Is Tesla getting out of the electric car business?

What sounds like a crazy idea is not so crazy when you think about it.

For a few days now, some analysts have been speculating (unfortunately behind various paywalls) that Tesla might withdraw as a manufacturer of electric cars.

Sounds pretty crazy at first, doesn't it?

Well, while Tesla pulling out of the electric car business might sound like a crazy idea at first, it's not so crazy when you think about it.

Let's start by imagining the situation Elon Musk finds himself in with Tesla at the beginning of Q2 2024: Tesla's stock price TSLA 0.00%↑ has been in a bear market for 30 months and is down almost 60%. Yet the company is very expensive by conventional valuation standards, such as the usual earnings or sales multiples, which we will discuss later.

Since Tesla's Q1 2024 delivery figures were published on 2 April, we know that Tesla vehicles are currently selling much worse than expected. At the beginning of March, analysts were still expecting deliveries of 470,000 vehicles in Q1, but only just under 387,000 electric cars were actually handed over to customers. This was 8.5% fewer than in the same quarter last year. Although Elon Musk tried to boost demand with a series of discounts and price cuts.

Three days later, on 5 April, Reuters reported that Tesla was abandoning its plans for the low-cost Model 2.

"Tesla has canceled the long-promised inexpensive car that investors have been counting on to drive its growth into a mass-market automaker, according to three sources familiar with the matter and company messages seen by Reuters. The automaker will continue developing self-driving robotaxis on the same small-vehicle platform, the sources said."

Elon Musk then accused the prestigious news service of lying

and announced just 5 hours later that Tesla would be unveiling its long-awaited Robotaxi on 8 August.

I am quite sure that Reuters has done professional research and that the end of the Model 2 is at least being discussed internally at Tesla.

If this Reuters report, based on the statements of three insiders, is true, it would be nothing less than a departure from Elon Musk's original master plan for Tesla. Since 2006, the plan has been to build affordable electric cars for the masses and become the world's largest car manufacturer.

Is Tesla pulling out of the electric car production?

If Reuters' investigation is correct: What can we expect from Tesla as an electric car manufacturer after the end of the Model 2?

The Cybertruck is a niche vehicle, and I think the six-figure deliveries that Tesla bulls are expecting are completely utopian.

Also the successor to the legendary Tesla Roadster, which is currently in development, is unlikely to reach large numbers.

After all, the Tesla Semi truck is already in pre-production. However, given the size of the Tesla group, which now has revenues approaching 100 billion USD, the Semi will not be THE major growth driver.

There is no other known pipeline of Tesla vehicles in development. This is very unusual for an automaker with its long product cycles.

When Elon Musk unveiled the third part of his master plan in March 2023, he offered grand visions for humanity's path to a sustainable future. However, to the surprise of many observers, no new electric car models were announced.Even back then, that didn't sound like an electric car manufacturer (anymore) when you think about it.

Tesla analysts still optimistic

A big problem for the Tesla stock is that analyst estimates are clearly too optimistic, in my view: Even after several forecast adjustments for 2024, double-digit revenue growth and at least constant EBITDA margins are still expected.

For 2025, even 20% sales growth and rising margins are priced in. These estimates seem to me to be significantly inflated. After all, the problematic and currently declining e-car business currently accounts for 85% of Tesla's total revenues.

After the disastrous delivery figures, Tesla will probably have to report a significant drop in sales for Q1 2024. I would not be surprised if this does not change significantly in the course of the year. Even a negative annual result in 2024 is not unlikely in my view.

Under normal circumstances, Tesla shares would have to fall even further in the coming weeks and months given this outlook. Even after the Q1 delivery figures, a crash would not have been surprising. However, this did not happen.

With the announcement of the Robotaxi marketing event on 8 August, Elon Musk even managed to interrupt the downward trend in Tesla shares, at least in the short term. But on 23 April, which is the upcoming earnings date, Elon and Tesla shareholders will be confronted with the harsh reality of the company's Q1 figures.

The valuation of Tesla stock

Falling sales and margins, possibly even a slide into the red, do not sit well with the still exorbitant valuation of Tesla shares. Although the stock has lost more than 50% of its value over the past 30 months, it still has a market cap of more than 500 billion USD, which is more than twice the size of all the German carmakers combined.

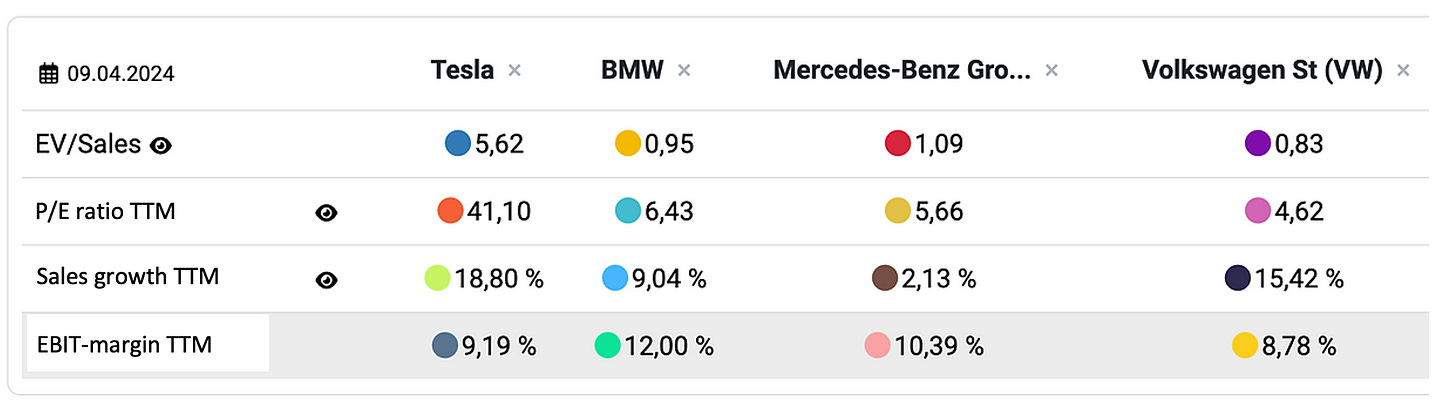

Tesla's revenue is valued at more than 5 times that of BMW, Mercedes or Volkswagen (the latter owning the majority of Porsche). Tesla's overvaluation becomes even clearer when looking at the P/E earnings multiples.

As long as Tesla was the fast-growing challenger with superior margins compared to the peers, such a premium valuation of Tesla shares could be reasonably justified.

But what if Tesla's sales and profitability in 2024 actually declines relative to traditional carmakers? Because these competitors maybe are holding up better in a difficult market, perhaps even having the more robust business model, contrary to expectations?

According to conventional thinking, a further decline in Tesla's shares seems inevitable in this scenario.

Unless.... Elon Musk would finally manage to get rid of those annoying comparisons with other car manufacturers. He never tires of insisting that Tesla is much more than just an electric car manufacturer.

He regularly refers to the huge potential of autonomous driving (Robotaxi) or the development of the humanoid robot Optimus, the supercomputer Dojo and, of course, the future use of AI.

From Elon Musk's point of view, it is only a hindrance to the valuation of Tesla shares that the financial market repeatedly measures Tesla by its e-car production and compares it with its competitors.

Has Elon even come to the conclusion that Tesla will not be able to generate the necessary cash flow in the medium term to finance the visionary projects of tomorrow and the day after tomorrow in the face of increasing competition, especially from China?

From this point of view, it is almost logical for Elon to focus his Tesla team to new visionary goals. He doesn't have to sell it to the public as if he's admitting defeat in the price war with Chinese electric car manufacturers. He will surely come up with something better to communicate to the masses.

My conclusion

No joke: In fact, I think there's a good chance that Elon Musk will order an end to electric car production. By doing so, he could suddenly ensure that Tesla is no longer compared to other carmakers on the basis of sales, margins and profits.

He would no longer have to face the harsh reality of the numbers quarter after quarter. Instead, Tesla would be valued as a visionary technology company with huge potential in autonomous driving, robotics, AI and sustainable energy. Only the sky is the limit.

Elon can sell the vision of such a company like no other person on the planet. The Tesla fans in the analyst community like Cathie Woods and others would probably even cheer such a move and call for new adventurous price targets.

Admittedly, this all sounds crazy, but it certainly sounds like an Elon Musk move to me.

I'm reminded of a legendary scene from the cult HBO series “Silicon Valley”. In it, venture capitalist and billionaire Russ Hanneman explains why companies with no revenue are better investments. Thanks to Jamin Ball and his highly recommendable Clouded Judgement SubStack for reminding me of this great clip.

Rarely have I waited so eagerly for an analyst call as for the upcoming Tesla earnings call on 23 April. On this day, Elon Musk will probably have to distract the public with grand visions from what are sure to be disappointing figures.

In the past, he has often been most convincing under intense pressure. Now his back is almost to the wall.

If you want to follow the exciting Tesla story together with me, you can

*Disclaimer: The author and/or associated persons or companies have shorted Tesla shares (as of 11/04/2024). This article is an expression of opinion and does not constitute any investment or financial advice.