Israeli Stock monday.com on the Rise: Investing Opportunity Despite War?

The market for agile work management software services is booming. Surprisingly, the best SaaS company in this space is not from the US.

I am always amazed at how many exciting Israeli software stocks there are on the Nasdaq. One of these SaaS companies is monday.com MNDY 0.00%↑ : the Israelis have delivered an impressive performance for over two years now since the IPO in June 2021. Despite a weak market environment for SaaS and the additional difficulties surrounding the war against Hamas.

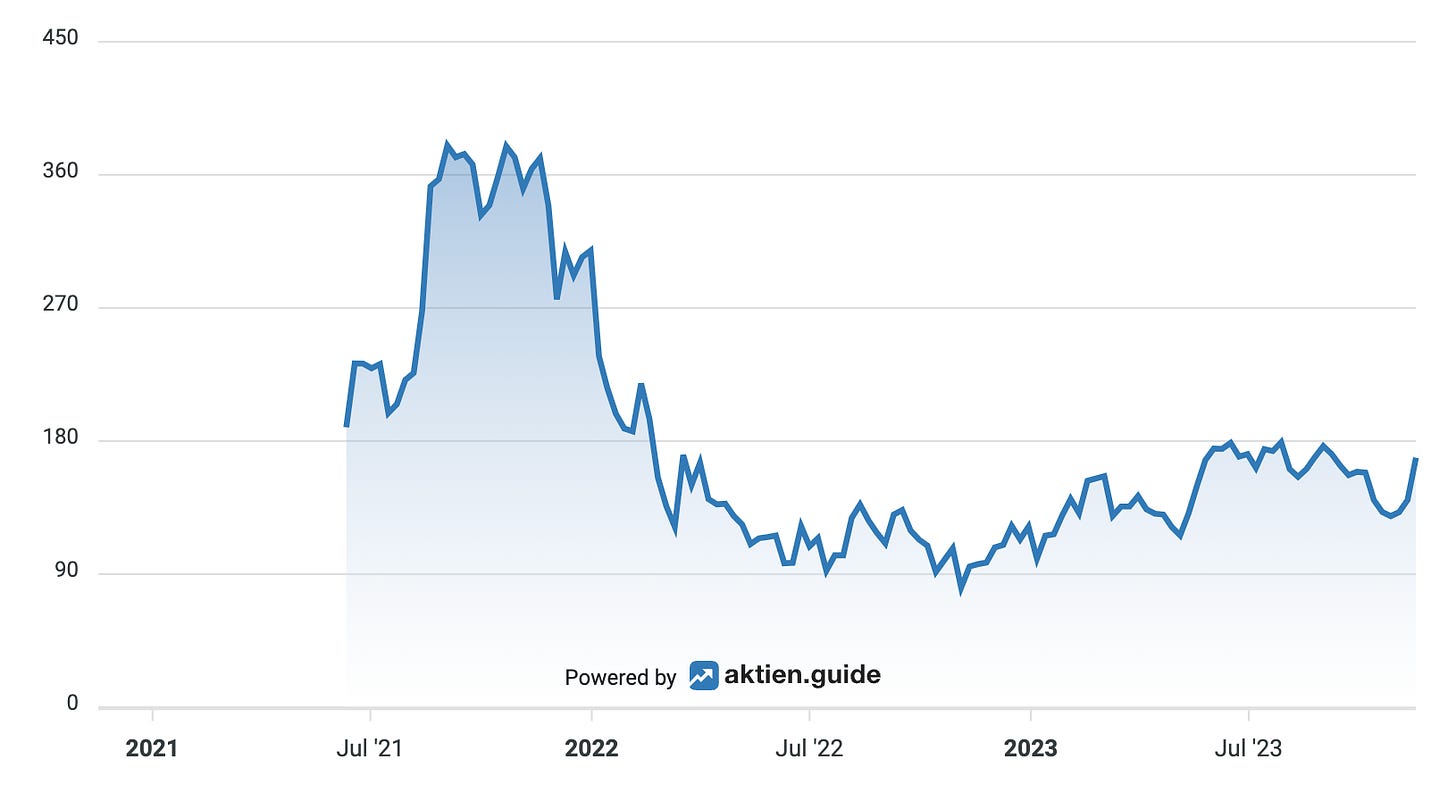

The monday.com share has already increased in price by 40% in the course of 2023. However, the current share price is still more than 50% below the highs reached at the end of 2021.

The figures just published for Q3 2023 once again led to a double-digit jump in the share price - as was the case after the figures for the last three quarters.

I would like to give you a closer look at this cloud share, which still receives far too little attention:

What does monday.com do ?

monday.com has become known as a cloud-based tool for project management.

One advantage of the monday solution over the competition is its great flexibility and user-friendliness, with which even non-developers can map workflows and optimize business processes with the help of so-called "building blocks" and integrate many other SaaS tools such as Outlook, Gmail, Zoom, Slack or Dropbox.

As a layman, you can imagine the monday software as a "Lego construction kit for business software". At least that's more or less the performance promise. It should be clear to the developers among you that the reality is somewhat different when it comes to the extensive requirements of a larger company.

In fact, monday products, which were originally aimed primarily at small and medium-sized business customers, are increasingly being used by larger companies too. At the end of September 2023, 2,077 customers were already paying more than $50,000 p.a. for their monday subscription, which is 57% more such "enterprise" customers than just one year earlier.

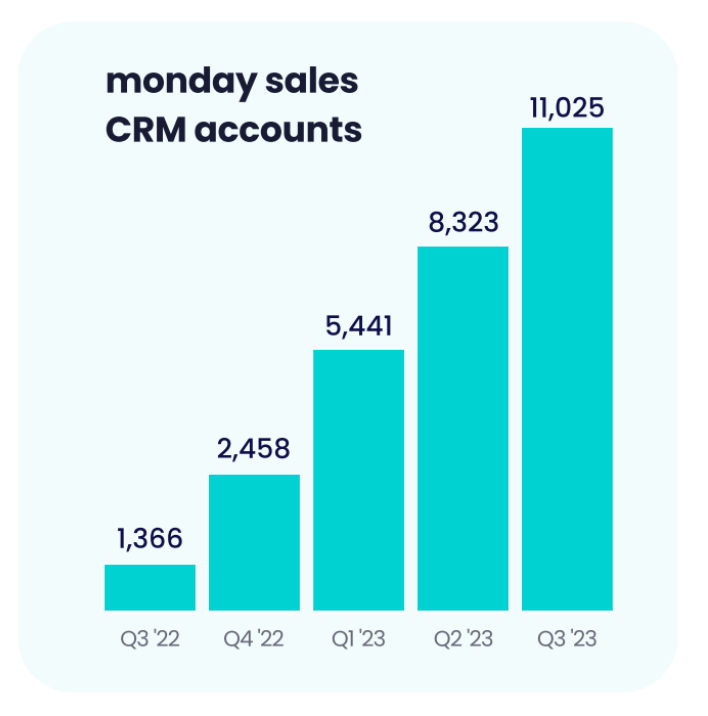

Meanwhile, monday.com is well on its way to evolving from a one-trick pony (project management software) to an agile workflow platform for a variety of applications. For a few quarters now, monday has been marketing its own Work OS platform with various ready-made applications not only for project management, but also for sales management (monday sales CRM) and for the software product development process (monday dev).

Hundreds of development partners use the monday API to provide additional applications and building blocks for the approximately 200,000 paying monday customers. It looks like an interesting ecosystem for external developers is maturing around the monday Apps Marketplace.

Monday.com Market and Competition

monday.com is often compared to Asana ASAN 0.00%↑ and Smartsheet SMAR 0.00%↑. Competition is fierce, and it is not yet clear who will emerge as the long-term leader in the booming market for agile work management software services. But I have now chosen my favorite. And I'll be happy to explain why:

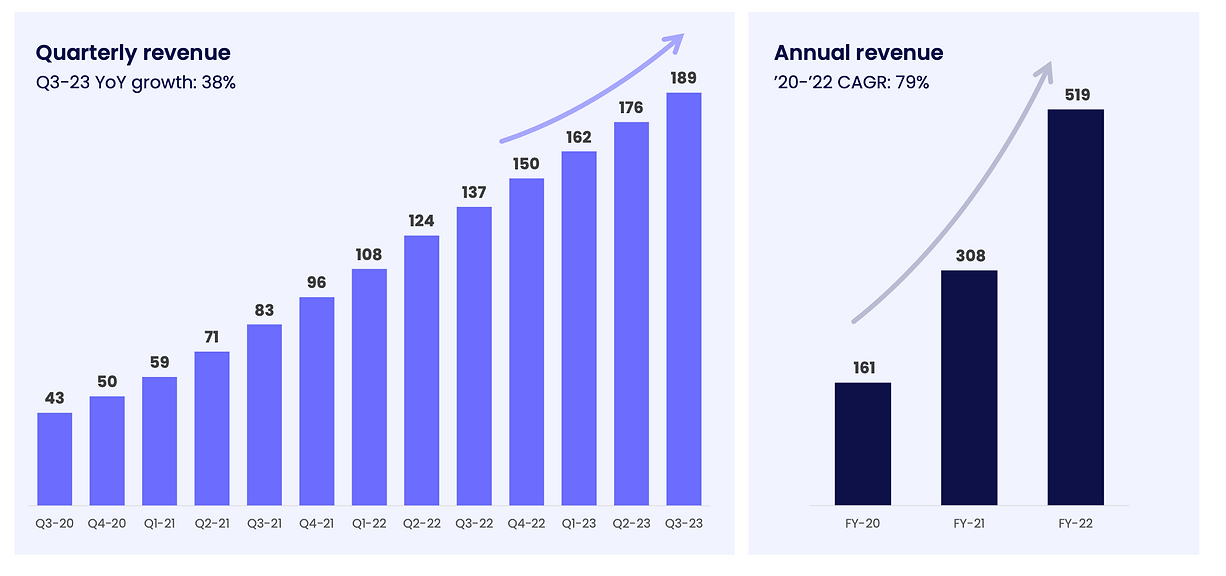

monday.com has only been on the market since 2014, making it several years younger than Asana and Smartsheet, which were founded in 2008 and 2005, respectively. This is the reason why monday.com's 2022 revenue of $519 million still lags slightly behind those competitors. However, monday is growing much faster and will at least significantly outpace Asana in terms of revenue (and profitability) in the current fiscal year of 2023.

Thanks to its Tel Aviv headquarters, monday has significant development cost advantages over its Silicon Valley competitors. Unlike Asana, monday.com is already generating significant cash inflows.

With its new CRM, which is being developed on its own WorkOS platform, monday.com aims to position itself as an alternative to established application service providers such as HubSpot.

The initial figures for the launch of the CRM are impressive: in the first 9 months of 2023, the number of monday CRM customers has more than quadrupled to over 11,000.

It remains to be seen, however, whether monday will be able to take market share from established players like HubSpot in the long run. One HubSpot partner told me that the monday CRM was not (yet) able to meet the often high expectations of HubSpot customers.

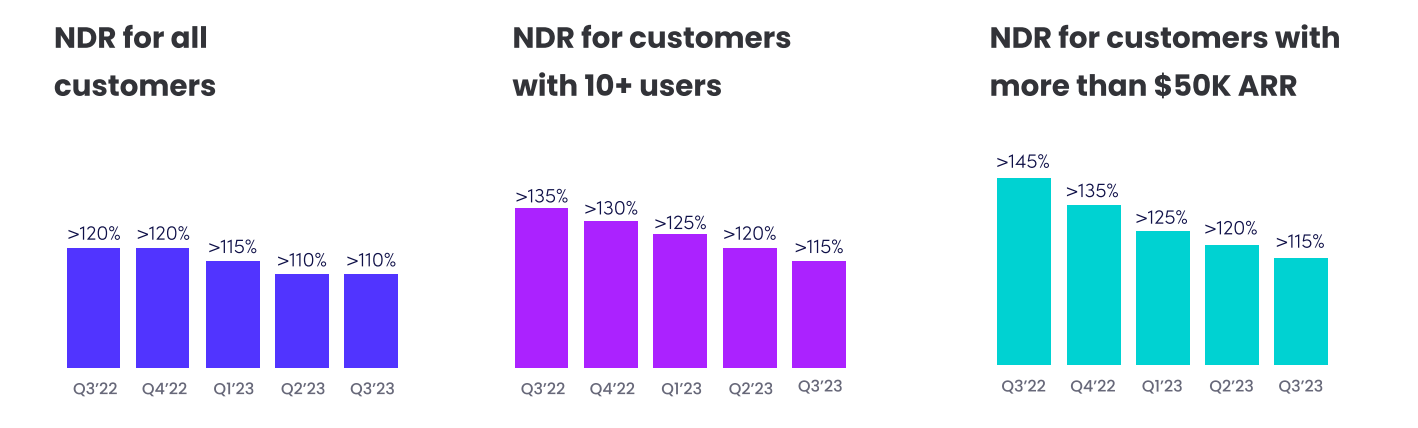

Despite the remaining functional deficits, customers seem to be very satisfied with the monday software for the most part. However, the high Net Retention Rate (NDR) of over 115% (for customers with more than 10 users) has declined in recent quarters, as it has for almost all cloud software vendors.

Probably the most important reason for this is the trend towards "cloud spend optimization". This means that customers are trying to reduce the cost of their cloud applications wherever possible, due to the current difficult economic situation.

In the recent post Q3 analyst call, monday.com's management was very optimistic that this "cloud spend optimization" trend is slowing down and that there will be no further decline in the NDR.

Monday.com financials for 2023

Monday's revenue exploded again in 2022, up 68% to just under $519 million. Unsurprisingly, growth has slowed in recent quarters to "only" 38% in Q2 2023.

Still, these purely organic growth rates are astonishingly high. After all, they have been achieved in the face of a gloomy macroeconomic environment that is severely hampering the growth of many SaaS application vendors.

At least as impressive as the sheer pace of growth is the development of monday.com's profitability:

monday.com's gross margin has been impressive since the company's IPO and has recently risen to 89% (GAAP). SaaS companies with such high gross margins can quickly become cash cows if the market demands it and management keeps a tight rein on costs.

And that is exactly what we are seeing at monday.com right now:

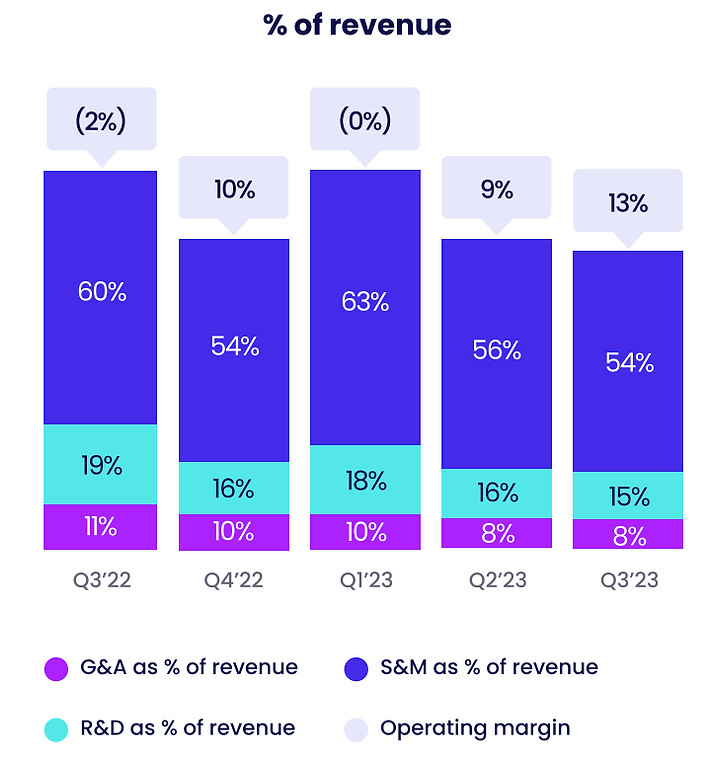

Operating expenses as a percentage of revenue fell from 90% in the year-ago quarter to just 77% on a non-GAAP basis.

In fact, the R&D cost ratio, which fell from 19% to 15% year-over-year, seems a bit low to me. This is probably due to the additional difficulty of recruiting enough qualified personnel in times of war. I am glad that management has announced higher R&D spending in the coming quarters.

The result of this sales and cost development is that despite the hyper-growth, the ample cash reserves from the IPO have not yet had to be touched to any significant extent. The debt-free company is sitting on over $1 billion in cash after Q3 2023!

In the first 9 months of 2023, monday.com generated $150 million of free cash flow, with the (adjusted) free cash flow margin recently reaching a record 34%.

I like the fact that monday already has a truly global business. More than 45% of its revenue is generated outside the U.S., and its software is available in 14 languages. This makes it easier to balance regional fluctuations, and the high costs of building an international organization are at least partially included in monday's current cost structure.

The monday.com guidance

In February, monday's management initially issued cautious guidance for 2023, which envisaged maximum revenue growth of 34%. With the presentation of the outstanding Q3 2023 numbers, this guidance has been raised for the third time, and now expects 40% growth, which equates to revenues of approximately $725 million.

According to the new increased guidance, monday's operating margin is expected to be positive for the first time in 2023, after -9% in the previous year (non-GAAP), reaching approximately 5%. This means that monday will reach break-even two years earlier than planned in the IPO business plan.

The priorities in the SaaS industry are visibly different today than they were two years ago. And this is a very healthy development in the market that investors should like.

The Valuation of Monday's Stock

Based on their revenue expectations, Monday's current price of $170 implies an enterprise value of $7.1 billion and an EV/sales ratio of about 10 for 2023.

On a free cash flow basis, this should lead to an EV/FCF (enterprise value to free cash flow) multiple of around 30 at the end of 2023.

This is not too much for a SaaS company with a gross margin of almost 90% and a free cash flow margin of 30%, which is still growing at over 35% p.a. (purely organically) even beyond the $500m revenue mark. Personally, I expect monday.com to hit the billion-dollar revenue mark as early as 2024.

If I am right - and if profitability continues to develop as positively as it has recently - monday.com's SaaS stock is attractively valued.

What's the catch?

One weakness in monday.com's numbers is the dilution to shareholders from its high SBC (Share Based Compensation), which accounts for 16% of revenue. Since the IPO, existing shareholders have been diluted by 25% through the issuance of additional shares; in the last 12 months, the dilution was still 10%.

It is important to keep an eye on the number of shares outstanding in the coming quarters. The company should use the now strong cash inflows to launch a share buyback program and limit dilution.

And what about war risks?

The difficult and uncertain situation in Israel due to the war against Hamas has not yet affected the company's performance. It is true that almost two-thirds of Monday's employees work in the company's home country, and a number of colleagues have been called up for military service.

But the company has been able to master these difficulties brilliantly so far. The risks resulting from the war should also be manageable in the coming quarters. After all, the Israeli customers affected by the war only account for 7% of Monday's revenue. And the cloud infrastructure runs entirely in data centers in the U.S., Europe, and Australia, well outside the crisis region.

The bottom line

monday continues to deliver outstanding results quarter after quarter in an extremely difficult environment. Despite some jumps after the quarterly results, the stock has not yet fully recovered from the tech crash of 2022.

As a result, valuations have become much more attractive over the course of the year. I am very optimistic that an investment in monday.com at current prices will yield a double-digit annual return in the coming years.

Disclaimer

The author and/or associated persons or companies may own shares in monday.com. This article is an expression of opinion and does not constitute any investment or financial advice.