100% chance with Warner Bros. Discovery stock?

Here is why I am very bullish on $WBD in the coming consolidation of the media industry

The merger of Discovery and Warner Media 18 months ago created a new media giant. Warner Bros. Discovery WBD 0.00%↑ , set out to become a serious competitor to Netflix and Disney. Since then, the company has been on a restructuring course, as Warner Bros. was mismanaged for years under its former owner AT&T.

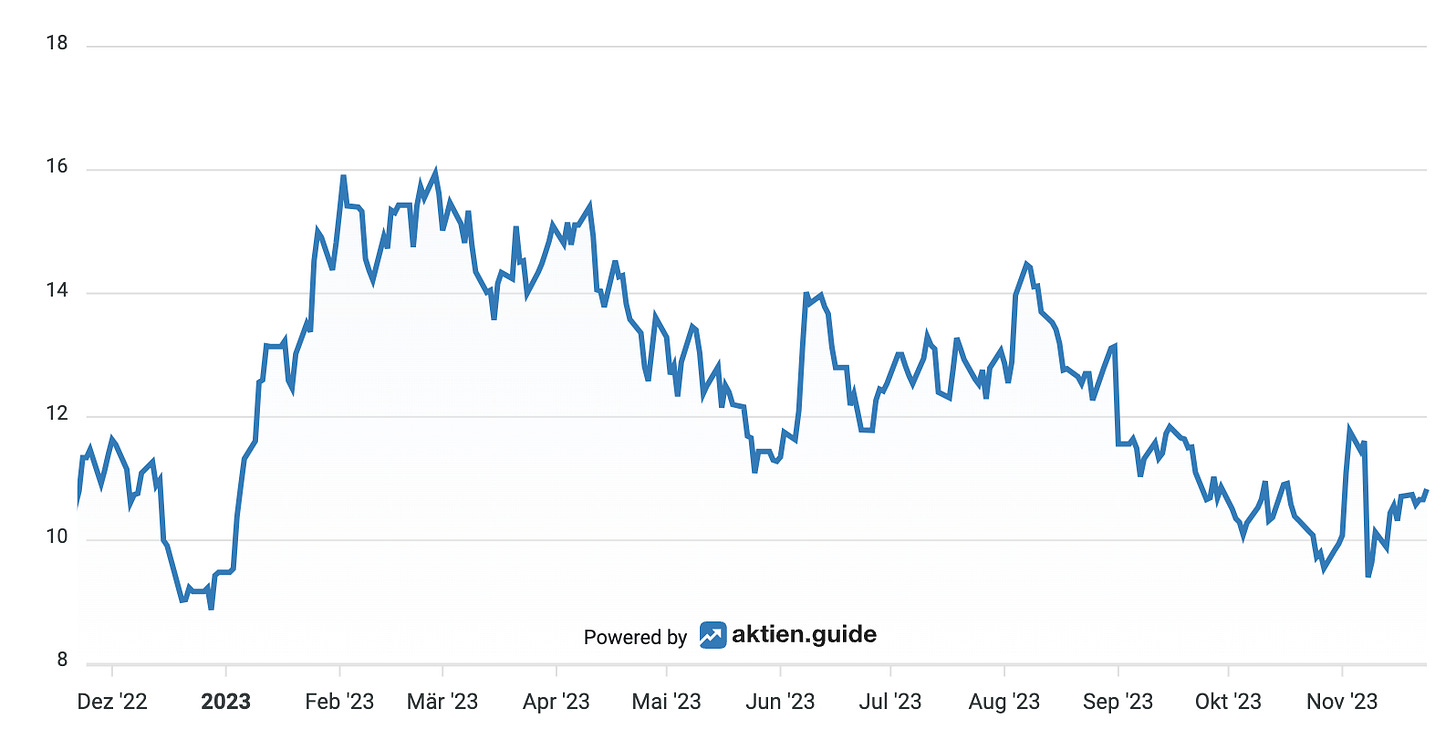

Not unexpectedly, shareholders are going to need a lot of patience here. At the beginning of 2023, WBD stock jumped 70%, only to give up all of those gains over the course of the year.

After the announcement of the Q3 2023 results, WBD shares even fell to a new annual low below $10. In my view, this was unjustified, so I increased the WBD position in my portfolio.

Here is the reason why I am very bullish on WBD stock after Q3 2023:

WBD mixed 2023 Numbers

Warner Bros. Discovery once again reported a net loss of $0.4 billion in Q3 2023 (down from a loss of $2.3 billion a year earlier). The meager 2% year-over-year revenue growth to $10 billion was slightly below analyst expectations.

However, these numbers are still skewed by major restructuring efforts and the fact that unprofitable businesses were deliberately scaled back or discontinued after the merger.

Given the high level of debt, cash flow is much more relevant in the current situation. The all-important free cash flow was impressive at $2.1 billion in the third quarter. However, this figure was higher than planned as budgets could not be spent as planned due to the now settled Hollywood writers and actors strike. Free cash flow expectations for the full year 2023 have been raised to $5.3 billion.

The debt situation of WBD

WBD's biggest challenge is the extremely high debt load that the company has taken on as a result of the merger. WBD Investor Relations provides a detailed breakdown of WBD's outstanding debt as of 9/30/2023, including maturities and interest rates.

It is extremely important for the company to generate high free cash flow in the coming years as planned in order to quickly reduce debt and interest expenses.

In fact, WBD has already significantly reduced its debt since the merger. Since 2022, $12 billion has been repaid. In Q2 and Q3 2023 alone, net debt was reduced by $4 billion to $43 billion at the end of September 2023.

Following the merger, management set a target of reducing the ratio of net debt to EBITDA to below 4 by December 31, 2023. This important milestone will be achieved despite the weak advertising market in 2023; the net leverage ratio was already 4.2 at the end of the third quarter.

The next medium-term goal is to limit debt to 2.5 to 3 times EBITDA. However, the original target date of the end of 2024 had to be abandoned after Q3. This disappointment was probably the main reason for the renewed sell-off of WBD shares after the Q3 numbers.

One thing needs to be clarified: WBD's debt is not to be considered a threat, even in view of a drastically increased interest rate level. It consists almost entirely of fixed-rate bonds with an average interest rate of 4.66%. Over the next 5 years, an average of less than $3 billion per year will come due.

The CFO has indicated that the high level of interest rates and the resulting decline in bond prices could now even be used to retire debt at a discount.

"With the vast majority of our remaining debt fixed, we'll be largely insulated from rising interest rates, and in fact, we'll have increasing opportunity to retire debt at a significant discount."

Hopefully, in a year or two, we'll be talking more about the profitable business than the progress of the restructuring and the strained debt situation.

WBD's streaming business (DTC segment)

WBD's new combined streaming service called Max was launched in the U.S. in May 2023. It combines the former HBO Max and Discovery+ streaming services into a single DTC (Direct-To-Consumer) platform.

World-renowned brands such as the DC superhero universe (including Superman, Batman and others), Harry Potter and Game of Thrones form the foundation of the streaming service, which will be rolled out globally over the next few years.

The original business plan for the merger called for the DTC business to reach profitability in the key US market in 2024. Management now expects this milestone to be reached as early as 2023.

However, the number of reported DTC subscribers is declining following the launch of Max, as the combination of HBO Max and Discovery+ means that many dual-current customers no longer need a dedicated Discovery subscription.

The number of WBD subscribers at the end of Q2 was only 95.1 million, down from 97.6 million in Q1 before the launch of Max. By comparison, Netflix reported 247 million subscribers at the end of Q3, and Disney+ recently suffered a slight decline in paying subscribers to 150 million. But a direct comparison of these numbers is misleading, as Max ist not yet rolled out in a number of important markets like Germany and France.

All the leading streaming providers have now launched ad-supported versions of their services and will increasingly monetize their DTC customers through advertising. At WBD, advertising revenues currently represent approximately 5% of total DTC revenues, with a strong upward trend.

The Studios Segment of WBD

WBD has some of the best studios in the world for the production of first class Hollywood movies. They produce not only for their own use, but also for third parties.

In recent years, however, the Warner Media Studios segment in particular has been poorly managed under AT&T's reign. There was a lack of cost consciousness and ambition, and ultimately many productions were disappointing.

After the merger, management was replaced. However, the signature of the new creative minds will only be seen in the coming years, as a typical movie project takes about 3 years to be released.

What hits theaters and living rooms in 2023/2024 will still be the legacy of the previous management. After a few disappointments, the "Barbie" movie was a complete success, grossing over $1.5 billion at the box office. This makes Barbie a prime example of how well a holistic marketing approach that leverages the various channels within the WBD ecosystem with a partner (such as toy maker Mattel) can work.

The computer game Hogwarts Legacy, developed by Warner Bros. Games, sold 15 million copies in the first few months after its release. The Harry Potter game has generated over $1 billion in retail sales.

But beware: these billions in sales at the box office for "Barbie" or in the distribution channels (at the "store counter") for the Harry Potter game are not the sales that end up in WBD's books as the manufacturer. A number of other partners also make money out of it.

The Networks Segment of WBD

You may be wondering how WBD can afford this expensive turnaround with a reported net loss of over $10 billion in the last 6 quarters since the merger.

The answer lies in its third and largest division, Networks, which is neglected in many WBD stock analyses because it is so unsexy.

This is the classic area of linear TV, which is generally negatively impacted by the cord-cutting trend (away from cable TV and toward Internet streaming). WBD revenues in the Networks segment are declining (about 5-10% p.a.), but still account for about half of total revenues.

Most importantly, these revenues from distribution and advertising in old-fashioned TV are highly profitable with an EBITDA margin of 40% and will continue to generate high cash inflows for years to come, which should enable the restructuring and gradual transition of the Group into the streaming age.

The Networks segment did not perform well in the third quarter. In particular, advertising revenues declined by 12% year-on-year, faster than expected. Nevertheless, the segment generated EBITDA of USD 2.4 billion in just one quarter.

Going forward, the strictly separate networks and streaming businesses may become more intertwined. This is because WBD is likely to distribute its Max streaming service via network operators, which are the main customers of the Networks segment. According to a report in the Wall Street Journal, Verizon has now put together a bundle with Netflix and WBD for its customers in the US. They can subscribe to the ad-supported versions of Netflix and Max at a special price and then be further monetized by Netflix and WBD through advertising. I think this is an interesting evolution of the streaming business and could be a win/win/win for everyone: The network operator, the consumer and last but not least the streaming providers.

Impending media industry consolidation

In the past, there has been speculation that WBD's falling share price could make it a takeover target for tech giants such as Apple or Amazon. Whether regulators would let such a deal through is another question.

Ambitious CEO David Zaslav made it clear in the Q3 2023 analyst call that he is not preparing his company for sale, but that WBD intends to remain active as a consolidator in the ailing media industry.

Both Zaslav and major shareholder and board member John Malone have made comments in recent weeks indicating that the company is reducing debt and building strong free cash flow in preparation for acquiring more media companies over the next two years. The focus is on companies whose streaming services are unprofitable and which, unlike WBD, have cash flow problems and may be on the verge of bankruptcy, Malone said in an interview with CNBC.

An interesting takeover target for WBD could be Paramount Global Group, which is groaning under its debt burden. Not only does it have 60 million streaming subscribers, but it also owns iconic networks like CBS, MTV, and high-profile movie franchises like Star Trek and Mission Impossible. While U.S. regulators are generally opposed to large media companies merging, they will be much more lenient if the companies are struggling to survive, according to multi-billionaire Malone. He has made billions in the past by buying and restructuring struggling media companies.

The valuation of WBD stock

WBD's financials for 2023 are still dominated by the one-time effects of the merger. In particular, the (still negative) net income is unsuitable for assessing the group's fundamental situation due to numerous balance sheet clean-up activities.

WBD management has revised its guidance slightly, mainly due to the impact of the Hollywood strike. Operating income in 2023 will be $500 million lower than previously forecast, meaning adjusted EBITDA will be at least $10.5 billion. This is due to certain productions not being completed or monetized as planned in 2023. Free cash flow should be at least $5.3 billion in 2023.

From 2024 onwards, it will be easier to assess the numbers and the progress of the business model transition. I expect WBD's EBITDA and free cash flow to grow at double-digit rates each year, based in part on my confidence in management's ability to execute. This would be significantly higher than most analysts currently expect.

At a current EV/FCF ratio of 13, WBD stock looks very attractively valued at around $10. If you believe management's mid-term guidance, free cash flow should reach more than $8 billion per year in a few years.

With a constant EV/FCF ratio of 13, this would imply an EV of $104 billion. Taking into account, for example, a remaining net debt of $30 bn, this would imply a market capitalization of around $74 bn or a share price of around $30.

In other words, there is a 100% opportunity here for those who believe in the turnaround capabilities of this management team.

The bottom line

The global investment community continues to have little interest in WBD stock due to the company's ongoing net losses, high debt, and difficult transition to streaming. WBD's management is under tremendous pressure to reduce its high debt levels as quickly as possible, but is making good progress quarter after quarter.

An investment in WBD shares at this time is first and foremost a vote of confidence in the abilities of Discovery's experienced management team led by David Zaslav (CEO) and Gunnar Wiedenfels (CFO). Prior to the merger with Warner Bros., they had already shown with flying colors how to trim a merged media company to a free cash flow margin well above 20%. If they can do it again, long-term shareholders will have a lot of fun with WBD stock.

If you want to follow the Warner Bros. Discovery stock together with me in the future, you can subscribe to my free Substack here.

Disclaimer

The author and/or associated persons or companies may own shares in Warner Bros. Discovery. This article is an expression of opinion and does not constitute any investment or financial advice.