Bye-Bye IAC: What The Spin-Off Means For Angi Stock

Why I built a position in underperforming Angi ahead of its impending spin-off from IAC.

In the past few days and weeks, I have received a number of inquiries from IAC shareholders regarding the upcoming Angi spin-off. So here is another update on the IAC / Angi investment case.

Since November 11th, 2024, the date of the initial announcement of the spin-off, the price of the Angi stock has fallen almost -40% to $1.60.

What is the status of the Angi spin-off?

IAC's board of directors has now approved the spin-off of Angi ANGI 0.00%↑ and plans to distribute all of IAC's IAC 0.00%↑ holdings to shareholders as a "special dividend". Prior to the spin-off, IAC will convert all of its Class B common shares of Angi into Class A common shares on a one-for-one basis and then distribute them in full to its shareholders, after which IAC will hold no Angi shares.

The timetable for the Angi spin-off has also been set, with the following important dates:

Record Date: March 25, 2025

Distribution Date: March 31, 2025

IAC shareholders holding IAC shares on the March 25th record date will have Angi shares credited to their accounts on March 31st payment date. Normally, no action is needed. However, based on past experience, some brokers may need a few days to correctly book the allotted shares.

Shortly before the deadline, on March 24th, there will be a reverse split of the Angi share at a ratio of 10:1, i.e. ten existing Angi shares will be converted into one new share. This will result in a corresponding increase in the price of the Angi share while reducing the number of shares outstanding by a factor of 10. For Angi shareholders, this means that after the reverse split, they will have only one-tenth of their original number of shares in their portfolio, but each will be worth ten times as much.

The distribution ratio, based on the number of Angi shares held by IAC on the record date, is approximately 0.5 Angi shares (after the reverse split) for each IAC share. Fractions of shares will not be distributed; instead, IAC shareholders will receive a cash payment instead of the fractions.

A shareholder who currently owns 100 IAC shares valued at $100*47=$4,700 will receive approximately 50 new Angi shares after the reverse split. Based on today's share price, these shares are worth €16 each, so the non-cash dividend in this case is approximately $800, or 17%.

What Will IAC Shareholders Get with Angi?

Angi Homeservices was created in 2017 through the merger of Angie's List and HomeAdvisor, two leading home services platforms. The merger was orchestrated by parent company IAC to consolidate the market for online referrals of craftsmen and household services.

Founded in 1995 by Angie Hicks and others, Angie's List established itself as a subscription-based platform where users could share ratings and reviews of contractors and service providers. HomeAdvisor was founded in 1998 and offered an alternative by connecting consumers directly with vetted service providers, often through a pay-per-lead model.

Both companies grew rapidly, but Angie's List experienced financial difficulties. The merger with HomeAdvisor was intended to combine the strengths of both business models and secure market share.

In July 2017, IAC completed the merger of HomeAdvisor and Angie's List, creating Angi Homeservices as a new Nasdaq-listed subsidiary. Since then, the company has a leading position in the challenging U.S. online home services referral market.

After the merger, Angi Homeservices invested in technology developments to further digitize the service booking process and position itself as a one-stop shop for home services. In the following years, the company added fixed-price services on its own account in addition to brokerage services to further differentiate itself from traditional marketplaces.

This growth strategy enabled the company to significantly increase its revenues to $1.8 billion by 2022. However, Angi's management was unable to build a sustainably profitable business. Angi became a problem child in IAC's investment portfolio and went through several unsuccessful CEOs.

The Angi Turnaround

In response, IAC CEO Joey Levin temporarily took over as CEO of Angi in October 2022 and initiated a turnaround. Since then, Angi has deliberately avoided unprofitable revenue streams, significantly reduced marketing and sales expenses, and focused on profitability rather than growth.

As a result, revenues fell by over -30% to $1.2 billion between 2022 and 2024, while EBITDA multiplied from a meager $16 million to $110 million. Free cash flow turned from -$69 million in 2022 to $105 million in 2024.

Jeff Kip has been responsible for Angi's development as CEO since April 2024. He worked for IAC for many years, including as CFO, and was also responsible for Angi's international business for many years, which significantly outperformed the U.S. business during that time.

Valuation Of Angi Shares Prior To The Spin-Off

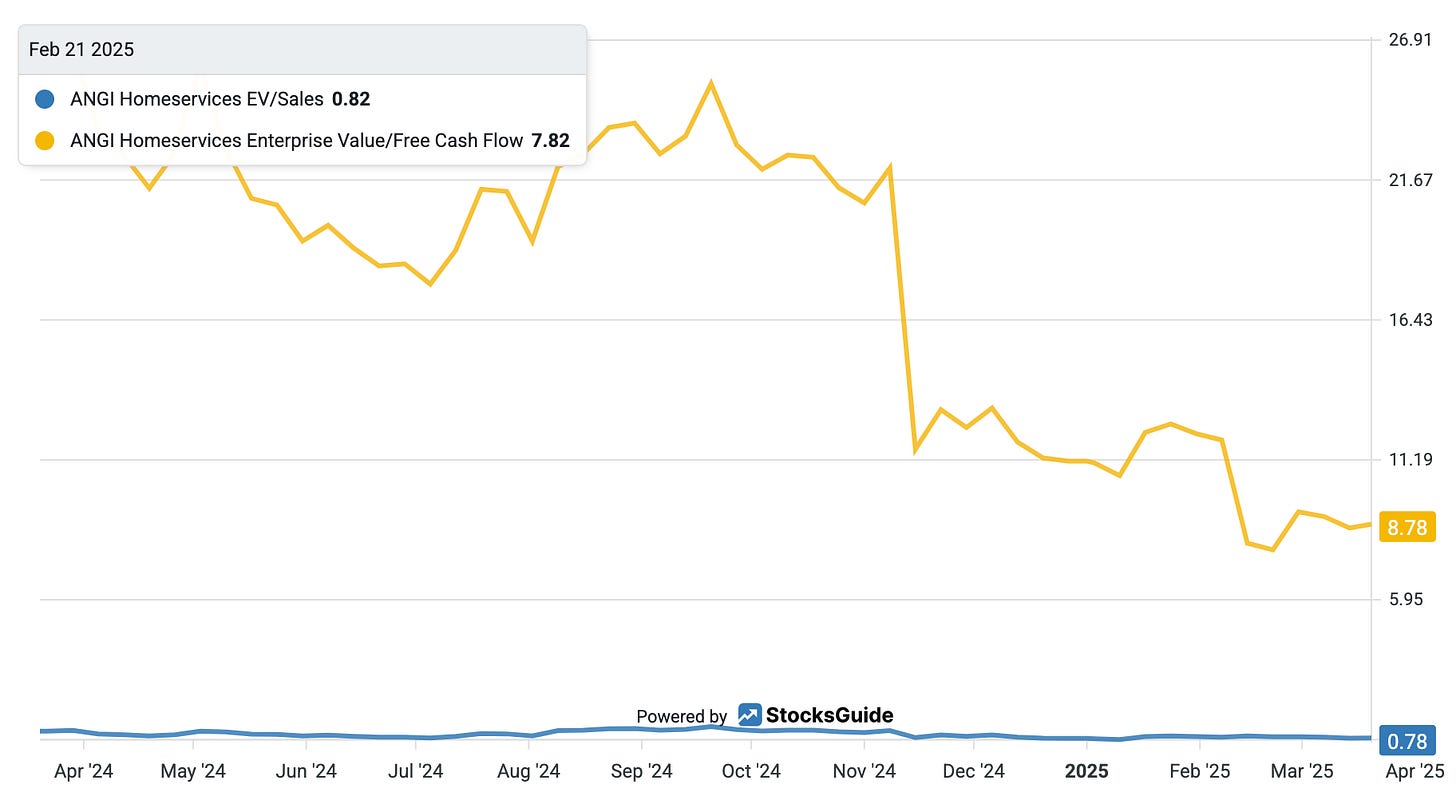

After the restructuring, Angi's sales are still about $1.2 billion, but the Enterprise Value is only $900 million, even though free cash flow is over $100 million per year and expected to grow in the coming years.

An EV/Sales ratio of less than 1 and a single-digit cash flow multiple sounds very attractive, at least to me, for a leading digital platform company in its niche.

Trust Is Everything - Without Trust, Everything Is Nothing

IAC's management squandered a lot of investor confidence with the last 2021 spin-off.

As a reminder, in May 2021, IAC shareholders received shares of the video platform Vimeo as a stock dividend. Vimeo was one of the winners in the Covid pandemic. The valuation at the time of the IPO was completely inflated, and IAC shareholders who did not sell their Vimeo shares in time lost over 90% of their value.

Some IAC shareholders are concerned that Angi's share price could further decline after the spin-off in a manner similar to Vimeo's in 2021/2022. In my opinion, they are wrong. The situation is not comparable at all. Vimeo was booming at the time of the spin-off. Vimeo stock was trading at a double-digit EV/Sales ratio, and growth was temporarily elevated due to the Corona boom. After this extraordinary growth phase ended, Vimeo was in need of restructuring and the stock price plummeted.

Angi, on the other hand, had just emerged from a difficult restructuring phase at the time of the spin-off. The return to a deliberately reduced but profitable revenue level is almost complete. After a transition year in 2025, when revenues are expected to be even weaker in the first half of the year, moderate profitable growth should be achievable from 2026 onwards, albeit from a lower base.

I have full confidence in Angi's management team following the repositioning. Joey Levin will support CEO Jeff Kip as Chairman. Joey's retirement as CEO of IAC should give him enough time to successfully complete the restructuring that he and Jeff have initiated. I am confident that they will be able to return Angi to a profitable growth path.

If they succeed and Angi returns to at least high single-digit growth by 2027, an EV/Sales multiple of 3 is quite realistic in the medium term. In this positive scenario, Angi's share price would multiply over the next few years.

Independence from IAC should be good for Angi's stock and open up new investor groups. So far, IAC owned 85 percent of Angi's shares. Angi's small free float was recently worth only about $100 million. The trading volume was correspondingly low, therefore for many institutional investors, Angi stock was not an option at all.

And most private investors are not interested in a stock that has suffered double-digit sales declines and lost over 90% of its value in recent years. I definitely see an opportunity here for value-oriented investors who are willing to act counter-cyclically.

Conclusion

I built up a position in Angi before the spin-off because I see a very good risk/reward ratio and the company looks undervalued after the price decline in recent months.

Whether there will be further price distortions in the course of the spin-off, as many IAC shareholders may want to cash in their stock dividends in the short term, I also do not know. In any case, I plan to hold my Angi position for the longer term and would be a buyer on any further short-term dips.

If you would like to follow Angi and IAC with me in the future, you can subscribe to my free Substack here:

*Disclaimer: The author and/or affiliated persons or companies own shares of IAC, Angi and Vimeo. This post is an expression of opinion and not investment advice.

very good article

What’s your thoughts that on the spin off, there will be a sell off ANGI shares because people will not want to hold shares of ANGI ? 🤔