 4 USD, an increase of almost 10% from the previous guidance following the strong first half.

The Cashflow outlook is even more positive, which is very important to me personally as an investor. PayPal now expects Free Cashflow of 6 billion USD in 2024, an increase of over 40% year-on-year!

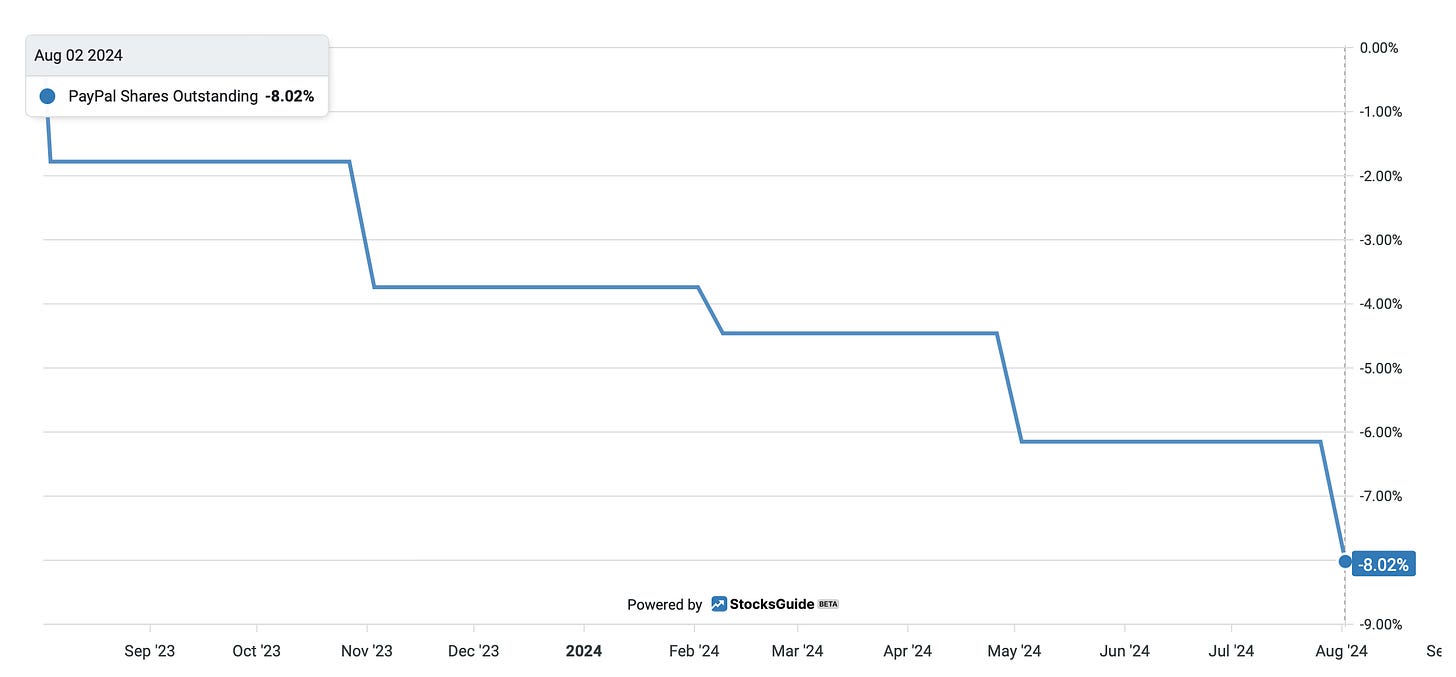

The use of the extra cash has also been clarified, as the planned share buybacks have been increased by 1 billion USD to 6 billion USD. It seems that management is extremely confident that there is no better use of funds than to buy back PayPal's own (undervalued) shares.

I can certainly understand this valuation view, but more on that later.

Bird's eye view of PayPal financials

PayPal is a company that has been growing for more than 25 years, with nearly 30 billion USD in revenue and more than 400 million active accounts. Despite its European banking licence, the company does not see itself as a bank, but as a FinTech: PayPal is no longer a dynamically growing start-up, but a giant that, in my opinion, has not been well managed in recent years.

Because of its sheer size, we as investors can no longer necessarily expect double-digit revenue growth from PayPal, even though global online payments will remain a growth market for years to come.

PayPal's revenue has grown by +8% in each of the last two years. And double-digit growth is unlikely to be achieved in 2024 either, with analysts forecasting +7%.

What I do expect from PayPal, at least in the medium term, is significant double-digit growth in profit and cashflow.

There is probably a lot of room for improvement there. Operating profit (non-GAAP) in 2023 was 6.7 billion USD, representing a margin of 22%. The margins of its lean competitor Adyen, for example, are twice as high.

There is also significant cost optimisation potential at PayPal, and the half-year 2024 figures already show that the new management is willing to exploit this potential.

PayPal is targeting Free Cashflow of 6 billion USD in 2024, 40-50% higher than last year. The company has a strong balance sheet, allowing it to use all of this cashflow to aggressively buy back its own shares.

The number of PayPal shares outstanding has already been reduced by 8% in the last 12 months. The rapidly declining number of shares outstanding is therefore a significant tailwind for earnings and cashflow per share.

The new management

My decision to invest in PayPal in 2024 had a lot to do with the new management. CEO Alex Chriss' first quarters have been promising and he has increasingly earned my trust.

Even if he raised expectations a little too high in the run-up to an investor event in January ("We will shock the world") and then failed to live up to them with the innovations that have been announced.

The development of Fastlane is very promising and offers a faster and easier way to pay securely online with PayPal. As an end customer, you can use Fastlane to store your card and shipping details centrally when you make your first purchase with PayPal. This stored data can then be used for future purchases wherever Fastlane by PayPal is available.

Such innovations are certainly not a revolution in e-commerce. But I don't think such a revolution is necessary to create significant value for PayPal shareholders in the years ahead.

The PayPal user base

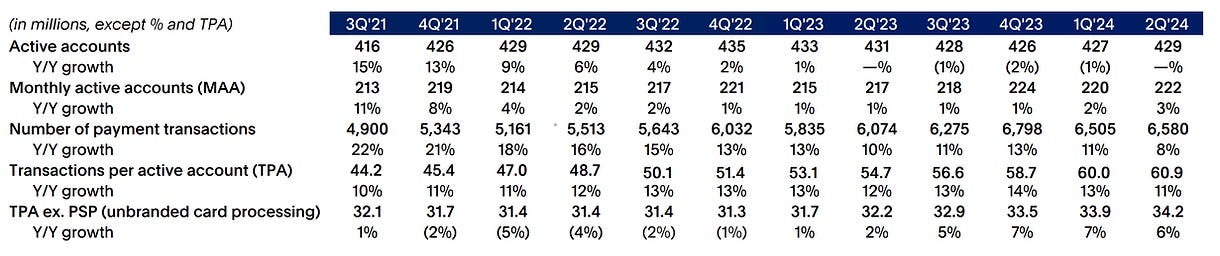

Very important to me: I now see more transparency in PayPal's published figures than in previous years. For example, there is a new disclosure of Monthly Active Accounts (MAA) of currently 222 million (+3% compared to last year). This figure seems to me to be more meaningful than the number of active accounts (429 million, unchanged year-on-year), which includes all users who have made a transaction in the last 12 months.

With over 400 million active users, the network effects are huge. In my opinion, the future for PayPal is no longer necessarily about growing the user base, but rather about better exploiting the great potential of this customer base, i.e. increasing user engagement on the platform.

Probably the company's biggest problem in the financial market is the alleged dwindling number of users due to increasing competition from Apple Pay and others.

I do not see any worrying trend in the published user numbers. On the contrary, the number of MAAs has increased by 3% over the past 12 months to 222 million. The number of transactions per active account (TPA) even grew by double digits last year. My interpretation of this is as follows: PayPal has a stable user base. And the active consumers who are valuable to the company are using the platform even more than they were a year ago.

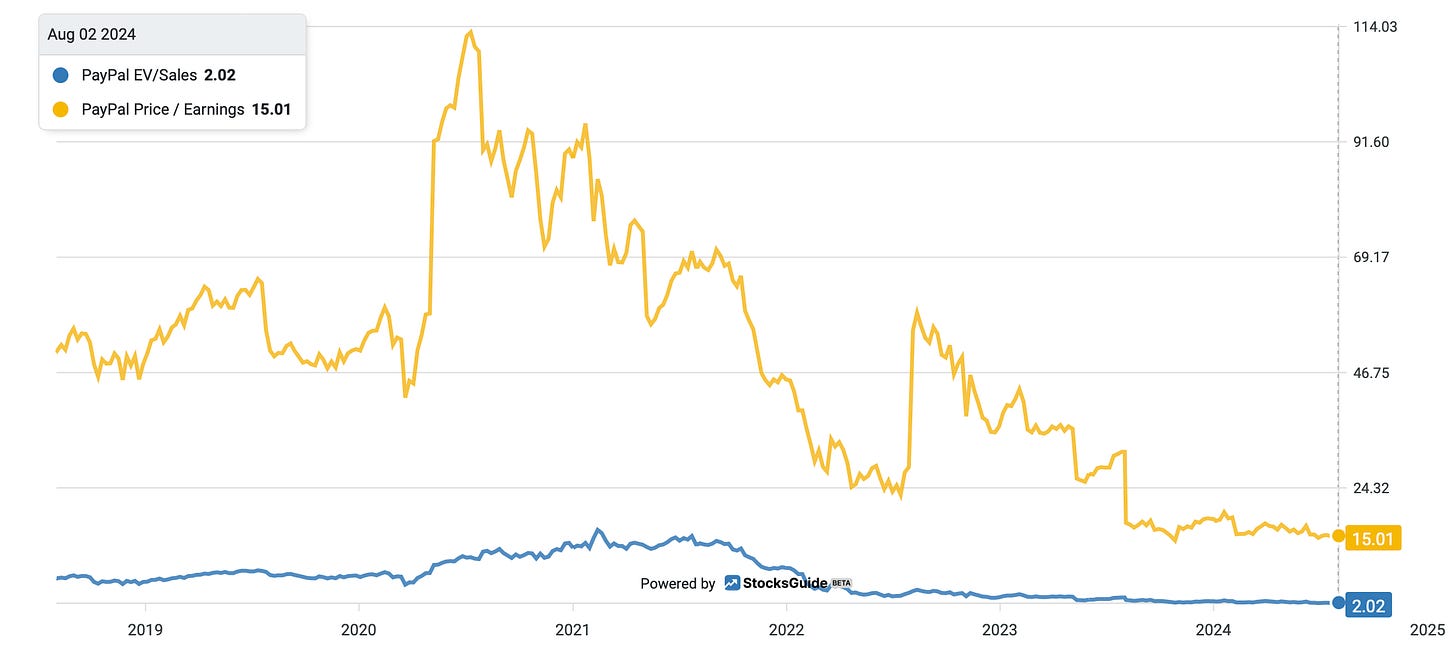

Valuation of PayPal stock

Following the release of its half-year results, PayPal's share price took a small leap forward. At a share price of 62 USD, PayPal is valued at 64 billion USD. This is roughly double its revenues. The P/E ratio is 15.

Based on these valuation metrics, PayPal shares have never been as cheap as they are today.

With Free Cashflow expectations increased to 6 billion USD, the EV/FCF multiple is 10, which I think is very attractive. Especially as I believe PayPal has considerable potential to grow profitability and cashflow significantly in the coming years.

Conclusion of my PayPal stock analysis

For years, PayPal shares were among the favourites of many retail investors. In the meantime, the stock has become rather unpopular. It is suffering from the expectation, shared by many analysts, that the PayPal platform could become less important in the age of Apple Pay and Generative AI.

I think these fears are overblown. PayPal's massive user base of over 220 million monthly users provides a good basis for the new management to create significant value for long-suffering shareholders in the coming years.

Over the past few months, I have built up a sizeable position in PayPal shares for the High-Tech Stock Picking wikifolio. Patience is now required to give the new management time to confirm the positive fundamental trend. Then it should only be a matter of time before the stock price leaves the valley of tears.

If you would like to follow PayPal together with me in the future, you can

Disclaimer:

The author and/or associated persons or companies own shares in PayPal. This article is an expression of opinion and does not constitute any investment or financial advice.