GitLab Stock: Time to Say Goodbye?

The Hard Question Every Investor Must Ask: Would I Buy It Again Today?

I have been invested in GitLab for 18 months, and I have written about my investment story in the following posts:

Unfortunately, GitLab shares have increasingly become a “problem child” in my portfolio over the past few quarters. This trend intensified this week with the publication of the latest figures for Q3 FY26. These results exceeded analysts’ estimates and management’s own guidance but disappointed me in terms of cash flow and particularly the underwhelming outlook for Q4.

The highly recommended Substack by @Sergey provides a summary of the GitLab Q3 FY26 figures here. Apparently, the financial market viewed these figures similarly to how I did, as GitLab shares fell sharply for the third time in a row after the figures were released.

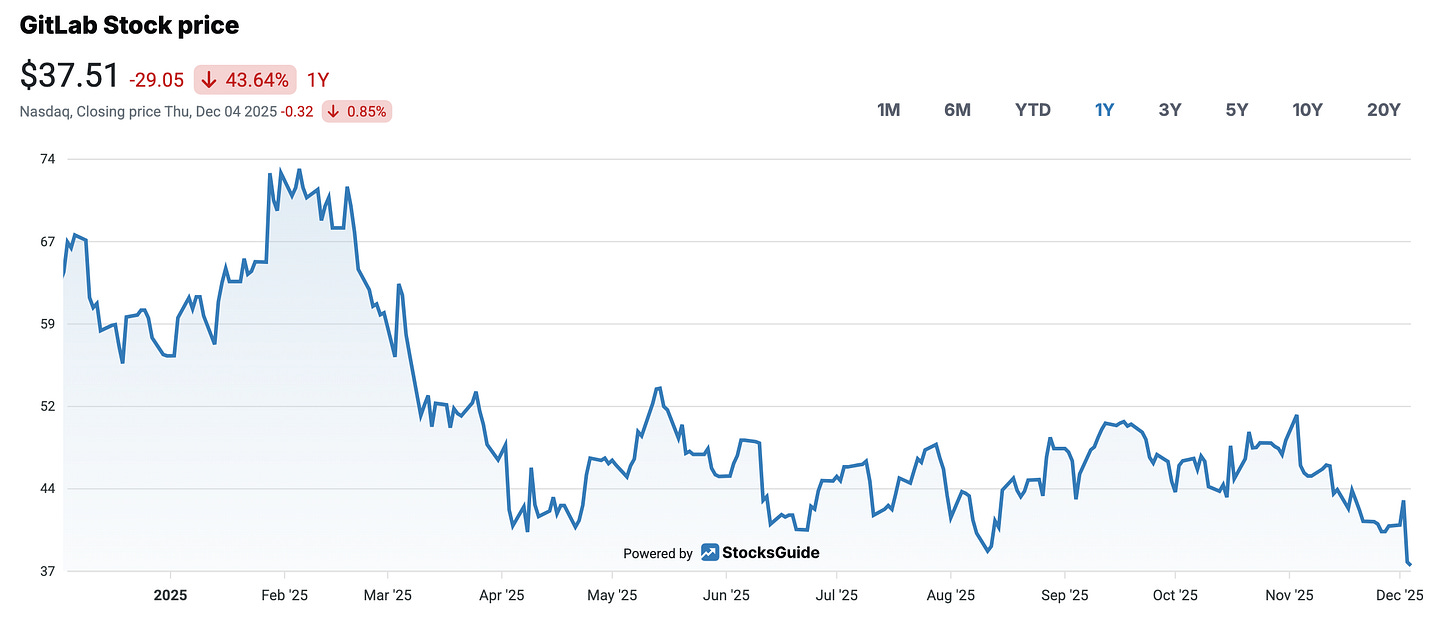

GitLab shares have lost 44% of their value in the last 12 months. They are now trading at a new annual low, and my own position is down almost exactly 30%. Regular readers of the High Growth Investing Substack know what this means according to my HGI investment strategy:

According to my “Rule of 30” that I imposed on myself for risk management reasons, I force myself to make a difficult decision after book losses of 30%. Either I take the opportunity to buy more of this stock at lower prices with high conviction, or I sell the entire position, realizing a loss of max. 30%.

If you are new to my Substack, you can learn more about this risk management strategy here:

30% down, this is where I am now with GitLab. I must seriously consider whether the GitLab investment case is not as sound as I originally thought.

“At this point, you need to do even more research and analysis and make a well informed decision about whether or not to make a bold anti-cyclical buy of additional shares.”

At least, that’s what I wrote in my strategy article linked above. In other words, I must answer the question for myself: Would I buy GitLab shares again today if I weren’t already invested?

Keep reading with a 7-day free trial

Subscribe to High Growth Investing to keep reading this post and get 7 days of free access to the full post archives.